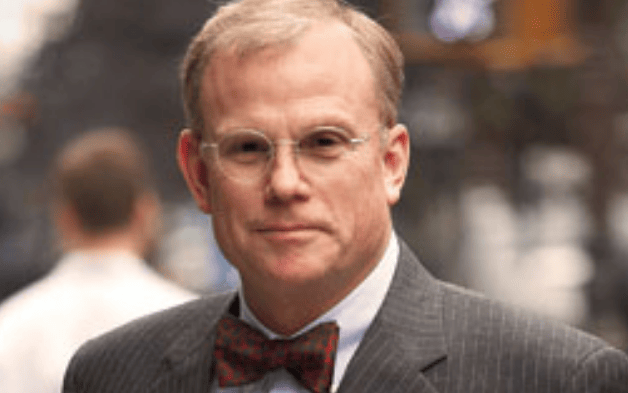

Politics can seem illogical. Listening to Stephen Kotkin, the John P. Birkelund ’52 Professor in History and International Affairs in the Woodrow Wilson School and history department of Princeton University, speak about President Trump and US politics provides evidence of that.

While the headlines we read and the stories we hear might leave us feeling that Trump is unreasonable or even ridiculous, Kotkin argues he is in a strong position. Trump has a loyal following among Republican voters; in fact, Kotkin said within that cohort, the Republican Party is less popular than Trump himself. In addition, there is no unfavourable economic situation at the moment to encourage voters to choose Democrats.

“The economy is booming, so the ability of the Democrats to mount a challenge makes sense in the liberal press, but it doesn’t make as much sense with the voters,” Kotkin said.

He adds that Trump is a genius at effective culture war and tribalism, which is how he won, and of course that continues.

The politics in the US, Kotkin said, are interesting and complicated.

“There are citizens of the United States who are supportive of Trump and Trump-like candidates at the local level, and because we live in a democracy, they’re entitled to exist and to have their voice heard, and it’s up to the Democrats to appeal to them and win them over, which is what could happen, but I’m not sure it’s going to happen [in the November 2018 mid-term elections].”

In more evidence of Trump’s strength, Kotkin emphasised the significance of the tax legislation, and Trump’s appointment of Supreme Court justices – another appointment to replace retiring Justice Anthony Kennedy looms, possibly before November’s elections.

“So the idea that Trump is incompetent and gets nothing done is partially true – the White House is empty, and of the 5000 available political appointments, he has made only several hundred, and half of them have been fired or quit. But on the policy side, there’s been a lot more than nothing, and depending on where you are in the social order and where you are on the values issues, it has been an extremely consequential presidency.”

Speaking at a roundtable hosted by Investment Magazine and sponsored by GAM and Shed Media, Kotkin gave Australian investors an insight into the workings of the White House and the complexities of US politics, and traversed geopolitical hotspots such as the Koreas, Taiwan, China and Russia.

Kotkin has taught at Princeton since 1989, including courses on modern authoritarianism, global history and the Soviet empire. And as a specialist in communist regimes, he has visited the White House occasionally during the last three administrations. In addition to learning more about the Trump enigma, investors at the roundtable were interested in learning more from Kotkin about the interaction and relationships between the US and key economies, such as China, along with how issues such as populism might play out around the globe.

In terms of how investors view geopolitics in their decision-making, Damian Graham, chief investment officer of First State Super, sums it up by saying geopolitics “doesn’t matter until it matters”.

“It feels like the rubber band’s growing a little bit, where there could be some additional risks,” Graham says. “This highlights a number of things [to watch]. Geopolitics is always relevant, sometimes more relevant than others.”

The China question

First State Super is one of the few funds in Australia with a Qualified Foreign Institutional Investor licence from China, and Graham wanted to hear from Kotkin about the view of China from within the US and whether that view was valid.

“How accurately do you think China is viewed by the US with what you know about China and the political system there, the market, and the market risks?” Graham asked. “It would be great to get a sense of how accurately you think perception is for the US around that, the relationships and also the forward-looking potential outcomes for China.”

Kotkin said: “In the Trump administration, there are hardliners in most of the important positions of influence and this includes on the big foreign policy issues, like Iran, North Korea and China.

“Cutting against enactment of [hardline policy] is the lack of policy process in the administration as a whole.”

