Key Takeaways

- We believe generative artificial intelligence (GAI) has the potential to significantly alter both the economic and investment landscape—making it more than just hype.

- In our view, companies with the infrastructure to integrate AI with their existing platforms and businesses building crucial generative AI components appear well-positioned for early success.

- Despite risks ranging from misinformation to labor displacement, we believe that widespread adoption of generative AI could provide immense long-term benefits to society.

The idea behind machines being able to think like humans has been around for nearly a century. In the 1940s and 1950s, computer scientist Alan Turing wrote a paper on machines being able to simulate human beings and created the world’s first “Chess-bot.” The term “artificial intelligence” was first used in 1956 by Stanford Professor John McCarthy, who later defined AI as “the science and engineering of making intelligent machines, especially intelligent computer programs.”1 To be sure, machine learning and artificial intelligence are not new concepts in investing, and in fact, both have been used in quant strategies for some time.

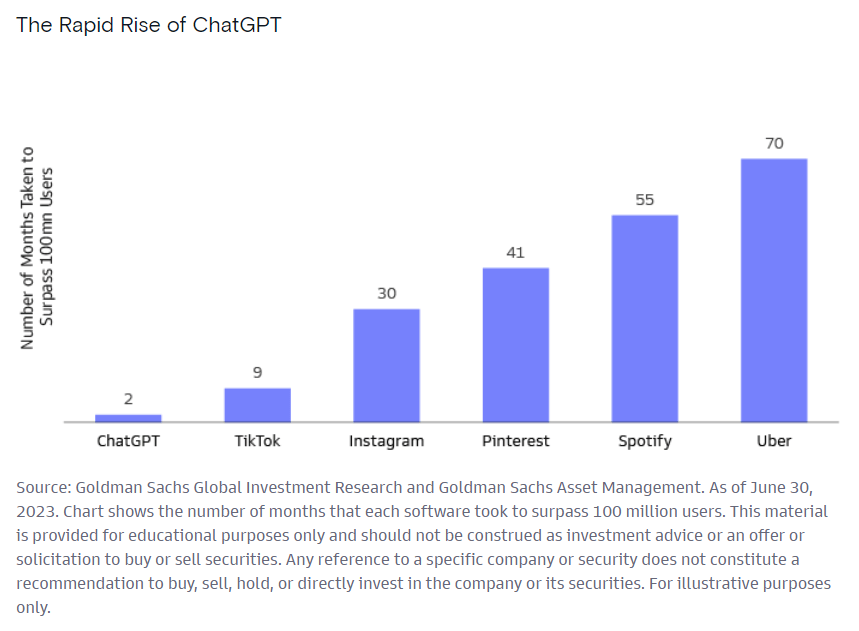

The renewed excitement around the topic stems from the generative aspect of AI. In November 2022, OpenAI released the first generative artificial intelligence (GAI) chatbot, ChatGPT. Put very simply, ChatGPT is a computer program designed to simulate conversation with human users. It can tell you a joke. It can report on the weather. It can even write this whitepaper. By using generative AI vs. traditional AI, ChatGPT can not only “hold a conversation” much better than chatbots of yesteryear, but also can translate language to code, write a resume for an entirely fabricated position, or create song lyrics about your favorite holiday in the writing style of Edgar Allen Poe. ChatGPT’s popularity soared, and within 5 days of being released, the software had over one million users. Furthermore, it was one the fastest applications to reach 100mn users ever.

HOW DOES IT WORK?

GAI’s functionality can be attributed to three key components: 1) neural networks, 2) deep learning, and 3) natural language processing (NLP). Just like human brains, GAI works on a system of multiple neural nodes that process and filter through information in multiple states. Consider a program that is teaching a computer to recognize paintings, and we show this program Andy Warhol’s Campbell’s Soup Cans.2 The initial layer in this artificial neural network is like the optic nerve, feeding raw data from the “eyes” to the “brain.” Data then flows through several neurons, and each has a different function and can communicate with others; perhaps the first is searching for edges and passing information along to the second, which is searching for shapes and passing information along to the third, which is searching for specific features. In this example, each node is an individual knowledge hub that screens and classifies data at each stage, ultimately leading to the model identifying the correct work of art. Taking the analogy one step further, deep learning is a means of machine learning through unstructured data.

