In this Fiduciary Investors series podcast Amanda White talks to Ben Meng, chief investment officer of CalPERS, the largest pension fund in the United States.

Meng, who oversees an investment office of nearly 400 employees and manages investment portfolios of roughly $400 billion, talks about the fund’s plan to achieve its 7 per return target – including the use of leverage – the liquidity management of the fund and how it could deploy capital during the crisis, and inflation.

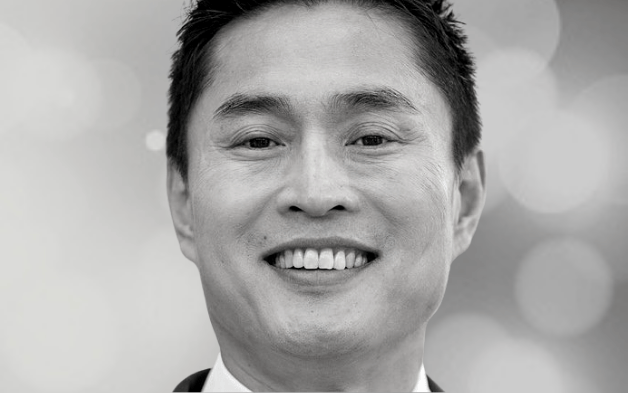

About Ben Meng

Yu (Ben) Meng rejoined CalPERS in January 2019 as chief investment officer (CIO). He oversees an investment office of nearly 400 employees and manages investment portfolios of roughly $400 billion, including the Public Employees’ Retirement Fund and affiliate funds.

Yu, a U.S. citizen born in China, returned to CalPERS after more than three years as the deputy CIO at the State Administration of Foreign Exchange (SAFE), the largest asset pool in the world with assets under management of over $3 trillion U.S. dollars.

About Amanda White

Amanda White is responsible for the content across all Conexus Financial’s institutional media and events. In addition to being the editor of Top1000funds.com, she is responsible for directing the global bi-annual Fiduciary Investors Symposium which challenges global investors on investment best practice and aims to place the responsibilities of investors in wider societal, and political contexts. She holds a Bachelor of Economics and a Masters of Art in Journalism and has been an investment journalist for more than 25 years. She is currently a fellow in the Finance Leaders Fellowship at the Aspen Institute. The two-year program seeks to develop the next generation of responsible, community-spirited leaders in the global finance industry

What is the Fiduciary Investors series?

The COVID-19 global health and economic crisis has highlighted the need for leadership and capital to be urgently targeted towards the vulnerabilities in the global economy.

Through conversations with academics and asset owners, the Fiduciary Investors Podcast Series is a forward looking examination of the changing dynamics in the global economy, what a sustainable recovery looks like and how investors are positioning their portfolios.

The much-loved events, the Fiduciary Investors Symposiums, act as an advocate for fiduciary capitalism and the power of asset owners to change the nature of the investment industry, including addressing principal/agent and fee problems, stabilising financial markets, and directing capital for the betterment of society and the environment. Like the event series, the podcast series, tackles the challenges long-term investors face in an environment of disruption, and asks investors to think differently about how they make decisions and allocate capital.