In the last year there has been a quiet revolution taking place as asset owners have been moving to integrate ESG into index designs for new mandates on core passive portfolios.

In the last year there has been a quiet revolution taking place as asset owners have been moving to integrate ESG into index designs for new mandates on core passive portfolios.

Integrating sustainability into investment strategies was a “minority sport” when David Harris joined FTSE 15 years ago. “Over this period, we’ve seen a dramatic change,” said Harris, who is now Group Head of Sustainable Business, London Stock Exchange Group, and Head of Sustainable Investment at FTSE Russell.

“For many years all the action on ESG integration has been in active asset management, whilst for passive, the focus has been limited to engagement and voting – in the last year that has all changed – for new mandates integrating climate and sustainability parameters into index design is being applied at scale and to core portfolios,” said Harris.

The rise in the use of “smart beta” has been central to enabling an investment approach to ESG, and has also bridged the divide between active and passive investing. “Using a smart beta approach enables passive managers to integrate a range of different factors into the design of an index,” noted Harris. “Once an asset owner decides that they will move away from a standard market benchmark and introduce other factors or design elements it’s an easy step to incorporate their investment beliefs on ESG as part of this,” he said.

Banking on climate risk

Late last year, HSBC Bank UK Pension Scheme, after 11 months of collaboration with FTSE Russell and Legal & General Investment Management (LGIM), switched its defined contribution (DC) equity default fund to follow a new passive fund with a 3-pronged climate change tilt, the Future World Fund. The LGIM fund tracks FTSE Russell’s first ‘Smart Sustainability’ index, the FTSE All-World ex CW Climate Balanced Factor Index that is designed to combine a smart beta factor approach with parameters that account for risks and opportunities associated with climate change. The index incorporates a range of factor tilts, including volatility, value, quality and size, and underweights companies with high relative carbon emissions and fossil fuel assets, while increasing index weight for companies with revenues that contribute to the transition to a green economy. With a further defined benefit (DB) allocation being added to the DC mandate HSBC Bank UK Pension Scheme has now allocated around £4billion to the fund.