Traditional machine learning may have required humans to tell the program specifically what to look for—if a painting contains pop art, the artist may be Andy Warhol or Keith Haring. By showing the program thousands of depictions of pop art, it can draw its own conclusions and further improve its analytic capabilities. Finally, NLP enables computers to interpret speech, gauge interest, read text, and evaluate images, both with syntactic and semantic analysis. By using NLP, a GAI model that is shown Campbell’s Soup Cans may be able to posit conclusions on the meaning behind the painting: perhaps Warhol depicted what he did to show that art should be for everyone, not just cultured curators, or maybe he was just an avid soup consumer! Put very simply, neural networks, deep learning, and NLP are all means of how AI thinks.

Is GAI Just Another Hype Cycle?

One of the key points of skepticism around investing in artificial intelligence is the debate as to whether it is another bubble. We argue that it is not, because AI is already making an important impact in investing, and because funding for GAI has already surpassed that of previous hype cycles at their respective peaks. Artificial intelligence and machine learning have been used in quantitative investment strategies for several years. Anyone who has ever used a trading algorithm has likely taken advantage of AI in investing, as many of these algorithms are making decisions based on large data sets at high speeds or exploiting possible arbitrage opportunities. AI can also be used to optimize asset allocations to construct portfolios that might perform better than those constructed with traditional techniques, aid in pre- and post-trade analysis, and analyze market and credit risk. While less known, some large language models may also be used in both sentiment analysis—e.g., comprehending subtext of corporate earnings calls—and portfolio optimization. Most recently, a GAI model was created to analyze Federal Reserve statements and assign them a “Hawk-Dove score,” with the goal of detecting potential trading signals.3 We expect these links between AI and investing to become even more intertwined as society becomes more familiar with the technology.

“Something else that sets GAI apart from many prior technological advancements is its potentially drastic impact on economies.”

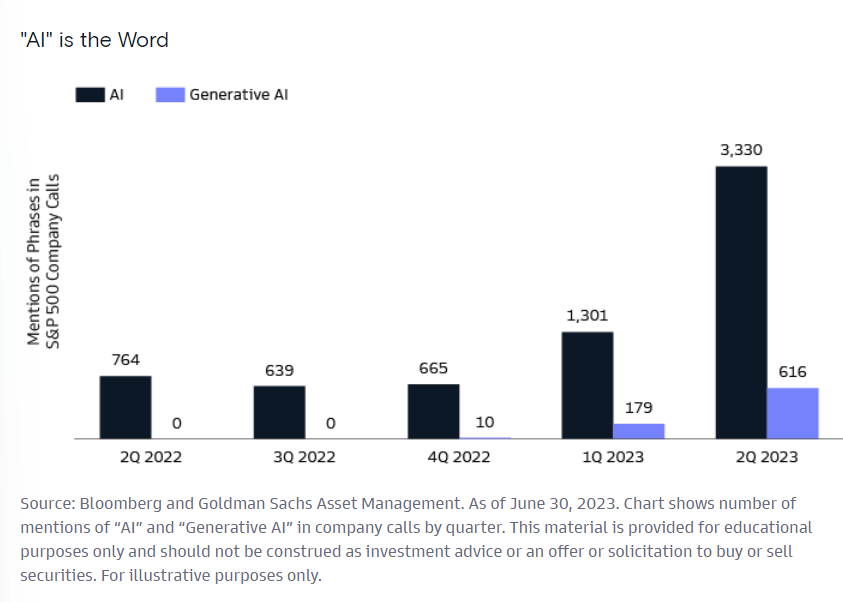

Another indication that AI may persist for some time is the amount of funding that is being deployed. In the first quarter of 2023, GAI companies raised $2.3bn from venture capital firms. Quarterly VC fundraising for the metaverse at its peak in 2021 was only $2.1bn. Large corporations are taking a similar interest; in 4Q 2022, there were only 10 mentions of “generative artificial intelligence” on S&P 500 company correspondences. We believe this stemmed from Microsoft’s purchase of a $10bn stake in OpenAI. In 2Q 2023, this number increased drastically, and even Mark Zuckerberg, who changed the name of his company to Meta in 2021, said, “[Meta’s] single largest investment is in advancing AI.”

