Funds around the world improved their scores on responsible investment disclosure by more than on any of the three other factors assessed in the 2023 Global Pension Transparency Benchmark.

The GPTB measures the transparency of disclosures of 15 pension systems across the value-generating measures of cost, governance, performance and responsible investment. Scores of all four factors improved this year compared to last year.

Responsible investment disclosures showed the most improvement, with the average score improving by 20 per cent, from an average score of 49 to 59 year-on-year.

This was followed by the governance factor, which achieved the highest average score this year of 65 out of a possible 100, an improvement of 11 per cent for the year. The gain was driven by 92 per cent of funds improving their governance disclosure.

Average scores for performance disclosures declined slightly, from 64 to 62 year on year.

Cost scores improved from an average of 48 to 51; however, with the stark improvement of the responsible investment factor, cost disclosures now rate as the lowest average score of all the four factors. Only 45 per cent of funds improved their public reporting on costs.

CEM Benchmarking product lead for transparency benchmarking Edsart Heuberger says that funds would generally gain the most by improving their external investment cost and responsible investing disclosures.

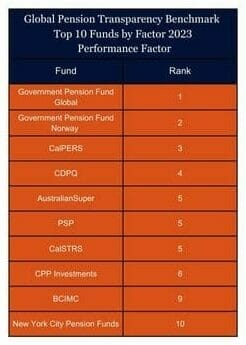

In terms of individual fund scores, the Dutch fund Stichting Pensioenfonds Zorg en Welzijn topped the list for cost. In the governance factor, three funds ranked equal first, all achieving the extraordinary result of full marks in their scores: Australia’s AustralianSuper, and Canada’s CDPQ and CPP Investments.

Norway’s Government Pension Fund Global was the best fund for transparency of disclosures related to performance and also took equal top spot with Dutch fund bpfBOUW for responsible investment.

In last year’s review it was noted that governance scores were most closely correlated with the overall score, and that perhaps it was the case that as good governance produces positive results, it creates greater incentive (or perhaps less disincentive) to be transparent with stakeholders.

CEM observes this year that responsible investing disclosures showed an equal correlation with governance and that good governance allows funds to move beyond simply managing assets and towards addressing wider environmental and social issues.

Cost factor

The average country cost factor score was 51 but there was huge variation between individual funds, with scores ranging from 7 to 93. Heuberger says as the dispersion in scores suggest, cost disclosures varied considerably in completeness, and he urges funds to pay more attention to this factor.

CEM’s asset-owner performance database clearly shows that net returns are materially impacted by investment management costs, with about 75 per cent of gross returns above benchmarks going to pay related investment expenses.

But paying more does not necessarily get you more: CEM says cost-effective investment management strategies generally outperform high-cost approaches over the long-term. Costs matter, and they should be understood, managed, and disclosed.

Barriers to comparing costs around the globe include differences in tax treatment, organisation/plan types, and accounting and regulatory standards, which all mean it is difficult to find common ground for assessment.

“Cost reporting seems to be the area where funds flounder a little bit,” Heuberger says. “It takes considerable effort internally, and also requires external managers to report to you. It could take five to 10 years to see the change required.”

Governance factor

The average country score for governance was 71 out of a possible 100. This represented an increase of seven from last year’s average score of 64, and makes it the best rated of the four factors.

The governance factor was one of the standout results in this year’s GPTB, with three funds ranked equal first and all three achieving the extraordinary result of full marks: AustralianSuper, CDPQ and CPP Investments all scored 100.

The biggest Canadian public funds continued to be the leaders in governance disclosures, consistent with their reputation of excellent governance. All five Canadian funds included in the benchmark featured in the top 10 funds for governance disclosures, and were all in the top 10 funds overall.

Performance factor

The overall average score for performance was 62, a slight decline from 64 last year. Average country scores ranged from 21 to 95.

The US and Canadian funds lead the way, with an average country score of 87 and 89 respectively.

These funds typically had extensive and good quality reporting across all performance components.

Responsible investing factor

Funds were scored based on 54 questions across three major components. The average country score was 49 out of 100 up from 42 in last year’s review, marking the biggest relative improvement among any of the four factors.

Improvements to disclosures were seen across all components and most countries, however this factor still has the greatest dispersion of scores reflecting that countries are at different stages of implementing responsible investing within their investing framework. Average country scores ranged from 0 to 94.

The Netherlands stole Sweden’s crown in this factor with a score of 77, besting the Swedish funds by a single point. Both countries had improved disclosures over the past year. The Nordic countries – Sweden, Denmark, Finland, and Norway – continued to do very well as a region on responsible investing, with all countries receiving scores well above average.

CEM’s Heuberger notes that funds were more likely to provide quantification of their responsible investing initiatives and this year, and that more funds went a step further and provided context by laying out longer-term goals.

CEM’s Heuberger notes that funds were more likely to provide quantification of their responsible investing initiatives and this year, and that more funds went a step further and provided context by laying out longer-term goals.

“Several funds started producing stand-alone reports focused exclusively on responsible investing which provided comprehensive, holistic overviews of their programs,” he said.

While overall in the past three years there has been positive momentum in the advancement of transparency across all the factors, there is still room for improvement.

“Leading countries excel in different areas,” Heuberger said.

“Canadians have terrific reporting on governance and investment performance. The Dutch are world-class on costs. The Nordics excel in responsible investing.

“Generally, funds would gain the most by improving their external investment cost and responsible investing disclosures.”

For all the scores and rankings by country, fund and factor click here