The extremely low levels of foreign investments in pension funds in emerging countries is cause for concern, according to the World Bank, which is calling for more diversification of portfolios.

A new paper by the World Bank, Pension funds capital markets and the power of diversification, outlines the need for pension funds, in emerging markets in particular, to invest more of their assets internationally in order to achieve higher returns with potentially lower volatility.

The paper calls for a deliberate creation of innovative domestic investment vehicles combined with more reasonable overseas investment limits, based on the size of the pension fund assets relative to macroeconomic and market factors.

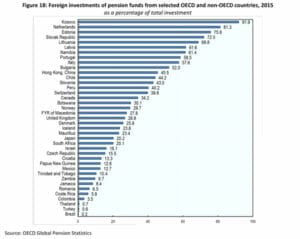

Some countries, including Brazil, Turkey, Thailand, Colombia, Costa Rica and Romania, have less than 7 per cent of their pension assets in foreign investments.

Brazil has less than 0.2 per cent investing offshore, according to the OECD global pension statistics. This compares to the Netherlands, which has 81 per cent of its pension assets invested outside the country.

Some emerging market countries have restrictions on the amount of foreign investments, notably some African countries and India which have a limit of zero.

“There is often much resistance to allowing pension fund assets to invest overseas as governments and authorities wish to see domestic savings used for domestic purposes,” the paper says. “Macroeconomic factors clearly play an important role – including foreign exchange regime, capital flows and policy and availability of foreign currency held by a country’s central bank … however, deciding on the amount and allocation of these international investments should be done in a systematic fashion.”

In particular it says that the amount of foreign investment allowed should be linked to the size of a pension fund’s assets compared to the size and turnover of domestic capital markets or flows, and currency movements.

The paper looks at Chile as an example of a country that has more systematically increased its overseas investment limits, raising them as the pension fund assets have grown and become too large for the domestic market.

The regulatory authorities in Peru have also gradually increased their limits on several asset classes.

The paper also points out that improving governance and management is an important precondition for diversifying these portfolios.