Of course, using AI also includes challenges. For instance, increasingly opaque algorithms can make it difficult for humans to monitor, evaluate, and understand how AI models will respond to inputs, anomalous events, or complex tasks. Additionally, AI relies on large amounts of data, especially in the learning phase. The quality and availability of this data can lead to improper calibration, skewing results.

We recognize that there may be growing pains with AI and acknowledge the potential risk of markets getting ahead of themselves. But in our view, GAI is here to stay.

Economic Impact of GAI

Something else that sets GAI apart from many prior technological advancements is its potentially drastic impact on economies. In the long term, we believe that widespread adoption of GAI has the potential to materially change our lives, interactions, and all of human existence. Goldman Sachs Global Investment Research economists have likened the impact of GAI to two milestone inventions in human history: the electric motor in 1890 and the personal computer in 1981. In each of these instances, the productivity “boom” did not begin until roughly 50% of businesses adopted the technology—a threshold that took 20 years to reach. After reaching this threshold, however, labor productivity grew by 1.5 percentage points annually for over a decade, and we believe that widespread adoption of GAI could yield similar effects to the tune of a 7% annual increase in global GDP, which stems from two main channels. First, many workers are employed in occupations that are partially exposed to AI automation. If AI can increase workers’ capacities, then plausibly, said workers may direct some of their newfound time toward more productive activities. Second, if workers do end up being displaced by AI automation, we believe that these workers will eventually become reemployed, and therefore boost total output. The size of GAI’s impact will ultimately depend on its true capabilities and adoption timeline, but we believe that it is possible to begin reaping the economic benefits of GAI sometime in the latter years of the 2020s.

Technological Impacts of GAI

AI has seemingly been the darling topic on company calls across industries. As of the end of June, the phrase was mentioned 3,330 times according to Bloomberg.4 The surprising aspect of this viral growth, aside from the broad volume of mentions, has been the range of companies—from Microsoft to Kraft to Moderna to Zoom—that are trying to incorporate AI into their businesses. As previously mentioned, the most widespread use of GAI thus far has been chatbots. Following Microsoft’s substantial investment in OpenAI for the use of ChatGPT, other tech companies have increased efforts in making their own chatbots (Google’s Bard, Snapchat’s “AI”). The functionality of chatbots extends far beyond jokes and weather updates. Chatbots have the potential to revolutionize customer service and improve the efficiency of human searches/research—ask ChatGPT to plan a travel itinerary of a camping trip for proof. Additionally, chatbots are becoming smarter and more sophisticated at incredible rates. Chatbots are not the only notable application of GAI. Through NLP, AI is being used to help programmers write original code. In some instances, according to Goldman Sachs Chief Information Officer Marco Argenti, developers are accepting nearly 40% of code written by AI,5 which could boost programming productivity by double digit percentages. Eventually, AI will be used in entertainment, medicine, and nearly every industry.

Investment Impact of GAI

Outside of the question, “is AI going to take over humanity,” investors are most curious as to where they can strategically position their portfolios to take advantage of its new developments. Given the different components of the GAI tech stack—including apps, hardware, cloud platforms, foundation models, and model hubs—companies may want to consider tech investments to capitalize on the benefits of GAI.

“There seems to be a plausible case for gai in just about every industry.”

In our view, the groups who may prosper the most are 1) large companies with infrastructure who can integrate AI with their existing platforms, 2) companies that produce both the components of AI and build/license GAI models, and 3) companies outside of technology who are most willing to scale their own AI adoption. Unsurprisingly perhaps, large tech companies with strong infrastructure stand to gain from the advent of new tech. By implementing AI models into existing productivity tools, workers could benefit from increased efficiency and the ability to leverage multiple sources of data in one application. For example, someone creating a presentation could use GAI to pull notes from a text document and populate a slide in a slideshow, all without leaving the slideshow application. Furthermore, GAI can help employees who are not as well-versed in software to take full advantage of the tools available to them.

