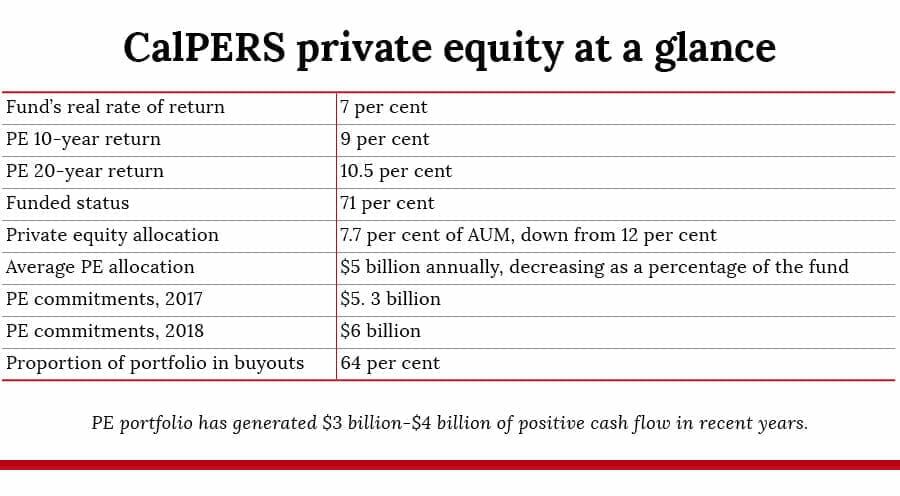

The California Public Employees’ Retirement System has taken another step towards clarifying the new shape of its $27.2 billion private equity allocation.

After two years of discussion and analysis, the CalPERS investment staff’s latest presentation to its 13-member investment committee inches the pension fund towards an execution phase for the new-look portfolio.

It also drops some of the more ambitious plans CalPERS had mooted for increasing direct investment in its best-performing asset class. There had been talk of creating a separate company and bringing private equity inhouse. The pension fund has taken these ideas off the table in the CalPERS Direct pillar of the new portfolio and states that it now plans to invest directly via a traditional general/limited partnership structure.

In this separate account model, CalPERS will be the only LP investing with a single GP. The captive entities will operate independently of the pension fund but with a clear mandate that will involve routine interaction with CalPERS senior staff. The entities will also have their own board of advisers, focused on ensuring the management team adheres to the fund’s mandate.

“It is the structure that works best for us going forward and the structure we’ve used quite deliberately in our real estate and infrastructure programs for over 20 years,” departing CIO Ted Eliopoulos said in his final board meeting in that role. “We have two decades of experience of separate account partnership; it is nothing new to us and right within the core competencies of our staff.”

Yu Ben Meng will take over as CIO in January, returning to CalPERS after serving as deputy CIO of China’s State Administration of Foreign Exchange (SAFE).

The partnership structure will allow the fund to invest for the long term and move the portfolio away from the playbook of short-term, co-mingled funds – leverage, dividends, cost cutting and selling assets after four years. The separate account vehicles will be “perpetual entities” and “evergreen”, says CalPERS senior portfolio manager John Cole, one of the key architects of the new portfolio. He explains that investments won’t have fixed terms and deals will be structured to incentivise behaviour that results in long-term value creation and growth. Investee companies will be encouraged to expand into new products and generate cash flow, jobs, long-term dividends and sustainable contributions to society.

This structure also offers the opportunity for better alignment on fees, which will be based on operating budgets rather than assets under management. The pension fund will also be able to specify the incentives it wants to prioritise, rather than taking what is offered “off the rack” in co-mingled fund investment. CalPERS will be able to incorporate its values, beliefs and principles into this section of the private equity portfolio, Cole says.

The individual GP mandates in the direct allocation will comprise late-stage venture capital companies in life sciences, tech and healthcare in the ‘Innovation’ portfolio. A twin seam will come via the ‘Horizon’ allocation, where CalPERS can model a platform approach to building the portfolio, which will feature long-term, core-economy companies capable of attractive cash yields.

Both portfolios will target an investment rate of about $1 billion to $2 billion in commitments annually, which will grow to $10 billion each over the next decade. Both will also employ an ‘operations approach’ to support and nurture investee companies’ growth. Allocations will be carefully selected so as not to compete with existing GPs within CalPERS’ continued allocation to co-mingled funds, where most of the portfolio will continue to reside.

Co-mingled

“We expect to continue to access co-mingled funds for the foreseeable future, in $5 billion to $7 billion commitments a year,” Cole says.

CalPERS has spent the last year evaluating potential partners for a discretionary role to help it access the best funds and improve its access to co-investment and secondary transactions. BlackRock, Goldman Sachs Asset Management, Neuberger Berman, AlpInvest Partners, Hamilton Lane, and HarbourVest Partners all submitted plans to CalPERS early this year detailing the role they would play in managing the largest private equity portfolio in the US. Cole says that, despite working with “six outstanding organisations”, the pension fund decided these approaches wouldn’t “meaningfully” strengthen the organisation”.

Now the focus at the fund is finding a permanent head of private equity to replace Réal Desrochers, who left in April 2017 to join a private equity firm. Once the position is filled, CalPERS will reconsider whether an advisory approach will help supplement its own capabilities and whether to extend capacity and resources in its allocation to co-mingled funds.

The emerging-manager pillar of CalPERS’ private equity program will also remain the same. It was established over a decade ago as a small, $1 billion allocation that promotes new manager blood and thinking in the private equity industry, allowing CalPERS to tap investors of the future. Although the fees are higher here, and CalPERS pays for a fund-of-funds adviser, the allocation will remain – and grow to about $1.5 billion.

“We think this is worthwhile and pays dividends to the fund,” Cole says.

Less is more

The fund will also continue working to axe its GP relationships to about 40. CalPERS has already reduced the number of private equity GP relationships from several hundred to about 90 today. At the presentation, interim CIO Eric Baggesen reminded the investment committee of the rationale behind scaling back on managers. When CalPERS had capital invested with several hundred GPs, it was comparable to investment in “an index of private equity firms”, where LPs ended up with an average of that universe. Now the focus is on investing with top-quartile managers, concentrating on a smaller number where the CalPERS relationship is material to the GP. The challenge, Baggesen says, is that not all managers want to be captive to CalPERS and the caprices of the organisation.