FIS 2020 delegates heard how US pension fund CalPERS wants to use leverage to push deeper into private assets, while Ronald Wuijster, chief executive officer, APG Asset Management said the policy response has made taking advantage of buying opportunities difficult.

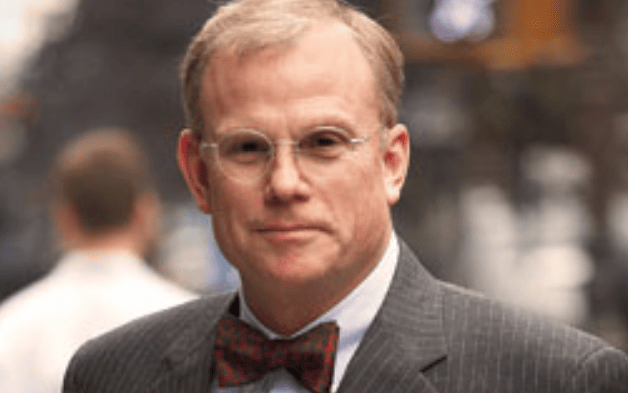

Leverage will enable CalPERS to invest more in return-producing private equity and debt allocations, and deployed prudently and opportunistically “could be very helpful,” Ben Meng, CIO of the $400 billion US pension plan told delegates at FIS Digital 2020. In a conversation with fellow investor Ronald Wuijster, chief executive officer, APG Asset Management, Meng acknowledged introducing leverage equivalent to up to 20 per cent of the assets of the fund (around $80 billion) exposed CalPERS to risk, yet he said the pension fund couldn’t hide from risk.

The use of leverage whether through borrowing or the use of derivatives is integral to his plan to increase the fund’s allocation to better-performing private equity and private debt. Meng said private equity is the only asset class that consistently delivers above CalPERS 7 per cent return target, and as more companies stay private for longer, it will continue to represent an attractive opportunity. “We are trying all possible ways to increase exposure to private equity,” said Meng who doesn’t have unanimous board approval for the policy. Margaret Brown voted against the policy changes at the June board meeting – the only dissenting voice.

Boosting the allocation to private equity holds other challenges beyond tapping liquidity or “having more assets” via leverage. CalPERS won’t manage the allocation in-house (around 80 per cent of the total fund is managed in-house) yet the “performance dispersion” amongst General Partners is large.

Access to the top GPs is critical, yet CalPERS mustn’t increase private equity by compromising the underwriting standards or liquidity provision of fund, said Meng, explaining that a key question is assessing how much the pension fund can “give to top managers.” In its new approach to private equity investment, CalPERS is “ramping up” its ability to co-invest and invest in separately managed accounts, as well as talking with potential captive GPs, willing to work with one Limited Partner. Although CalPERS scale and brand will help access top GPs the fund is also limited by its size and the fact GPs only raise money “every three years or so. “This is not something we can rush,” said Meng.

Managing liquidity risk is also a key component to the success of deploying leverage said Meng, who explained how the fund’s new liquidity framework will help ensure sucess. CalPERS has identified all “potential uses of liquidity” spanning paying benefits to margin calls, rebalancing needs and ensuring dry powder on hand. Similarly, it has identified all potential sources from contributions to dividends, turning assets to liquidity and, as of late, “borrowing liquidity.” Meng told delegates that not all sources of liquidity are the same and noted the potential risk, but reassured that the fund has run scenario analysis and standard risk management procedures.

Real market pricing?

When the conversation turned to how the investors are responding to the crisis, Wuijster noted that the policy response makes taking advantage of buying opportunities challenging. “We worry if we are looking at real market pricing,” he warned. In the first few weeks of the crisis the main concern was liquidity, particularly around access to credit markets and the asset manager’s ability to hedge its liabilities via interest rate swaps. “Central banks started intervening after one to two weeks and this made a difference and kept markets up,” he said. “It was a tight situation in the first weeks.”

APG has rebalanced for most of its client funds and is now starting to look at positioning the portfolio for opportunities. “We are talking with clients about financial positions and different economic scenarios, working with them to see what they think, and their risk appetite.”

As for corporate restructuring, Wuijster noted “companies in the middle” that will need to rethink strategy and emphasise sustainability.

Meng reminded delegates that because the current crisis stems from a health issue, only a vaccine will bring resolution. Until then, volatility will dominate, countered by fiscal policy providing short-term relief “to see if the market can work it out.” He added: “One way or another volatility will stay.”

Regarding inflation rising due to the stimulus, Wuijster said high inflation “would be a surprise” and is “not the most likely scenario.” He cautioned, however, that higher prices for petrol and medicines could drive inflation, as could the economic impact of Covid-19 “being less-than-expected.”

Both men agreed that more opportunities exist in less efficient and transparent private markets where dislocations are more pronounced. Although technology companies are driving the recovery in public markets they noted “laggards in the index too,” and flagged that the real impact of Covid-19 is still “evolving.”

CalPERS navigated the immediate volatility and “extreme dislocation” by “keeping calm and carrying on,” said Meng. The pension fund was able to rely on its “ten pathways” to liquidity and rebalance the portfolio. He said the fund’s “serendipitous” liquidity planning and preparation for this part of the cycle has allowed it to navigate the crisis so far. “We have a plan,” he concluded.

Amanda White will interview CalPER’s CIO Ben Meng this week as part of the Fiduciary Investors podcast series.