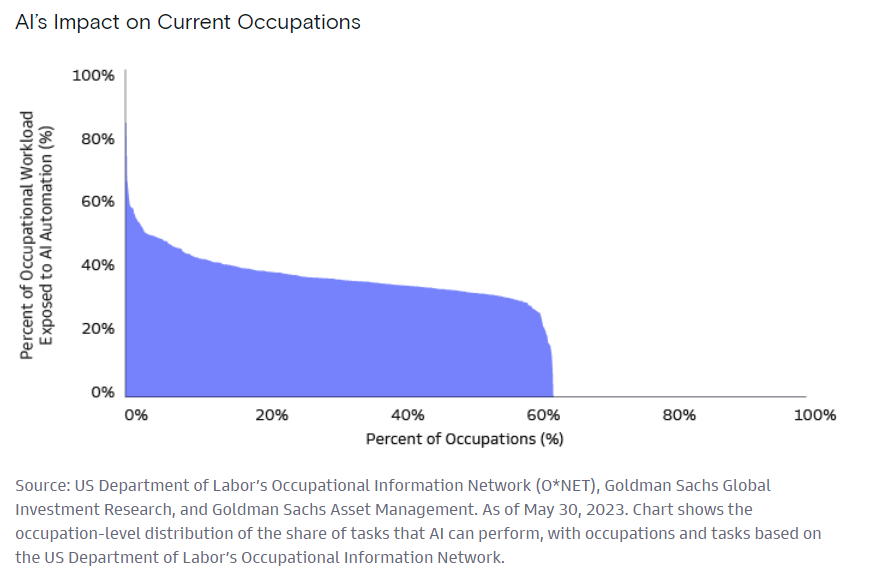

Outside of just productivity, tech companies may be positioned to quickly adopt GAI in search engines—DevOps and cybersecurity to name a few. Second, there is now a global demand for GAI models, but not all companies have the infrastructure/resources to build their own. For a smaller company looking to increase productivity, it makes sense to subscribe to use an AI model that was created externally. We also believe manufacturers of graphics processing units (GPUs) and other components of AI may be able to succeed. Finally, given that roughly 66% of jobs are exposed to AI automation, we believe that any company that can embrace GAI to improve its efficiency could benefit. Healthcare is just one example of a sector in which GAI tools could be leveraged for patient diagnosis, personalized treatment plans, and novel drug design. There seems to be a plausible case for GAI in just about every industry, and although there are very few jobs in which GAI can automate more than half the work, we believe widespread adoption of GAI could provide a double-digit productivity boost in many fields.

Despite being in the early stages of discovery and adoption, the potential advantages of GAI are hard to ignore. However, the narrowness of the recent market rally may be evidence that the markets may not have fully embraced AI yet. Because it is unclear how exactly the adoption of GAI will impact company fundamentals, it may be too early to tell if GAI companies are overvalued, and it is unclear if traditional valuation methods should be applied in this space. Having said that, some tech valuations are severely stretched. Investors may have difficulty in selecting future GAI winners at the right price. As managers continue to study the space, the markets may dictate new valuation dynamics, potentially with the help of AI.

Key Risks

We see three main risks when it comes to widespread adoption of AI technology: 1) privacy and copyright issues, 2) ethical issues, and 3) labor displacement. The large language learning models upon which AI platforms are built leverage huge amounts of data to train, meaning that a cyber-attack or data breach could potentially cause significant damage. More unique to GAI is the risk of copyright infringement. While still early, notable examples of AI “theft” have come from the music industry, in which sound engineers have been able to use artificial intelligence to create original music with AI versions of famous artists’ voices. In some instances, the replication is uncanny. There is also the matter of ethical issues when it comes to using AI, notably in the forms of plagiarism and misinformation. As mentioned earlier, GAI models are trained on existing available data, so the likelihood of content being plagiarized is higher, and it is the user’s responsibility to sensibly use the content generated. Additionally, GAI tools have been under scrutiny around the accuracy of information being disseminated, which can be dangerous to users like asset managers who are unable to verify them.

Despite the dangerous risk that misinformation poses, the risk that we feel is most impactful is labor displacement. We believe that approximately two-thirds of US occupations are exposed to some degree of AI automation, with particularly high exposures in administrative and legal professions but low exposures in construction and maintenance. An estimated 7% of jobs could be displaced.6 However, history shows that worker displacement from automation is mostly offset by the creation of new jobs. Sixty percent of the jobs that exist today did not exist in 1940, and over the last 80 years, the technology-driven creation of new jobs has accounted for 85% of employment growth.7 We expect AI to be no different, with new roles being created in data science, AI research, and engineering, to name a few. Additionally, while the future interplay between labor unions and GAI is unclear, we have already seen that unions in industries like airlines, medicine, and entertainment writers are navigating the nuances of emphasizing human involvement in jobs while seeking protections from companies and government regulations against being replaced completely.

