There is a prevailing view among LPs that once a PE firm has an underperforming fund, the best way forward is to stop committing to future funds. Even if that firm had multiple, top quartile funds in the past, LPs have a hard time letting go of that one bad fund. It’s a real life application of the old mantra, “Fool me once, shame on you. Fool me twice, shame on me.” Yet many private equity firms seem to experience the following life cycle:

- First stage: $500 million – $5 billion fund sizes with a focus on a specific part of the market that leads to top quartile or top decile performance; professionals hungry to succeed and willing to do whatever it takes to win

- Second stage: fund size grows by 2x-4x due to the success of previous funds; the firm can’t resist the almost insatiable LP demand for their fund; the larger pool of capital causes them to deviate from the strategy that made them successful; hunger for outperformance replaced by hunger to gather assets, build a large organization, and/or enjoy life

- Third stage: the most recent, larger fund is underperforming and raising capital becomes very challenging; the fund decides to go back to what made them successful in the first place; fund size shrinks by 25%-80% and returns improve dramatically

Over the last decade, almost every LP has been confronted numerous times with the decision on whether to commit to a PE fund that was once top quartile, but then raised too much capital and invested it too quickly and now their most recent fund is mediocre. That firm has been humbled by a poor performing fund and now raising capital is challenging. Even though they’ve admitted their mistakes and they’re ready to return to the core competencies that made them successful in the first place, LPs seem disinterested. As institutional investors, how should we respond? Should we make a commitment, believing that the firm won’t repeat the mistakes of the past? But what if the firm underperforms again? Will my judgement be questioned for getting fooled twice?

Thus far, we’ve not given it much thought. To quote Nancy Reagan: “Just Say No.” Life is short and there are plenty of good PE funds. Why take a chance on a “restart” firm? In the past year though, a few data points made me wonder if the decision to decline these funds was correct. Is it possible that a historically strong performing PE firm who has one challenging fund might be highly incentivized to fix their mistakes and prove to others that the firm can be successful again? Is it possible that the firm’s source of differentiation never went away, but was simply neglected in favor of other priorities? Maybe they’re more compelling today because the low demand could allow LPs to better align terms?

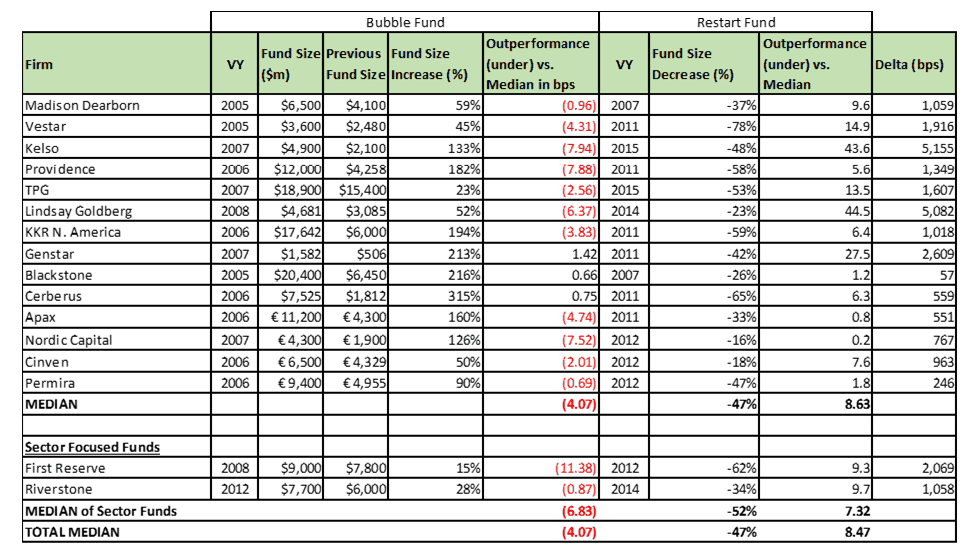

Below is the data set I used to test the hypothesis that outperforming firms who underperform should be avoided. In aggregate, I found 20 firms that fit the criteria of a fund size increase of 20% or more followed by a fund size decrease of 15% or more. At half of these firms, the fund size increase was 100%+ and in 65% of them, the subsequent fund size decrease was greater than 40%. The data only shows detailed information on 16 of the firms, as four had incomplete public information that had to be supplemented with private data. I selected the firms based on the 1,000+ funds I’ve seen in my career. The data set is anecdotal, but it’s a starting point for examining the entire universe. All of the performance data is based on information available on the websites’ of public pension funds. The analysis controls for vintage year bias by comparing the funds outperformance relative to the Cambridge Associates’ benchmark. The challenge in the analysis is the limited data set. First, a fund has to have 1-3 strong performing funds, then a much larger fund, and then a much smaller fund. That typically requires at least 12-15 years. In addition, some firms can’t raise capital after a poor performing fund or choose not to, so it’s impossible to include these firms in the data set. Finally, some funds are sector focused and if the sector experienced a prolonged downturn, that fund likely won’t outperform until sector conditions improve.

