Real estate is one of the asset classes hardest hit by the pandemic. Although FIS 2020 experts warn that some companies may never return to the office, opportunities are already appearing in smaller, regional hubs while listed real estate will recover quicker than private investments.

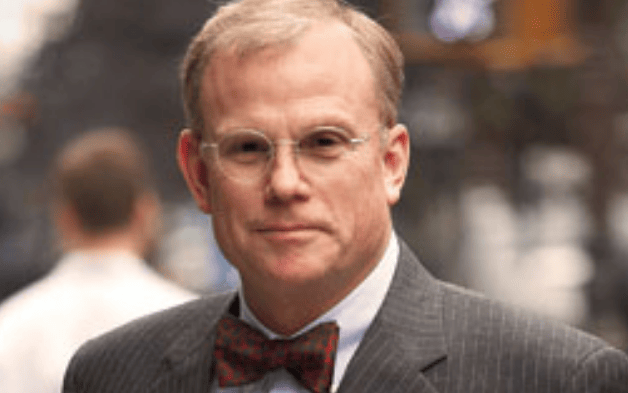

COVID-19 has “turbo charged” changes already underway in real estate, Jason Rothenberg, head of real estate at the $110 billion State of Wisconsin Investment Board, SWIB, told FIS 2020 Digital delegates. The pension fund allocates 8 per cent of its AUM to real estate in a portfolio that targets both durable income and alpha, favours private investment and a high level of control via segregated accounts and joint ventures. Since the crisis, the pension fund has navigated rent relief requests and is currently studying ways on how best to bring people safely back into offices, he said.

Rothenberg also noted that carrying out due diligence and inspections of properties during lock down is challenging. Checking real estate conforms with social distancing rules across dining, fitness and healthcare sectors makes the pension fund’s relationships with partners and managers all the more important: SWIB doesn’t manage real estate “in isolation” but uses a manager or two, he said.

Unconventional fiscal policy, low interest rates and uncertainty as to where inflation is heading is casting uncertainty over the asset class, said Jon Cheigh, CIO at Cohen & Steers. Income generating assets are normally “top of list” if people are worried about inflation, yet “significant” disruption from the pandemic has left retail and commercial offices empty, he said.

Yet Cheigh reminded delegates that real estate’s range has expanded in recent years to include logistics, data centres and tech towers. “Retail and office are smaller than some of these other areas which have now become bigger parts of the market.”

He said the future is best viewed through different lenses. Hotels and offices will go through a “normal recession” cycle, while in a second phase some sectors like office, university and elderly housing will have to adjust to new social distancing rules and adapt to “unique” conditions.

He said that winners and losers will emerge from the current market. On one hand office is bound to be hit hard.

“Parts of some companies may never return to the office,” he warns. However, he countered that people still want to work in offices for concentration, culture and collaboration. “Office is an area where we will be selective and find value; we see decentralisation of some areas and some gravitation away from global cities and more affordable lifestyle cities. There are changes afoot.”

Real estate is also a key asset for investors seeking to protect against inflation – a worry that is “seeing lots of interest,” he said.

He also cautioned that while real estate faces unprecedented challenges because of our new virtual lives “in reality everything we consume is physical.” He said that a shift in dominant sectors within real estate doesn’t herald the demise of the whole asset class, just as the end of banks’ dominant role in stock indexes in the 2000s didn’t leave equity markets permanently damaged.

He urged investors to diversify (although he said even smart people never get it 100 per cent right) and invest with conviction: some retail assets will make sense, as will some office assets. He also said that over a full-cycle investors wanted listed and unlisted real estate to balance returns, risk and volatility. “A combination is best but at times you want to be tactical. Listed tends to correct first creating more of an opportunity.”

As for the much-talked of shift out of cities in response to COVID-19, both commentators were circumspect.

“I believe in cities. They are engines of creativity and productivity,” Rothenberg said.

However, he noted that near-term there will be more of a focus on so-called 18-hour or smaller cities which don’t have the same pressure on public transport or health services.

“In the long-term this is a blip, but in the short-term we will see movement out of global growth cities into regional hubs,” he predicted. Cheigh concluded that this held opportunities for decentralised retail and dinning solutions. People working from home want to go somewhere for lunch, he said.