We feel that GAI could drastically change both the economic landscape and the investment landscape. As with many new technologies, there are certainly risks, but we believe that the benefits of adoption of GAI far outweigh the costs. Through GAI, humans are given some of the most futuristic “game pieces” the world has ever seen with no gameboard or instructions on how the game should be played. That is where the art and imagination of artificial intelligence takes hold. As civilization starts to learn how to wield these tools, we believe the possibilities for innovation could be truly endless.

Important Information

1 John McCarthy, “What is Artificial Intelligence?” As of November 12, 2007.

2 Museum of Modern Art, Andy Warhol’s Campbell’s Soup Cans, 1962.

3 Bloomberg, “JPMorgan Creates AI Model to Analyze 25 Years of Fed Speeches.” As of April 26, 2023.

4 Bloomberg and Goldman Sachs Asset Management. As of June 30, 2023.

5 The Wall Street Journal, “Goldman Sachs CIO Tests Generative AI.” As of May 2, 2023.

6 Goldman Sachs Global Investment Research, “The Potentially Large Effects of Artificial Intelligence on Economic Growth.” As of March 26, 2023.

7 Goldman Sachs Global Investment Research, “The Potentially Large Effects of Artificial Intelligence on Economic Growth.” As of March 26, 2023.

Glossary

Artificial intelligence is the development of computer systems able to perform tasks that normally require human intelligence.

Generative AI is a type of AI system capable of generating text, images, or other media in response to prompts using a database.

Risk Considerations

All investing involves risk, including loss of principal.

General Disclosures

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant.

Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Goldman Sachs has no obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes.

THESE MATERIALS ARE PROVIDED SOLELY ON THE BASIS THAT THEY WILL NOT CONSTITUTE INVESTMENT ADVICE AND WILL NOT FORM A PRIMARY BASIS FOR ANY PERSON’S OR PLAN’S INVESTMENT DECISIONS, AND GOLDMAN SACHS IS NOT A FIDUCIARY WITH RESPECT TO ANY PERSON OR PLAN BY REASON OF PROVIDING THE MATERIAL OR CONTENT HEREIN. PLAN FIDUCIARIES SHOULD CONSIDER THEIR OWN CIRCUMSTANCES IN ASSESSING ANY POTENTIAL INVESTMENT COURSE OF ACTION.

The views expressed herein are as of the date of the publication and subject to change in the future. Individual portfolio management teams for Goldman Sachs Asset Management may have views and opinions and/or make investment decisions that, in certain instances, may not always be consistent with the views and opinions expressed herein.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change, they should not be construed as investment advice.

This material is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon the client’s investment objectives.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. It should not be assumed that investment decisions made in the future will be profitable or will equal the performance of the securities discussed in this document. The website links provided are for your convenience only and are not an endorsement or recommendation by Goldman Sachs As-set Management of any of these websites or the products or services offered. Goldman Sachs Asset Management is not responsible for the accuracy and validity of the content of these websites.

The opinions expressed in this white paper are those of the authors, and not necessarily of Goldman Sachs. Any investments or returns discussed in this paper do not represent any Goldman Sachs product. This white paper makes no implied or express recommendations concerning how a client’s account should be managed. This white paper is not intended to be used as a general guide to investing or as a source of any specific investment recommendations.

Examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

Company names and logos, excluding those of Goldman Sachs and any of its affiliates, are trademarks or registered trademarks of their respective holders. Use by Goldman Sachs does not imply or suggest a sponsorship, endorsement or affiliation.

Past performance does not guarantee future results, which may vary.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA): This material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches (“GSBE”). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Switzerland: For Qualified Investor use only – Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Bank AG, Zürich. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Bank AG, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Asia excluding Japan: Please note that neither Goldman Sachs Asset Management (Hong Kong) Limited (“GSAMHK”) or Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H ) (“GSAMS”) nor any other entities involved in the Goldman Sachs Asset Management business that provide this material and information maintain any licenses, authorizations or registrations in Asia (other than Japan), except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore, Malaysia, India and China. This material has been issued for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited, in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H) and in or from Malaysia by Goldman Sachs (Malaysia) Sdn Berhad (880767W).

