The Treasury Department issued a report in Mayseeking comment on ways to improve retirement income security in Australia.

We recommend a simple innovation by Treasury that can achieve the three principles of an effective comprehensive income product for retirement (CIPR): “efficient, broadly constant income, in expectation; longevity risk management (income for life); and some access to capital.”

Australia’s Treasury could issue new, low-cost, liquid and safe ultra-long bond instruments we call SeLFIES (standard of living-indexed, forward-starting, income-only securities).

SeLFIES start paying investors upon retirement and pay real coupons only, indexed to aggregate per capita consumption – for a period equal to the average life expectancy at retirement. It is easily shown that SeLFIES ensure constant income (in terms of standard of living), provide access to capital and improve longevity risk management. These bonds are a good deal for the Treasury, too.

Retirement security challenges

The Treasury report notes: “The retirement phase of the superannuation system is currently under-developed and needs to be better aligned with the overall objective of the superannuation system of providing income in retirement to substitute or supplement the age pension. The government is addressing this through the development of a retirement income framework.”

By issuing SeLFIES, Treasury can have an immediate impact on the retirement challenge, create a liquid retirement income option, and raise funding for infrastructure. These bond instruments provide a retirement income strategy, improve engagement, and offer a flagship CIPR.

Individuals seek a guaranteed, real income, ideally from retirement through death, and to lead a lifestyle comparable with pre-retirement.

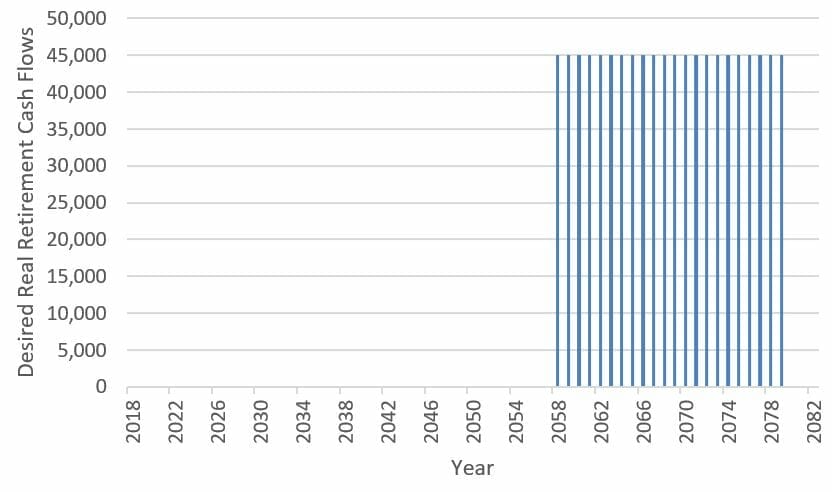

Chart 1 visualises a retirement savings goal – a 25-year-old Australian woman desires basic/comfortable $45,000/year guaranteed super income, starting at age 65, for 22 years (assuming a life expectancy of 22 years in retirement, based on the most recent data from the Australian Government Actuary – for men, it’s closer to 20 years). This guaranteed income would secure the retiree’s pre-retirement standard of living.

Chart 1: Potential desired retirement cash flows for a 25-year old Australian

Chart 1: Potential desired retirement cash flows for a 25-year old Australian

A major challenge to achieving this goal isindividuals’ lack of the necessary financial knowledge to determine how much to save, what assets to invest in, and how best to de-cumulate. Few adults can answer basic questions about compound interest, the effect of inflation or the benefit of diversification. They are overwhelmed by the information their portfolio reports provide.

Further, investing in existing assets for retirement is risky, because these assets fail to provide a simple or low-cost cashflow hedge against desired retirement income (Chart 1). For example, deferred life annuities offer a retirement cashflow profile, but are complex, illiquid, inflexible in providing survivor benefits, not commonplace in Australia, and often costly.

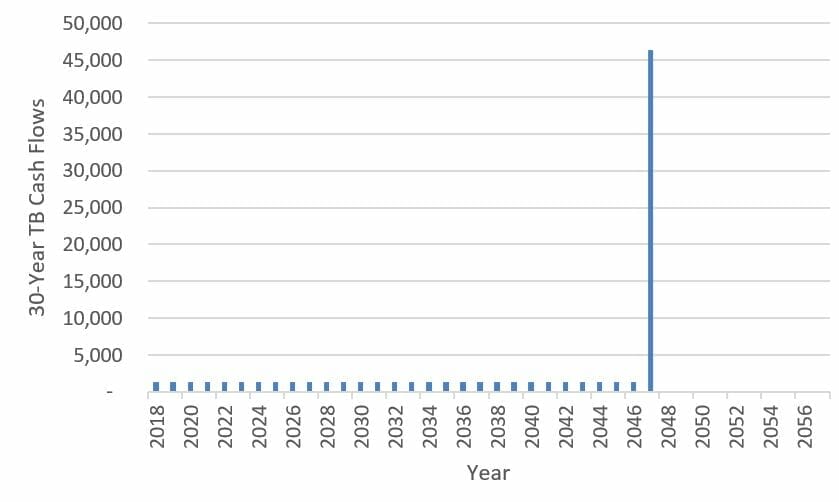

Treasury bonds (TBs) are also not an ideal match. They offer the traditional payout of interest-only coupons and principal repayment at maturity (see Chart 2). This means peoplereceive coupons before they need them (while they work and have income) and, thus, must reinvest them at future, uncertain interest rates. Also, for 25-year-olds, the principal is repaid in a lump sum 10 years before retirement, leading to further cashflow mismatches and re-investment risk.

