Nevada’s public pension plan only pays 11 basis points in total costs due to 80 per cent of the fund being indexed. But CIO Steve Edmundson says low fees are a byproduct, not the reason for the strategy.

Low complexity, low costs and a disciplined rebalancing strategy are the key elements in how the Public Employees Retirement System of Nevada (NVPERS) aims to meet its long-term investment return target of 8 per cent a year.

About $32 billion of NVPERS’ $40 billion, as at June 30, 2017, is managed in index strategies, explicitly designed to minimise complexity and to minimise the risk of the fund missing its return target.

As a by-product of an indexed-focused strategy the fund also boasts low costs. NVPERS accounts for the year ended June 30, 2016, reveal total investment expenses – including fees paid to fund managers and consultants, as well as investment administration expenses – were $39.3 million, or just 0.11 per cent of the fund’s $35 billion of assets at that date. The fund’s non-investment administrative expenses were just less than $11 million, or about 0.03 per cent of fund assets.

At these levels, NVPERS is low-cost by North American pension fund standards – even including $24.7 million of fees reported by the fund as paid to private equity general partners over the period.

Analysis by CEM Benchmarking in 2014 found US pension schemes spent, on average, 0.59 per cent of assets on investment management. The same analysis found Dutch funds – the lowest cost in the world – spent on average 0.44 per cent of assets.

NVPERS paid just $498,000 over the year to one of its investment managers for the management of an $8 billion US equity index portfolio – less than 1 basis point.

The chief investment officer for NVPERS, Steve Edmundson, says that while minimising complexity is an objective of the fund, it’s “a chicken or an egg thing: an uncomplicated fund leads to lower investment costs”. But a focus on keeping costs down precludes a high degree of complexity anyway.

Edmundson says the greatest benefit of indexing is often overlooked in the debate about the pros and cons of management styles, and it has less directly to do with minimising costs than many assume.

“Yes, it’s uncomplicated and, yes, it’s low-fee,” he says. “However I think more important than all that, indexing is a tool to put the exact market exposures into the portfolio that we’re looking for.

“That’s something that’s sometimes not appreciated when people refer to indexing.

“They say, well, you’re just getting what the market gives you, which is true, but what it means is we get to put in the exact market exposure that we want.

“It’s the best tool for the job, and it’s the best tool for the way we manage the fund. Keeping costs low is a nice byproduct of it.”

Strict rebalancing

NVPERS’ long-term investment objective of 8 per cent is based on a targeted return of 4.5 per cent above inflation.

“The fund’s current inflation expectation, which our actuary and board is reviewing now, is 3.5 per cent,” Edmundson says. “A 4.5 per cent real return we think is reasonable, but of course it will be impacted by the underlying inflation expectations.”

Outside its index portfolios, the fund holds about $8.4 billion in private market assets, including $1.7 billion in private equity. The long-term target for private equity is to exceed the S&P 500 Index by 4 per cent a year, over rolling 10-year periods.

NVPERS’ rebalancing strategy clearly defines triggers and what actions should be taken when asset allocation strays from long-term targets of 30 per cent in US fixed income, 42 per cent in US equities, 18 per cent in international equities and 10 per cent in private markets.

For each asset class the strategy defines a liquid asset target – the long-term target weighting of an asset class expressed as a percentage of the fund’s liquid (non-private market) assets – and a “liquid asset rebalance trigger”. When the liquid asset target hits a trigger, the portfolio is rebalanced back to the liquid asset target. For US equities, the liquid asset target is 46.7 per cent. The trigger to rebalance up to the liquid target is when the liquid allocation hits 44.3 per cent, and to rebalance down to the liquid target the trigger is 51.4 per cent.

“The funding source/destination shall be those asset classes that are the farthest from their policy target,” the fund’s investment policy says.

Edmundson says his chief task is to “do an effective job” of managing the fund’s asset allocation, including rebalancing, and to ensure the fund sticks to its stated philosophy even as market conditions change around it.

“Changes to our fund’s asset allocation are fairly infrequent and that is, in fact, by design”, Edmundson says. Adjustments to asset allocation are “somewhere in a three- to five-year time period, that’s about right”.

All NVPERS’ money is managed externally, and Edmundson says there are no plans to change that.

“I’m currently the only investment employee here in Nevada, so that would be a tall order,” he says. The fund’s organisational chart identifies a total of fewer than 70 staff.

Edmundson says that successful investing is as much about being patient and disciplined as it is about having any great ability to predict future market movements. Patience and discipline have been tested, with the portfolio returning 2.3 per cent in the 12 months to June 30, 2016, with positive returns from US stocks and bonds offset by negative returns from international stocks.

“It’s easy to get into the 24-hour news cycle – or it’s the second-by-second news cycle – and to get sucked into the daily noise,” he says.

“Ultimately what’s going to drive the return of our fund, and every other fund out there, is its asset allocation, how much we own in risk assets and how much you have allocated to risk-control assets.

“It’s easy to get caught up in trying to add value around the margins, when really the value that’s going to be added is in sticking with the approach over longer time periods.”

Long-term relationships

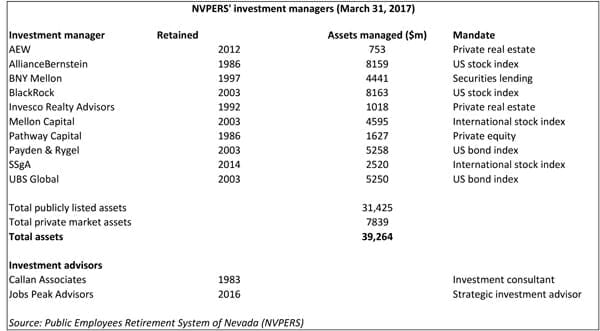

Some of NVPERS’ managers have been managing money for the fund since the mid 1980s; it last appointed a new manager in 2014. As long as its managers meet performance parameters, including minimising tracking error, “it’s not too surprising that we’re not going to be hiring and firing managers too often”.

Edmundson says NVPERS maximises its bargaining power on fees by employing few managers but awarding them significant mandates.

“We want our fees to be as competitive as possible, while still getting the service and the results that we’re looking for,” he says.

“Fortunately, that’s pretty easy to do with index strategies and the fee structures are going to be low. That helps, and it also helps keeping the number of managers low. Having fewer portfolios, but having them larger, certainly gives us the ability to carry a little bit more weight when negotiating fees.”

He says the fund’s relationships with its external managers are necessarily close, but “the relationship is a little bit different than it would be if those were actively managed portfolios”.

“Their main job is just to minimise tracking error relative to the index, and that’s something we’re constantly watching, but the relationship is inherently a little bit different than you would see with an active manager,” he says.

“But because those relationships are large, we are in regular communication with all our managers.”

Ultimately, a low-complexity, low-cost philosophy is how NVPERS has chosen to remove some of the gamble from meeting its pension liabilities over the long term. Edmundson says other funds will find success in other ways, but the main thing is “there’s a cultural buy-in from all the constituency”.

“From a cultural standpoint the fund believes the strategy in place is going to be successful over long time periods, and that belief in the underlying investment strategy allows you get through the tough spots,” he says.

“We know what we’re good at here, and that’s managing asset allocation and being patient and disciplined, and keeping our costs low. We’re just going to focus on what we’re good at.”