Hong Kong: This material has been issued or approved for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited, a licensed entity regulated by the Securities and Futures Commission of Hong Kong (SFC). This material has not been reviewed by the SFC. © 2023 Goldman Sachs. All rights reserved.

Singapore: Investment involves risk. Prospective investors should seek independent advice. This advertisement or publication material has not been reviewed by the Monetary Authority of Singapore. This material has been issued or approved for use in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H).

Australia: This material is distributed by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (‘GSAMA’) and is intended for viewing only by wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth). This document may not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced or distributed to any person without the prior consent of GSAMA. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth). Any advice provided in this document is provided by either of the following entities. They are exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences, and are regulated under their respective laws applicable to their jurisdictions, which differ from Australian laws. Any financial services given to any person by these entities by distributing this document in Australia are provided to such persons pursuant to the respective ASIC Class Orders and ASIC Instrument mentioned below.

- Goldman Sachs Asset Management, LP (GSAMLP), Goldman Sachs & Co. LLC (GSCo), pursuant ASIC Class Order 03/1100; regulated by the US Securities and Exchange Commission under US laws.

- Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), pursuant to ASIC Class Order 03/1099; regulated by the Financial Conduct Authority; GSI is also authorized by the Prudential Regulation Authority, and both entities are under UK laws.

- Goldman Sachs Asset Management (Singapore) Pte. Ltd. (GSAMS), pursuant to ASIC Class Order 03/1102; regulated by the Monetary Authority of Singapore under Singaporean laws

- Goldman Sachs Asset Management (Hong Kong) Limited (GSAMHK), pursuant to ASIC Class Order 03/1103 and Goldman Sachs (Asia) LLC (GSALLC), pursuant to ASIC Instrument 04/0250; regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws.

No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

New Zealand: This material is distributed in New Zealand by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (’GSAMA’) and is intended for viewing only by wholesale clients in Australia for the purposes of section 761G of the Corporations Act 2001 (Cth) and to clients who either fall within any or all of the categories of investors set out in section 3(2) or sub-section 5(2CC) of the Securities Act 1978, fall within the definition of a wholesale client for the purposes of the Financial Service Providers (Registration and Dispute Resolution) Act 2008 (FSPA) and the Financial Advisers Act 2008 (FAA),and fall within the definition of a wholesale investor under one of clause 37, clause 38, clause 39 or clause 40 of Schedule 1 of the Financial Markets Conduct Act 2013 (FMCA) of New Zealand (collectively, a “NZ Wholesale Investor”). GSAMA is not a registered financial service provider under the FSPA. GSAMA does not have a place of business in New Zealand. In New Zealand, this document, and any access to it, is intended only for a person who has first satisfied GSAMA that the person is a NZ Wholesale Investor. This document is intended for viewing only by the intended recipient. This document may not be reproduced or distributed to any person in whole or in part without the prior written consent of GSAMA.

Canada: This presentation has been communicated in Canada by GSAM LP, which is registered as a portfolio manager under securities legislation in all provinces of Canada and as a commodity trading manager under the commodity futures legislation of Ontario and as a derivatives adviser under the derivatives legislation of Quebec. GSAM LP is not registered to provide investment advisory or portfolio management services in respect of exchange-traded futures or options contracts in Manitoba and is not offering to provide such investment advisory or portfolio management services in Manitoba by delivery of this material.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law by Goldman Sachs Asset Management Co., Ltd.

South Africa: Goldman Sachs Asset Management International is authorised by the Financial Services Board of South Africa as a financial services provider.

Colombia: Esta presentación no tiene el propósito o el efecto de iniciar, directa o indirectamente, la adquisición de un producto a prestación de un servicio por parte de Goldman Sachs Asset Management a residentes colombianos. Los productos y/o servicios de Goldman Sachs Asset Management no podrán ser ofrecidos ni promocionados en Colombia o a residentes Colombianos a menos que dicha oferta y promoción se lleve a cabo en cumplimiento del Decreto 2555 de 2010 y las otras reglas y regulaciones aplicables en materia de promoción de productos y/o servicios financieros y /o del mercado de valores en Colombia o a residentes colombianos. Al recibir esta presentación, y en caso que se decida contactar a Goldman Sachs Asset Management, cada destinatario residente en Colombia reconoce y acepta que ha contactado a Goldman Sachs Asset Management por su propia iniciativa y no como resultado de cualquier promoción o publicidad por parte de Goldman Sachs Asset Management o cualquiera de sus agentes o representantes. Los residentes colombianos reconocen que (1) la recepción de esta presentación no constituye una solicitud de los productos y/o servicios de Goldman Sachs Asset Management, y (2) que no están recibiendo ninguna oferta o promoción directa o indirecta de productos y/o servicios financieros y/o del mercado de valores por parte de Goldman Sachs Asset Management.