Because of these mismatches, even a portfolio of traditional, ‘safe’ TBs, unless heavily financially engineered at some cost, would be risky.

Treasury also issues inflation-linked bonds but even if payments were adjusted for inflation, they would not be sufficient; for savings invested long before retirement, standard-of-living risk is significant. The amount needed to maintain one’s evolving lifestyle while working will probably increase over this long horizon, potentially leaving retirees with inadequate savings to cover that more affluent lifestyle.

This absence of both effective income-hedging instruments for institutions and simple methods to allow financially unsophisticated individuals to achieve their goals is a major challenge for Australia.

Chart 2: Cash flows from a traditional, nominal 20-year TB (with a 3% annual coupon)

Chart 2: Cash flows from a traditional, nominal 20-year TB (with a 3% annual coupon)

Addressing issues, satisfying CIPR principles

SeLFIES address many of these issues. They start paying investors upon retirement and pay real coupons only, say $5, indexed to aggregate per capita consumption, for a period equal to the average life expectancy at retirement; for example, another 22 years. Unlike current bonds that index solely to inflation, SeLFIESwould cover both the risk of inflation and standard-of-living improvements. SeLFIES would be designed to pay people when they need it and how they need it, and greatly simplify retirement investing.A 55-year-old would buy the 2028 bond today, which would start paying coupons when she turns 65, in 2028, and keep paying for 22 years, through 2050.

In this way, even the most financially illiterate individual can be self-reliant with respect to retirement planning. The complex decisions about how much to save, how to invest, and how to drawdown are folded into an easy calculation of how many bonds to buy. For example, if investors want to guarantee $45,000 annually, risk-free for 22 years in retirement to maintain their current standard of living, they would need to buy 9000 SeLFIES – $45,000 divided by $5 – over their working life. This achieves the first principle of an effective CIPR: broadly constant income.

Besides being simple, liquid, easily traded at low cost and with low credit risk, SeLFIES would also be bequeathed to heirs.

SeLFIES would qualify as a CIPR, as they offer total clarity on the retirement income that would be earned, hence super statements would be much clearer, as they could tell citizens how much retirement income is guaranteed and how many additional bonds need to be purchased to achieve the target. Further, since the assets would be liquid, individuals would have access to capital and could easily change their target retirement income level or even target retirement date with minimal effort. This ensures that SeLFIES would achieve a second principle of an effective CIPR: access to capital.

SeLFIES do not directly address longevity – the other principle of an effective CIPR – but they do go a long way toward hedging longevity risk. (Another innovation, which we call longevity-indexed variable expiration bonds, would create bonds to hedge longevity risk directly but in the interest of brevity, we do not discuss those here.) By covering the average life expectancy, SeLFIES ensure that poorer individuals who tend to have lower-than-average life expectancy are covered for longevity risk. In effect, the shorter-lived, poorer segments of society are not subsidising the richer, longer-lived segments of society. The richer, longer-lived participants can purchase deferred life annuities. Moreover, innovative Australian insurance companies and super funds could also purchase such bonds to better hedge their retail retirement income products. SeLFIES improve asset-liability management of vendors and insurance companies, potentially improving their willingness to offer these deferred life annuities and also lowering cost. These characteristics can indirectly help SeLFIES contribute to longevity risk management.

In research, we have shown how SeLFIES could be combined with risky assets to create products that could ensure guaranteed retirement income (i.e., the amount invested in SeLFIES) and attempt to raise returns and lower contributions. Innovative investment operations could be used to hedge dynamically and target a retirement income that a participant might have in mind. Further, safe harbour could be provided to those flagship CIPRs that achieve the client’s target retirement income, thereby ensuring that safe harbour would be based on outcome, as opposed to investment process.

SeLFIES are a good deal for governments, too. In fact, governments would be the biggest beneficiaries. First, cash flows from SeLFIES would reflect synergistic cash flows for infrastructure spending: namely, large inputs upfront for capital expenditure, followed by delayed, inflation-indexed revenues, once projects are online. Second, SeLFIES would give governments a natural hedge of revenues against the bonds, through value-added taxes such as Australia’s goods and services tax.

The looming retirement crisis needs to be addressed by timely innovation, because the longer governments wait, the higher the cost to the taxpayer. SeLFIES would improve retirement security and fund infrastructure, and could be created immediately at low cost. They would also allow the Australian Government to ensure that superannuation trustees could achieve their retirement income covenant and all the goals of an effective and flagship CIPR.

Robert C. Merton is a Nobel laureate in economics and teaches at MIT and Harvard University. Arun S. Muralidhar is cofounder of Mcube Investment Technologies.