In addition, Trump’s behaviour around any particular issue is unpredictable and inconsistent. The situation in North Korea continues to be volatile and many lives in the region could be at risk, but Kotkin said it is not a global system threat. What is a systemic threat is Taiwan, he argues. On one hand, the Chinese claim Taiwan as their territory and call it a core interest; on the other hand, the US has an act of congress that obliges it to defend the security of Taiwan.

“Taiwan is the systemic issue that can blow up everything, and miscalculation on one side or the other – or even the Taiwanese as the third-party actor in this – could lead to a systemic crisis of proportions where the risk [can’t be priced],” Kotkin said. “So you can see the Americans know that the Taiwan thing gets under the skin of the Chinese, and you can see how irresistible it is from the American side to play that card, and the hardliners around Trump are whispering in his ear.

“For the Chinese regime, they see that public opinion on the island has been moving definitely away from identifying as Chinese toward identifying as separate Taiwanese. Time is not on the mainland’s side. So I’m very concerned, the whole thing could blow up.

“I’m not saying that one side is right or wrong, the problem is the incentive to do something, to miscalculate and to take an action that destroys the global system.”

Kotkin, who has visited Russia many times, and was a Pulitzer Prize finalist for his book Stalin: Paradoxes of Power, also said Russia was a major piece of the global balance of power. But it is not Russia’s strength, but its weakness, that is the problem.

“It’s so ironic because Russia looks like this big bad beast that’s doing all these things, when, in fact, the thing is barely holding together in some ways, haemorrhaging human capital, and we should be afraid that without Russia, China has more wide-open space,” Kotkin said. “Now, once again I’m impressed with China, what they’ve achieved economically is breathtaking and every time I go back, I’m more and more impressed, but the regime is not a friendly regime.”

Populism will persist

In terms of big geopolitical themes, Kotkin told the investors that global populism is not going away, that it is structural and there is no reversal.

“Globalisation does not produce sameness, it does not bring people together. The internet didn’t do that either, it accentuates difference, so you get the nationalism, and you get the cultural responses,” he explained. “Globalisation is not Westernisation, China didn’t become like the US, and it’s not going to, it’s China. It has its own civilisation, its own institutional legacies, and this is true of any place you go. There is a level of Westernisation, harmonisation, of institutions in places like the EU, but now we also see the accentuation of difference, even in places like that.

“Globalisation does not produce sameness, it does not bring people together. The internet didn’t do that either, it accentuates difference, so you get the nationalism, and you get the cultural responses,” he explained. “Globalisation is not Westernisation, China didn’t become like the US, and it’s not going to, it’s China. It has its own civilisation, its own institutional legacies, and this is true of any place you go. There is a level of Westernisation, harmonisation, of institutions in places like the EU, but now we also see the accentuation of difference, even in places like that.

“It’s a deeper, structural open-markets assumption that if you integrate economically and technologically you then become more like each other culturally and institutionally. That assumption is false. People retain their culture, they retain their institutions and, moreover, those are accentuated in the process of integration.

“Democracy must incorporate the entire political spectrum, from Trump to Zuckerberg and everything in-between. We live in a democracy and people have opinions. It just so happens that the resentment, the anger, the culture condescension and the reaction to that – all of that makes it seem radioactive. Trump voters have a legitimate opinion, and democracy gives a voice to that.

“I’m only afraid if the politics turns violent. I don’t see any trouble with right-wing nationalists or socialists having a voice, I just don’t want it to be militarised the way it was as a result of the First World War.

From an institutional investor point of view, this raises some interesting questions, CSC chief investment officer Alison Tarditi said.

“I think that long-term investors, and decision-makers more broadly, are being challenged to keep pace with two fundamental shifts,” Tarditi said. “The first is a broad sociological shift towards connectivity, but not necessarily cultural connectedness. And the second is a shift in our ability to imagine the future, which has been compromised by an unfamiliar mix of disruption from technology, policy and amplifying stakeholder voices.

“As investors, we’re all used to dealing with uncertainty. But it does feel as though we are having to adjust from decision-making with probable certainty to decision-making with much less, arguably constant, uncertainty. The potential tail risks associated with political strains across and between both the developed and developing worlds give examples of this. We all understand that the long-term consequences of these risks are likely to be important. Regulators, governments and policymakers are reacting to, rather than proactively driving, these forces. How cross-geography relationships develop or deteriorate and how global governance structures evolve or fail matter to long-term investors.

“It isn’t clear that these risks are adequately priced. Neither is it really possible to identify when, or indeed whether, they ever will be. Today’s discussion has been useful because it has provided a roadmap for thinking around these issues and their subtleties.”