The data shows that of the 20 firms with a “restart” fund, 17 raised funds in 2005-2008 that were 35%-671% larger than the previous fund. 17 of the 20 funds, or 85%, underperformed the median benchmark by 69 bps – 2,400 bps. On a median basis, generalist firms underperformed by 407 bps and sector focused funds 683 bps. All 20 funds raised subsequent funds in 2007-2015 that were 16%-78% smaller than the previous fund. The median decrease across all funds was 47%. Of these 20 restart funds, 19 outperformed the median. On a median basis, generalist firms outperformed by 863 bps and sector focused funds by 732 bps. It would be one thing if a few firms outperformed, yet 95% of the restart funds outperformed their median benchmark and 90% did so by more than 500 bps!

Source: Fund data – WSIB, CalPERS, CalPERS, CalSTRS, State Board of Administration of Florida, Colorado PERA, Wikipedia, other public sources; as of 12/31/17 – 9/30/18

Benchmark: Cambridge, as of September 30, 2018; benchmark matched to strategy

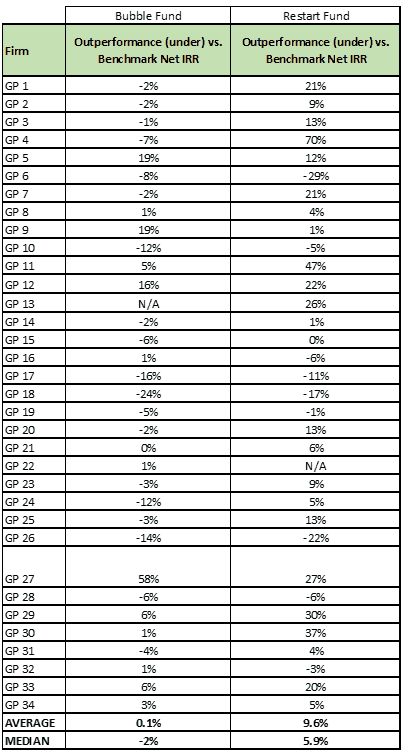

RCP Advisors, a fund-of-funds platform focused on U.S. lower middle market funds, ran a similar analysis among funds in their proprietary database with fund sizes of $2 billion or less. RCP found 34 funds that fit the “restart” fund parameters defined above. Each fund was at least 40% smaller than the previous larger fund. The chart below summarizes their findings. The spread between the median “restart” fund and the previous fund when compared to the median returns of the benchmark was 780 basis points in favor of the restart fund. The spread was even higher when comparing the average returns. While not shown in the chart below, the TVPI data also shows outperformance of restart funds over the previous funds when compared to a benchmark.

| Median Fund Size | Percent of funds above the CAM US Buyout Median | Median Outperformance above CAM US Buyout Median | Average Outperformance above CAM US Buyout Median | |

| Previous Larger Fund | $475 million | 45% | -1.9% | 0.1% |

| Restart Fund | $178 million | 71% | 5.9% | 9.6% |

Source: RCP, as September 30, 2018

Benchmark: Cambridge, as of September 30, 2018; benchmark matched to strategy

Source: RCP, as September 30, 2018

Benchmark: Cambridge, as of September 30, 2018; benchmark matched to strategy

The conclusion here should not be to commit to every “restart” fund and our findings should not be viewed as a recommendation to do so. Every situation is different. Some firms, despite raising a larger fund and underperforming, have no desire to change their behavior. Other firms continue to underperform for a host of reasons: the market has competed away their differentiation, the best investors have left the firm, and/or the market has changed and the firm refuses to adapt. Regardless, the data shows that outperforming funds that become underperformers deserve consideration. Hopefully this information will lead you to engage with a “restart” fund in your portfolio to determine whether making a new commitment makes sense, rather than dismissing it immediately.

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of Mr. Bradle’s employer, the State Board of Administration of Florida, or Mr. Abell’s employer, RCP Advisors.