For some investors, plunging equity valuations in March were an opportunity to ‘get back in’ at reasonable prices. More recently the rapid recovery has been a cause to position conservatively once again. Asset allocations and the correct exposure in today’s challenging markets is a pervasive theme at FIS 2020, where panellists will also discuss how shifting corporate supply chains will impact investor strategies.

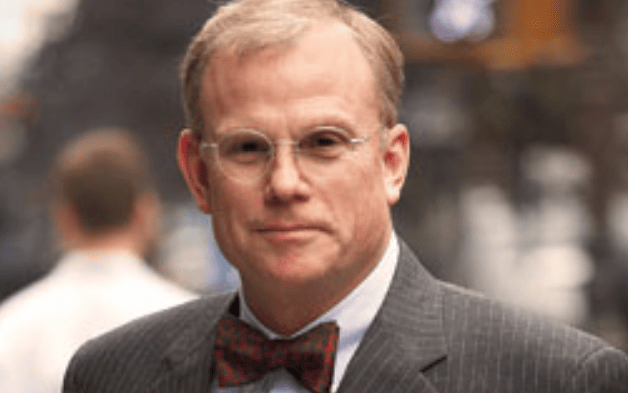

Veteran contrarian investor Matt Clark, CIO of the South Dakota Investment Council (SDIC), argues that for now, at least, the chance to take advantage of price dislocations by increasing exposures has passed. The rebound in equity markets has led the internal team to position the fund conservatively once again he explains, reflecting on how the crisis is impacting the $15 billion fund’s asset allocation, another central theme at FIS 2020.

Strategy at the pension fund for the US state’s public-sector employees is focused around adjusting asset allocation exposures as prices fluctuate around the team’s assessment of fair value. Rapidly changing events in February and March “stepped up the pace,” explains Clark.

“The crisis has definitely stirred up relative valuations providing opportunities to reposition whenever relative prices shifted more than our analysis suggested was justified,” he explains.

Indeed, the March decline provided an opportunity to get back into the market at reasonable prices. “We are a long-term focused, contrarian-leaning investor. Our valuation work suggested that markets were significantly overvalued at the end of 2019, so we were conservatively positioned. In March, markets become moderately undervalued allowing some overweight exposure.”

However, things have since changed given the swift and rapid recovery, he says.

“The recovery, in our view, has taken valuations back up almost to the levels in January, particularly when a modest amount of longer lasting earnings impairment is taken into account. As a result, we have in recent days shifted back down to our earlier, very conservative position.”

Supply chain risk

How companies’ navigate the pandemic’s consequences on their supply chains will be a key influence on market behaviour. China’s shut down hit western factories dependent on Chinese components in a disruption that could now accelerate attempts by companies to diversify away from China. Elsewhere, the pandemic is turning countries inward and the demand for self-sufficiency is rising – most prevalent in health-related products.

“In my opinion, de-globalisation will impact portfolios via decreased profits for certain platform companies that will be less able to have their products manufactured in cheap labour countries – think Apple for example,” says Olivier Rousseau, executive director of France’s Fonds de reserve pour les retraites “If de-globalisation is in fact mostly ‘de-Chinaisation’ then the impact could be less because other Asian economies (Vietnam, Indonesia, Malaysia, Thailand) will replace China as on offshoring Eldorado. In the short term there would be increased costs caused by the transfer of physical supply chains.”

Rousseau also believes the COVID-19 crisis has shown companies the importance of maintaining reasonable levels of inventory.

“In the pharma sector it is probable that governments will be much more interventionist and demand that big pharma re-onshore a lot of their production and keep large inventories of critical imported inputs. At the same there will be more public and private money available for biotech,” he predicts.

FIS2020 will discuss other trends in equity markets too. Passive investors may have to consider if buying the index as a whole still makes sense if some industries will be safer investments than others: travel is unlikely to rebound soon; banks could face increased risk as corporate insolvencies rise. Even within seemingly robust sectors such as technology, there will be divergence by company. Amazon is hiring, Microsoft says the numbers using its technology for remote conferencing has boomed, but Apple chief executive Tim Cook said the company is in “the most challenging environment” it has ever seen speaking at a recent conference call to discuss the company’s results.

The Fiduciary Investors Symposium Digital 2020 on June 23 and 24 will look at the extreme uncertainty of the global economy including the changing geopolitical dynamics and the potential unravelling of globalisation; the unprecedented fiscal and monetary policy responses and the implications for investments; how investors are positioning portfolios and managing short and long term risks; supply chain risks and responsible capitalism; what a sustainable recovery looks like and how investors can ensure it happens.

Asset owners can register for the Fiduciary Investors Symposium here.