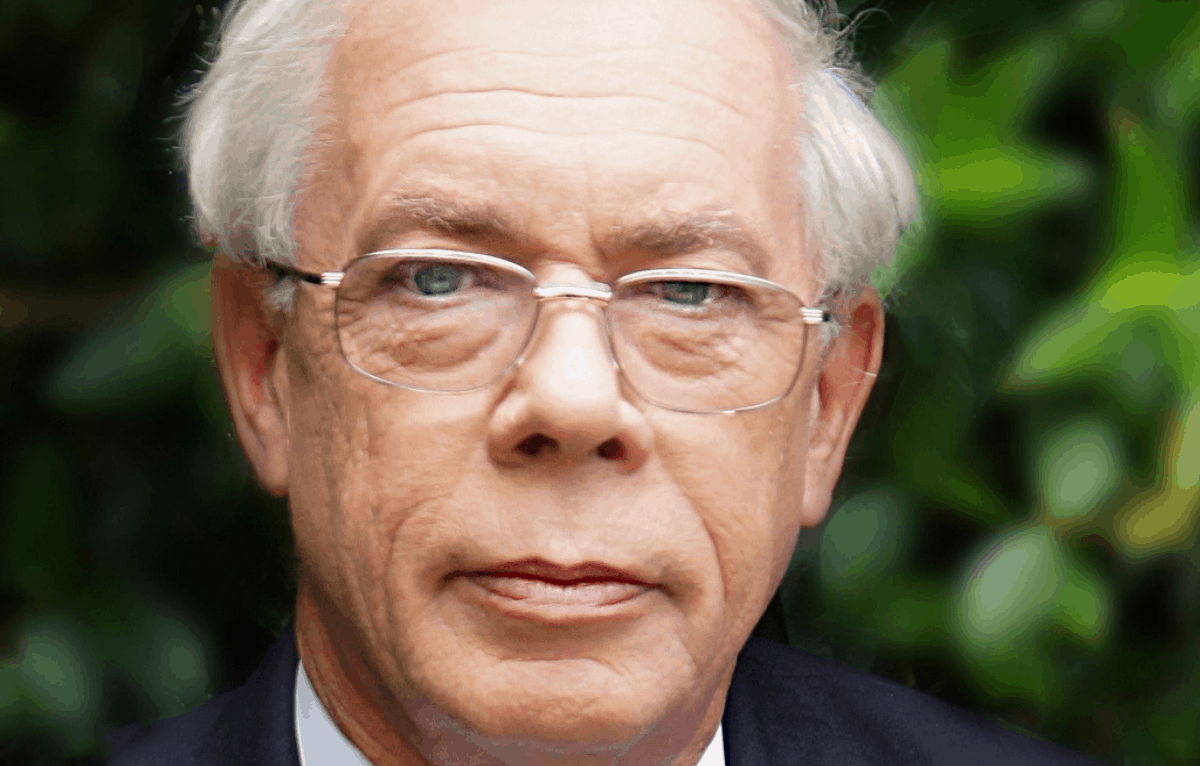

Pension funds have “no business” engaging with policy makers but instead should influence change through stewardship, which is also the main function of asset managers, according to John Kay, Supernumerary Fellow in Economics at St Johns College, Oxford University.

“As a pension fund I’m not sure you have any business engaging with policy makers. You can have your own personal views but you can’t have a view as a trustee of a pension fund,” he said at the 8th Sustainable Finance Forum. “Companies should also stop engaging with policymakers there is no legitimacy to this kind of lobbying. I want less funded political lobbying of all kinds.”

Kay said a dialogue needed to open up around what the legitimate activity of a business is, including the role of lobbying.

“What we need to do is amend the way these people think about their business, and change the rhetoric in how people talk about business,” he said.

Kay said that the rhetoric of “shareholder value” was being used as an excuse for businesses being run in the interests of a small number of people, mostly the senior employees.

“The great paradox in the rise of shareholder value, the rhetoric around business, is the description about what most businesses do is not correct – it’s repulsive and false,” he said. “We need to address that to solve the underlying problem of how we make business legitimate and respectable again.”

Kay said that the business of business, is business, and business is not about “doing good”.

“The corporation is not the vehicle for determining what we think a public benefit is. If the public good is to be determined by business people, you probably won’t like the concept of what that public good is. There’s not too little public engagement by companies, there is too much.”

Kay said the way to change the rhetoric is with different rhetoric.

“We’re talking about cultural changes. When people say you can’t do that, I say we have had a negative corporate cultural change since the 1980s, which indicates culture is malleable and if it has changed in one direction it can change in the other.”

Kay said it was imperative that asset owners collaborated in order to have impact.

“If you are a pension fund with limited resources you are a small shareholder in a particular company, even if you are Norges Bank or Blackrock you are a small shareholder. Getting together with others is key to this,” he said.

The Investor Forum was launched in the UK in response to the Kay Review of UK equity markets and long-term decision making in 2012, with the intention of promoting shared commitment to long-term strategies and sustainable wealth creation among asset owners, asset managers and companies.

“When I did the review, one outcome was to facilitate large shareholders working collectively to engage with companies. The Investor Forum is making it easier and giving an umbrella for institutional investors to work together. I hope we are moving in the right direction.”

Kay told delegates that stewardship was the main function of a large asset manager, and all players in the investment value chain needed to encourage them to get more resources to do that.

“Asset managers have tendencies to have a corporate governance department which is separate from portfolio management, they are not integrated despite how much they say it is true.”