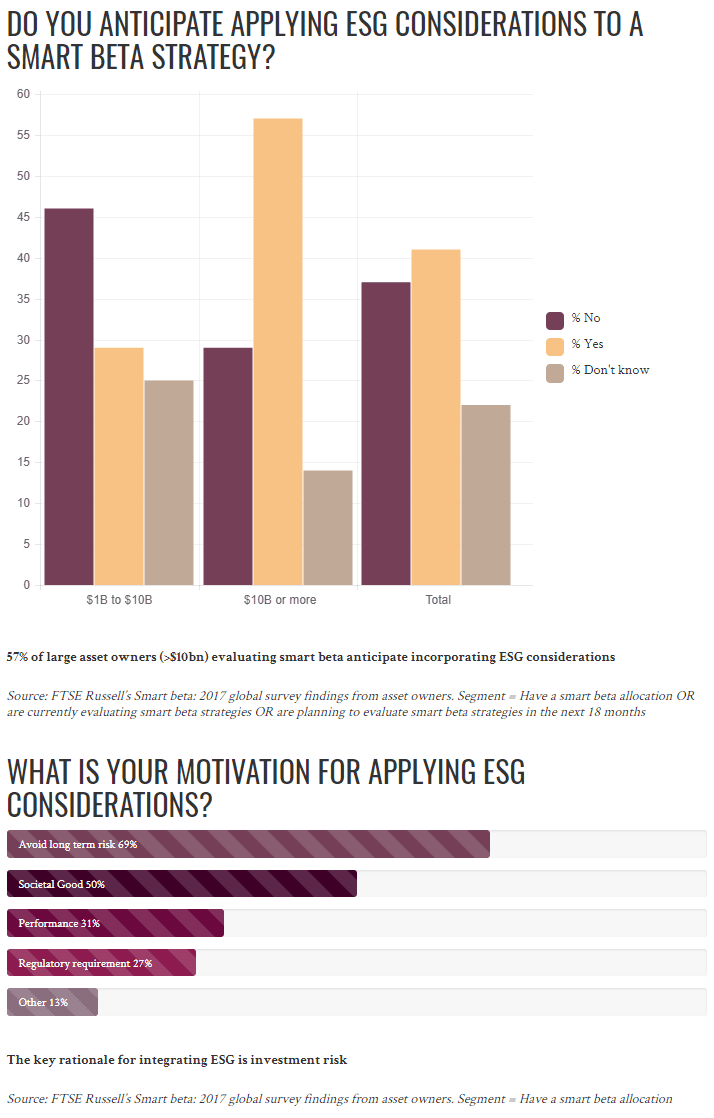

“This was a game changer less than 12 months ago, but I would say it’s rapidly becoming the norm in terms of new smart beta mandates that we’re seeing come through from our clients,” said Harris. This trend is evidenced by FTSE Russell’s fourth annual smart beta survey of global institutional asset owners. The survey, which covered almost 200 asset owners globally, finds firstly that a majority of asset owners, by AUM, have or plan to have smart beta allocations; and secondly among those managing larger funds (with over $10 billion in AUM) 57% would like to incorporate ESG into their smart beta strategies. The main rationale provided for ESG integration into smart beta was investment risk. “As someone who has worked on ESG indexes for over 15 years I find this incredibly exciting – finally, now, this is the core of the market in terms of new mandates,” said Harris. “Obviously if you look at existing and incumbent AUM, the picture is very different, but when you look at the changes, the trends are all moving this way.”

The importance of green revenue disclosure

At the turn of the century, it’s fair to say that ESG reporting by listed companies was scant. “This has changed radically over the last 15 years,” said Harris. “A lot more information’s now available and the reliability is improving, but it’s still a long way off from where it should be in a number of market segments.”

However an area that FTSE Russell has been dedicating resources to has been that of corporate revenues across green industries and sectors, from advanced batteries and electric vehicles to flood defences and water desalination. This enables them to provide a breakdown of green revenues at a stock or portfolio level, and to use this data in index construction. However, Harris expressed concern that although there has been much focus on “operational” ESG reporting there has not been the same focus on encouraging more detailed revenue breakdowns from companies for green product lines.

“The reliability of revenue data is strong, as it’s generally audited data, but what we’ll find is, some of those companies aren’t breaking out in enough detail to be able to get the green revenue data. So, for example, you may have a lighting company that isn’t breaking out its LED lighting sales versus its tungsten or halogen.”

Companies must answer the call

The growing demand from investors for standardised, comparable information on material ESG issues means that company boards need to pay attention.

In February, FTSE Russell’s owner, London Stock Exchange Group (LSEG) issued a guide to ESG reporting for companies setting out recommendations for good practice. A global guide, it responds to demand from investors for a more consistent approach to ESG reporting, which is now a core part of the investment decision process. It has been provided to more than 2,700 companies that have securities listed on LSEG’s UK and Italian markets with a combined market capitalisation of more than £5 trillion.

The development of the guide was a year-long process led by three different LSEG executives; Raffaele Jerusalmi, CEO of Borsa Italiana; Mark Makepeace, CEO of FTSE Russell; and Nikhil Rathi, CEO of London Stock Exchange plc. “Each of the three CEOs ran workshops with listed companies and investors to develop recommendations on what corporate ESG reporting is valuable from an investment perspective,” said Harris. “Given the unique make up of the group, from major exchanges to a global benchmark provider, we work across the investment chain and can help convene the market to address important questions.” The guide sets out key attributes of “investment grade data” including green revenue reporting as well as setting out details of potentially relevant reporting metrics for different industries.

Growing sophistication in the future

Institutional investors now have better data and more tools to integrate ESG than ever before. “We are at a very exciting time where there are efficient approaches to integrate ESG into index design, using the same technology and models that we apply for any other smart beta index, which can also control, or limit, any inadvertent exposures. Investors can now reflect their investment beliefs on sustainability and climate change into the design of future indexes,” concluded Harris.