One of the silver linings of the pandemic has been that location is not a restraint on investment when it comes to investing in venture capital with investors seeing venture opportunities springing up in all corners of the world.

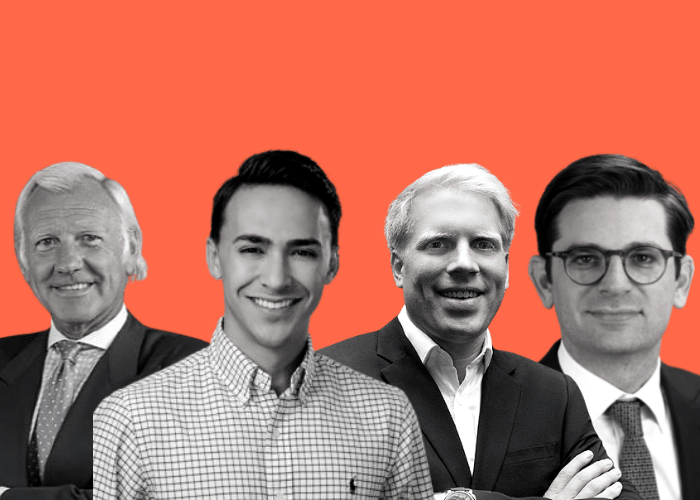

Leading an expert panel discussing venture capital investment at FIS Digital 2021, Todd Ruppert who’s current roles include chair of INSEAD endowment following a 27-year tenure at T. Rowe Price, said investors should tap the asset class since many companies are staying private for longer. Moreover, investors who have backed start-up innovation have played a significant role in helping find solutions in healthcare and technology through the pandemic.

Magnus Grimeland, chief executive at Antler described the VC firm’s mission as helping grow companies that will help build a better future. Antler finds founders, and backs individuals, to build companies from scratch and deliver strong investor returns. He said trends in the VC space show really high returns from the top decile funds but enduring volatility. He also described a tremendous amount of deal flow, investors with dry powder at the ready and fierce competition to invest in the best companies.

He also noted how regulatory changes mean more capital is flowing into the asset class. At Antler strategy is focused on the very early stage, finding entrepreneurial founders in research teams at institutions or tech companies seeking to build new companies from scratch.

“We find people who otherwise wouldn’t be an entrepreneur,” he said, noting that this approach also skews away from the California and China bias to finding companies coming out of new ecosystems.

Fellow panellist Mitchell Hammer, investment associate at Princeton University Investment Company, told delegates that the endowment began investing in venture capital in 1981, and that venture is now a meaningful part of the overall asset allocation. The fund has a 30 per cent allocation to private equity comprising pre-seed and venture to buyouts, currently overweight at around 40 per cent.

“In many ways, venture is the perfect asset class for endowments,” he said citing the fund’s ability to allocate long term.

Similarly, Todd Cohen, director, investment office at New York Presbyterian Hospital described the fund’s positive view on venture in a relatively new program. Several years ago, the allocation was just a small corner of the portfolio, now it is increasingly central within private equity and the fund is increasingly taking the allocation out of buyouts and putting more into venture. Venture will be the risk generation for the portfolio going forward, leading out-performance.

“We are long term bullish; some valuations give us reason to pause, but we will continue to allocate into the foreseeable future,” Cohen said.

Panellists reflected on how venture opportunities are springing around the world. Although San Francisco and China will continue to produce great companies for years to come, more cities across the US are developing hubs for fast growing companies like Boston, Miami and Seattle. Outside the US, panellists listed Stockholm, Berlin and Singapore as venture hubs alongside Vietnam, Japan and Korea.

Grimeland also expressed excitement in Africa, noting great companies coming up, just a few years behind Southeast Asia. Adding to the list, Cohen noted opportunities in Israel while Hammer said that one impact of the pandemic (and travel ban) has been to make geography less of an issue when backing founders.

“We increasingly see managers outside their typical locations; location is not a restraint on investment,” he said.

Panellists also noted the broad similarities between selecting entrepreneurs and selecting managers. Antler seeks to fund entrepreneurs and founders with drive to solve a problem and grit to press on when they hit barriers, citing Tesla and AirBNB’s founders as entrepreneurs with this flavour of true grit. The ability to execute is another sought-after characteristic.

“We look for a history of execution,” said Grimeland, noting that often founders have great ideas but can’t execute.

Panellists agreed that VC can be a hard way to make money but that it should have a place in a diversified portfolio. Moreover, they also cautioned on the volatility between high and low venture fund performance. As a stand-alone allocation it is buyer-beware, but as part of a diverse portfolio venture adds a lot of value.

Next the conversation turned to start-ups listing via SPACS, or Special Purpose Acquisition Companies, one of the hottest trends in investment circles. Grimeland described the trend as holding positives and negatives for start-ups.

On one hand, it provides these companies with a new source of capital. On the other, and less positively, it has resulted in some companies going public too soon and put under pressure from management teams in the SPAC. It can lead to founders worrying more about shifts in the stock price than building a great business, he said.

Echoing these sentiments, Hammer suggested founders ensure incentives are aligned and described the SPAC craze as a symptom of equity market exuberance that could lead to founders and investors making poor choices.

As for VC manager selection, panellists counselled on the importance of diversity across geographies, ideas and advisory networks for a different perspective.

“It is difficult to get into our program,” said Hammer. That said, he noted that the endowment doesn’t look at track record that much, and invests in first time funds based on their team strength.

Panellists also touched on the importance of diversity in the founder pool, and the dangers of missing talent.