It is possible to unlock significant positive alpha using a combination of big data and traditional ESG ratings.

By combining big data and analyst-driven ESG information, investors can identify value opportunities in ESG and construct a strategy that delivers alpha while investing in companies with superior ESG performance scores. The combination yields significant positive alpha of about 4-5 per cent annually.

My paper “Public sentiment and the price of corporate sustainability” analyses data for the years 2009-18 provided by MSCI and TruValue Labs, the pioneer in artificial intelligence-driven ESG data. I use MSCI ratings for ESG performance due to their industry-wide prevalence and employ TruValue Labs’ data to find sentiment in semantic big data for ESG topics.

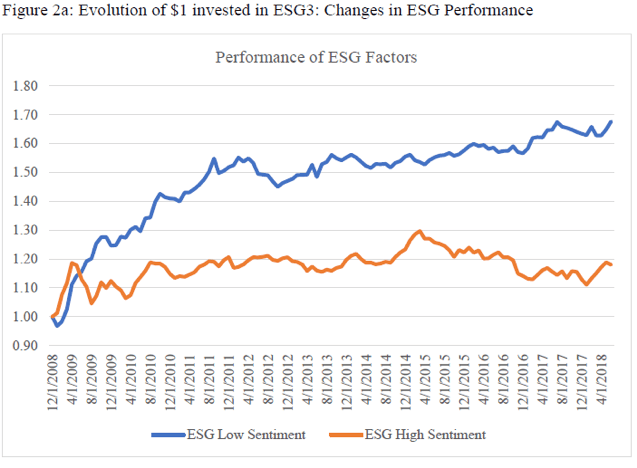

ESG ratings were paired with TruValue Labs’ sentiment data about a company’s sustainability performance. That data is drawn from sophisticated sources, including industry analysts, non-government organisations, media reports and think-tank analysis. The alpha came from a strategy of going long on firms with strong ESG performance and negative TruValue Labs’ ESG Momentum performance; there was also alpha found by going short on firms with the reverse.

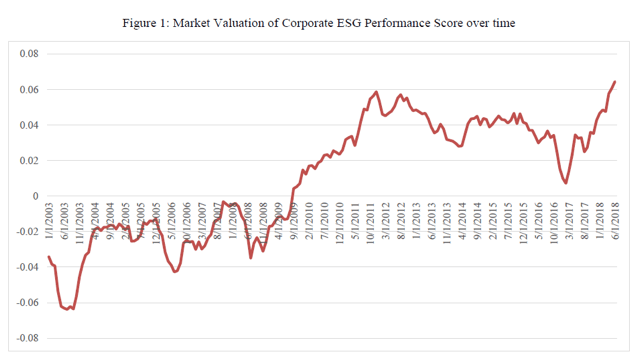

The first main result of the research shows the price of companies that display sustainability performance has increased over time. This is the estimated premium (if positive) or discount (if negative) that firms with better sustainability performance trade at relative to peers after accounting for several factors such as current profitability, size, leverage, past returns and other firm characteristics. This is good news for companies that perform better on material sustainability dimensions (as defined by MSCI), as the market rewards them with a higher multiple.

This higher multiple is even greater in the presence of positive public sentiment about a company’s sustainability performance from these sophisticated sources, as captured by TruValue Labs. In the presence of negative sentiment, a firm’s sustainability performance is largely discounted.

This has fundamental implications for how chief sustainability officers and business leaders work with the broader ecosystem. The higher price of corporate sustainability poses a challenge for ESG investors: they need to ask if they are getting good value for money. It is not only a matter of the value of corporate sustainability anymore, it is also a function of the price you are paying for it. Value for price is key.

I believe this research highlights the next stage in the evolution of ESG data and shows the power of combining traditional ratings with new, innovative datasets to fully understand the contribution of intangible value to firm valuations.

George Serafeim is a professor of business administration at Harvard Business School.