Asset owners are reporting only half of their true total costs according to analysis by CEM Benchmarking exclusively for Top1000funds.com. This means tens of billions of dollars across the industry is not being reported.

“Are our fund’s costs reasonable in comparison to other funds?” CEM Benchmarking has been helping asset owners answer this question for 28 years.

Why do asset owners not simply review each other’s financial statements to compare their costs? After all, financial statements must comply with accounting standards.

One would expect that costs across funds would be presented in a complete and comparable way, at least for funds subject to the same accounting standards (e.g. US GAAP, IAS). Unfortunately, this is not the case.

Our research indicates that, at best, only half of true total investment management costs are included in asset owner financial statements. Across the industry this means an enormous amount of costs actually incurred go unreported. Tens of billions of dollars are not reported by asset owners.

How did we conclude that only half of costs are reported in annual report financial statements?

Short answer to the above question, not easily. Our cost estimates are based on 28 years of collecting detailed cost and performance data from asset owners. Table 1 supports our estimate and is also based on a recent comprehensive review of the public disclosures of 24 large global funds representing $4 trillion of AUM.

Table 1.

Actual costs and reported costs in annual report financial statements1

| Basis points | |

| External manager fees, third party services and internal costs2 | 51.4 |

| Private asset carry2 | 12.3 |

| Transaction costs2 | 10.5 |

| True Total Cost | 74.2 |

| Average financial statement Total Costs in annual reports 1 | 37.5 |

| Financial Statement Total costs relative to True Total cost | 51% |

1 Based on a recent study of financial reporting disclosure practices of 24 global funds representing $4.4 trillion.

2 Based on 300+ global pension and sovereign wealth funds representing $9.3 trillion in assets in the CEM database. Transaction cost estimate is based on a subset of 27 global funds representing $1.7 trillion in assets. CEM conducts an annual survey of asset owner performance, costs, and value for money metrics. Time period chosen to match financial reporting disclosure practices study.

The group of large global asset owners studied to arrive at the estimate above chose to participate in the CEM database, suggesting that these are asset owners who particularly care about costs. We believe our estimate that 49 per cent of costs go unreported in financial statements of annual reports is conservative and the extent of under-reporting is likely to be higher across the entire industry.

Why are costs reported so differently in financial statements?

Averages do not always tell the whole story and that is certainly the case here. While the average fund reports only around half its true costs, from fund to fund, there are big differences.

Some report 80 per cent or more of their true costs, others, less than 30 per cent. The problem is accounting standards provide so much room for interpretation that two funds with identical investment costs could disclose vastly different figures, while still complying with accounting standards. Most accounting standards do require disclosure of all invoiced investment costs. While this requirement may seem simple and clear, in practice it leads to inconsistency and frequently to large unreported costs.

What costs are reported most inconsistently in annual reports?

Pooled investments vs. separate accounts – Many pooled investment funds net fees from returns. Fund unit holders never receive an invoice. Separate accounts, on the other hand, generally invoice funds directly. If funds report only invoiced fees, costs could look dramatically different simply due to their choice of pooled or separate account structures. We found some financial statements did not disclose any external fees because they are all netted from returns.

Private market investments – Private market investments made through Limited Partnership agreements (LP’s) are particularly problematic when it comes to cost transparency.

- Base manager fees are often invoiced and reported after netting offsets and rebates representing fees paid to the General Partner from portfolio companies. CEM believes that the portion of these charges kept by the GP should be included as an additional cost and the portion rebated to the LP should not be used to offset base fees. Why? Because base fees are payable regardless of transactions with portfolio companies and the GP keeps its share of offsets and rebates.

- Carried interest (aka performance fees) is often poorly reported, if reported at all. Very few funds disclose the level of carried interest accrued or paid, amounts that can be very material. There is not even consensus about whether carried interest is a cost. Some asset owners do not include carried interest because they believe it is a form of profit sharing and not a cost. This problem is even more acute with fund of fund arrangements where there are two layers of fees that often go unreported in financial statements.

Transaction costs – Perhaps the area that is most poorly disclosed is transaction costs. In recent years regulators in the UK, the Netherlands and Australia have required more fulsome disclosure of transaction costs. But elsewhere in the world disclosures remain rare. Transaction costs are not trivial, they can represent 20 per cent of total investment costs. The second issue with transaction costs is inconsistency in what is included/not included. Complete disclosure includes brokerage commissions, estimates of fixed income trade spreads, and deal acquisition and other transaction costs for private assets.

