Connecticut-based financial services management consultant, Casey Quirk, and institutional investment specialist publication, top1000funds.com, joined forces in a global chief investment officer survey to measure the sentiment of asset owners, and the extent to which the 2008 crisis has had an effect on the behaviour of internal investment teams, their outlook and corresponding asset allocation. With combined assets of around $5 trillion, pension funds, sovereign wealth funds, endowments and insurance funds all participated in the survey.

Since 2008, nearly half of the respondents (45.7 per cent) had revised their investment performance targets, with a review of objectives and expectations resulting in lower target returns.

Respondents were asked about the impact the crisis had on five aspects of investing: the investment target return, investment benchmark or policy portfolio, a focus on tactical asset allocation or hedging overlays, a dedicated tail-risk allocation, and time spent on manager research.

More than half of the respondents have increased their focus on tactical asset allocation or hedging overlays since the 2008 crisis. Some of the funds surveyed had implemented factor-based asset allocation and an active hedge overlay and, in particular, had moved towards a more dynamic asset allocation approach. And about 20 per cent of respondents had introduced a specific dedicated tail-risk allocation.

Partner at Casey Quirk, Daniel Celeghin, says the renewed focus on dynamic asset allocation and investment policy changes is very consistent with what the consultant has seen in other research.

“The discussion about dynamic asset allocation use before the crisis was settled. Funds would set their strategic asset allocation and not be market timers, they would trust the long-term and rebalance in a disciplined fashion,” he says. “That question is back open to debate. This survey very definitely shows large asset owners, globally, are willing to give dynamic asset allocation another try.”

Downward revision of benchmarks

A related trend, also demonstrated in the survey results, he says is the revision of the target benchmark or policy portfolio. “If you’re going to be doing dynamic asset allocation then your bogey, you’re tying to it also changes. A lot of benchmarks were set many years ago when real interest rates were much higher, and you could get 5 to 6 per cent.”

Celeghin says no matter what the policy portfolio is supposed to reflect – be it expected liability, peer risk, or an output of risk tolerance and asset allocation – the benchmark is coming down. Indeed one of the most significant changes measured in the survey was the number of respondents (60 per cent) who had revised their investment benchmark or policy portfolio as a result of the 2008 financial crisis. Within that revised policy, there was a noticeable decrease in domestic equities (42.2 per cent of respondents had decreased this allocation), and an increase in illiquid alternatives (46.3 per cent) and hedge funds (38.5 per cent).

In the next two years this trend will continue. Domestic equities allocations are expected to decrease further: 35.7 per cent of all respondents said they would decrease these allocations, and 42 per cent of those who had already decreased allocations would decrease them further.

Of those who responded, 42.1 per cent said they would increase both hedge funds and illiquid alternatives in the next two years. Of those who had already increased the allocations, 60 per cent said they would continue to increase their allocation to hedge funds, and 63 per cent said they would continue to increase their allocation to illiquid alternatives.

(Click to expand.)

The ins and outs of management

When it came to assessing managers, the number-one attribute as ranked by the respondents was investment leadership or the people that ran the manager, this was followed by investment performance, thought leadership, market perspective, portfolio construction advice, ownership, incentives and remuneration and finally client service and support.

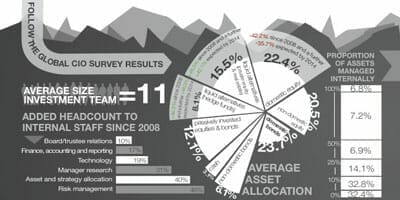

Two thirds of the respondents managed at least some assets in house, with 7 per cent managing 100 per cent internally. But 41 per cent of respondents said they expected the amount of assets managed in house to increase in the next two to three years.

Cash (51 per cent) and domestic bonds (42 per cent) were the most likely assets to be managed in house, with non-domestic equities and hedge funds the most likely assets to be managed externally.

While cost was the most likely reason for managing assets in house (37.2 per cent of respondents), it was followed quite closely by control (30.2 per cent). Of the investors surveyed, the cost of external managers was much greater than internal investment resources. The most likely cost of external managers was 50 to 100 basis points (41 per cent of respondents) while more than 75 per cent of respondents spent less than 10 basis points on internal management.

With regard to asset allocation and portfolio construction decisions, the overwhelming majority (71.4 per cent) said they would rely more on internal staff, rather than consultants or asset managers, in the next four years. Since 2008 about 40 per cent of investors have reported spending more time on manager research, which has come in the form of more RFPs, more indepth correlation analysis, using the consultant and manager database information more comprehensively, and as part of a function of performing diligence on a broader range of strategies.

“This survey implies that asset managers globally need to evolve their offerings. Institutions will gravitate towards managers that have a clear role in helping meet their overall return objective, preferably in a fee-efficient manner. This could mean managers with expertise in dynamic asset allocation and risk management, as well as managers that have been able to consistently deliver returns that are uncorrelated to the broader public markets,” Celeghin says.