Although it may sound like an idea left over from the longhaired summer of love or – heaven forbid! – some shaggy utopian age of socialism, a growing number of institutional investors have felt widespread dissatisfaction with the third-party services for sale on Wall Street. Why it took them so long, God only knows.

In their draft paper, Platforms and Vehicles for Institutional Co-investing, Jagdeep Sing Bachher and Ashy HB Monk from the Alberta Investment Management Corporation and Stanford University, respectively, look at the first glaring question that institutional sharing throws up: how it can be done.

They set out to answer this by examining one particular case study of collaboration at the Cleantech Syndicate, a group of 12 family offices worth about $40 billion. In addition, the authors also use qualitative data collected from more than 20 on-site case studies of public pension funds and sovereign wealth funds around the world.

The paper arrives at a kind of recipe for cooperation in the form of “setting up co-investment vehicles and platforms” and finishes off by praising the “important and groundbreaking first steps towards a new model” of, well, organisational sharing.

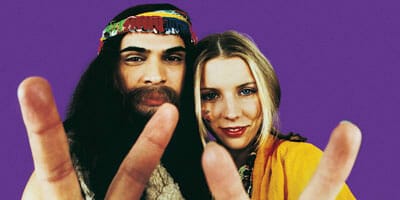

Are institutional investors getting in touch with oft-derided sharing themes of the hippie movement? Is socialism finally driving its thin red wedge into the heart of international capitalism? Find out here: Platforms and Vehicles for Institutional Co-Investing.