Esta presentación es estrictamente privada y confidencial, y no podrá ser reproducida o utilizada para cualquier propósito diferente a la evaluación de una inversión potencial en los productos de Goldman Sachs Asset Management o la contratación de sus servicios por parte del destinatario de esta presentación, no podrá ser proporcionada a una persona diferente del destinatario de esta presentación.

Israel: This document has not been, and will not be, registered with or reviewed or approved by the Israel Securities Authority (ISA”). It is not for general circulation in Israel and may not be reproduced or used for any other purpose. Goldman Sachs Asset Management International is not licensed to provide investment advisory or management services in Israel.

Jordan: The document has not been presented to, or approved by, the Jordanian Securities Commission or the Board for Regulating Transactions in Foreign Exchanges.

Bahrain: This material has not been reviewed by the Central Bank of Bahrain (CBB) and the CBB takes no responsibility for the accuracy of the statements or the information contained herein, or for the performance of the securities or related investment, nor shall the CBB have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein. This material will not be issued, passed to, or made available to the public generally.

Kuwait: This material has not been approved for distribution in the State of Kuwait by the Ministry of Commerce and Industry or the Central Bank of Kuwait or any other relevant Kuwaiti government agency. The distribution of this material is, therefore, restricted in accordance with law no. 31 of 1990 and law no. 7 of 2010, as amended. No private or public offering of securities is being made in the State of Kuwait, and no agreement relating to the sale of any securities will be concluded in the State of Kuwait. No marketing, solicitation or inducement activities are being used to offer or market securities in the State of Kuwait.

Oman: The Capital Market Authority of the Sultanate of Oman (the “CMA”) is not liable for the correctness or adequacy of information provided in this document or for identifying whether or not the services contemplated within this document are appropriate investment for a potential investor. The CMA shall also not be liable for any damage or loss resulting from reliance placed on the document.

Qatar This document has not been, and will not be, registered with or reviewed or approved by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or Qatar Central Bank and may not be publicly distributed. It is not for general circulation in the State of Qatar and may not be reproduced or used for any other purpose.

Saudi Arabia: The Capital Market Authority does not make any representation as to the accuracy or completeness of this document, and expressly disclaims any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of this document. If you do not understand the contents of this document you should consult an authorised financial adviser. The CMA does not make any representation as to the accuracy or completeness of these materials, and expressly disclaims any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of these materials. If you do not understand the contents of these materials, you should consult an authorised financial adviser.

United Arab Emirates: This document has not been approved by, or filed with the Central Bank of the United Arab Emirates or the Securities and Commodities Authority. If you do not understand the contents of this document, you should consult with a financial advisor.

European Economic Area (EEA): This marketing communication is disseminated by Goldman Sachs Asset Management B.V., including through its branches (“GSAM BV”). GSAM BV is authorised and regulated by the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten, Vijzelgracht 50, 1017 HS Amsterdam, The Netherlands) as an alternative investment fund manager (“AIFM”) as well as a manager of undertakings for collective investment in transferable securities (“UCITS”). Under its licence as an AIFM, the Manager is authorized to provide the investment services of (i) reception and transmission of orders in financial instruments; (ii) portfolio management; and (iii) investment advice. Under its licence as a manager of UCITS, the Manager is authorized to provide the investment services of (i) portfolio management; and (ii) investment advice. Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law. In Denmark and Sweden this material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches (“GSBE”). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law (“FIEL”). Also, Any description regarding investment strategies on collective investment scheme under Article 2 paragraph (2) item 5 or item 6 of FIEL has been approved only for Qualified Institutional Investors defined in Article 10 of Cabinet Office Ordinance of Definitions under Article 2 of FIEL.

Date of First Use: August 7, 2023. Compliance Code: 326285-OTU-1837720