Investors all over the world are pondering the inflationary environment: is inflation coming; will it stick; what does it mean for investments; is stagflation possible; how should portfolios be hedged?

The Fiduciary Investors Symposium to be held online on May 25 and 26 will take a deep dive into the inflationary expectations of investors and look to history as a guide on asset class performances during different inflationary regimes. It will hear from investors who argue both sides of the coin with regard to inflation and the outlook for investors, providing indicators to look for to know whether a particular scenario will play out.

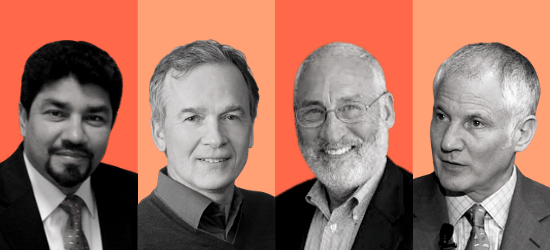

Chief economist of Pictet Asset Management, Patrick Zweifel, argues that the growth environment is as important as inflationary regime and shows that in periods of low and high inflation, so long as there is growth, risky assets will perform well. He says it’s also a good environment for emerging markets.

The event will look in detail at emerging markets including how a lack of transparency and sound data remain huge challenges in many emerging markets. A dedicated session will look at how investors assess the risk of investing in emerging markets given the inefficient access to information and the role that ‘economic transparency’ has in affecting asset prices. Another session will look at the need for investors to back companies with strong secular growth to find alpha in emerging markets.

Professor Stephen Kotkin, Professor of History and International Affairs at Princeton University and long-time collaborator of Top1000funds.com will look at the rising simultaneous threat and an opportunity for investors in China. Kotkin will guide investors on how to navigate a worsening geopolitical situation and what it means for economic growth. He will examine whether the current course is a steady state, or whether big shocks, for the better or for the worse, are possible and even likely.

The other key theme for investors, and policymakers, is the extreme debt levels in the global economy. In 2020 governments, companies and households around the world raised $24 trillion to offset the pandemic’s economic toll. This has brought the global debt total to an all-time high of $281 trillion or 355 per cent of global GDP, according to the Institute of International Finance. The event will examine what this level of debt means for investors and how they allocate capital including a deep dive into infrastructure – including the expanded definition of infrastructure to include things like data centres – and private debt markets

Farouki Majeed, chief investment officer of Ohio School Employees Retirement System and one of the investors speaking at the event, says his concerns in the medium to long term are centred around the growing debt burden and the implications of that on returns.

“There is huge stimulus in the US and it is all being borrowed from the future. The latest round of stimulus probably went a little too far. The new administration is trying to incorporate some of their other agendas into the COVID relief which is fine in the short term, but it’s a lot of money.”

Majeed points out the $27 trillion debt bill in the US has pushed the debt to GDP ratio to 130 per cent, up from 91 per cent a decade ago and 55 per cent 20 years ago. In 1929 at the time of the market crash the debt to GDP ratio was 16 per cent.

“We have that federal debt to GDP and have never seen such erratic prices at that level. That will be a drag on future economic growth,” he says.

As an investor, Majeed’s job is to figure out how these concerns and opportunities can be reflected in the asset allocation, and this event will examine the various responses by investors around the world.

The COVID crisis has been an accelerator for certain key themes driving markets, and has highlighted that some long-held assumptions in investments should not be made anymore. Bob Prince, co-CIO of Bridgewater will look at the assumptions in an MP3 world, where monetary and fiscal policy are coordinated, and what portfolio construction looks like in this environment.

He says in an MP3 world, direct government spending rather than mostly efficient markets will be a much larger influence on the investment assumptions we take for granted, the drivers of growth and inflation, the flow of liquidity and how it impacts the cash flows of each asset, the pricing of the assets, their discount rate and the currency they’re denominated in.

Another session will look at the financial system as an amplifier of regime probability and examine the structural trends in the financial sector post-COVID and whether the crisis has reinforced a paradigm of lower for longer, or poses a threat to it. It will showcase the signposts for investors that we are heading in one direction or another and what that means for capital allocation. The discussion will look at the resilience of the sector including how effectively the debt overhang caused by policy responses will be dealt with, and the physical and transition risks posed by climate that have been accelerated by the crisis. The session will debate whether there is a possibility of financial repression and what that would mean for investors.

The conference ends with a keynote address by one of the most famed economists, Nobel Prize winner, Professor Joseph Stiglitz. He says the big differences between the vaccine rollouts and the scale of the stimulus measures across the world could result in a K-shaped global economic recovery, with much of the developed world booming but poorer countries continuing to struggle. However the west, with its growing debt, is not out of the woods either, he argues.

The event program has more than 20 investors from all over the world responding to speakers, provoking questions and giving insight into their thinking on these important issues.

If you are an asset owner and would like to register to attend visit www.fiduciaryinvestors.com