Going beyond requirements – Examples of better cost disclosures in annual reports

Fortunately however, some funds do recognise that mere adherence to accounting standards results in an incomplete and misleading cost picture. Some leading global asset owners are choosing to go above and beyond the minimum requirement in their reporting. Here are two excellent examples.

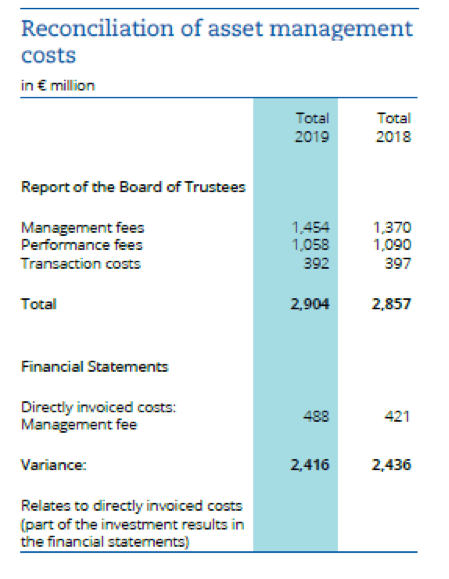

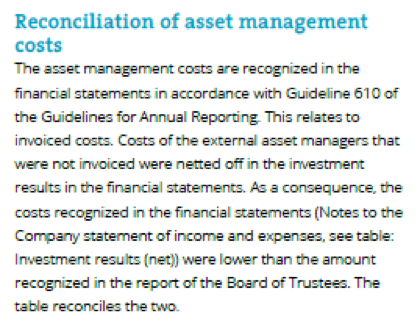

- ABP provides a reconciliation of financial statement costs versus true total costs

In their 2019 annual report, ABP, a fund that covers government and education workers in the Netherlands, provided a table reconciling the difference between invoiced external manager fees disclosed in accordance with accounting Guideline 610 for Annual Reporting with what they report to their board, which is the true total costs including costs netted directly from the assets. The difference is stark, actual asset management costs were €2,904 million, compared to what is included in their financial statements, just €488 million.

Excerpt of 2019 ABP Annual Report (English version) page 53, the pension fund for government and educational workers in the Netherlands.

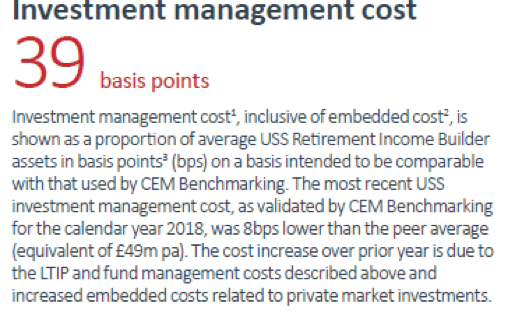

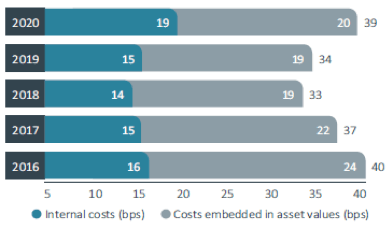

- Universities Superannuation Scheme (USS) focuses on total cost rather than financial statement cost

USS, the principal pension scheme provided by universities and other higher education and associated institutions in the UK builds on their financial statement costs of 19 bps – which reflects only internal costs plus invoiced external management costs. In all discussion of costs in their annual report, they refer to their asset management costs as 39 bps, which reflects not only internal and invoiced costs but also costs that were deducted from the assets directly.

Exhibit 2 – page 7 of USS Report and accounts 2020

4Excerpt of USS Report and accounts for the year ended 31, March 2020 page 7. USS is the principal pension scheme provided by universities and other higher education and associated institutions in the UK

Implications for fund management and stakeholders

While it might be expected that following the generally accepted accounting principles would provide complete, standardised, easily comparable figures, this is not the case. Accounting standard boards should take note that current accounting rules and practices result in incomplete and non-comparable cost reporting in asset owner financial statements.

Fortunately, some of the world’s leading asset owners choose to go above and beyond minimal financial statement requirements in the other sections of their annual reports (eg management discussion and analysis, report from board/management), to disclose their true total costs.

Transparent, clear, and complete cost disclosure is just one aspect of a good annual report, but an important one. In his 1954 book, The Practice of Management, Peter Drucker said: “What gets measured gets managed”.

Though perhaps not as catchy, we suggest expanding that premise: “What gets measured in a clear and complete manner and disclosed in public documents, gets managed to fiduciary standards.”

Sandy Halim, CPA, CFA and Mike Reid work at CEM Benchmarking