While the portfolio turnover of professionally managed long-only equity funds has been declining on average over recent decades, we have found that managers turn over their portfolios every 1.7 years on average (58 per cent turnover ratio). This finding stems from recent research carried out by Mercer in conjunction with the 2 Degrees Investing Initiative and the Generation Foundation under the Tragedy of the Horizon project.

The study analysed over 1,700 equity strategies with at least three years of recent consecutive data. Overall, the project aimed to explore the potentially suboptimal allocation of capital for the long-term due to the limited ability of the finance sector to capture long-term risks within typically short-term risk-assessment frameworks.

An emphasis on short-term outcomes by investors is potentially damaging for beneficiaries since companies may miss out on profitable long-term investment opportunities and ignore longer-term risks by prioritising quarterly earnings expectations.

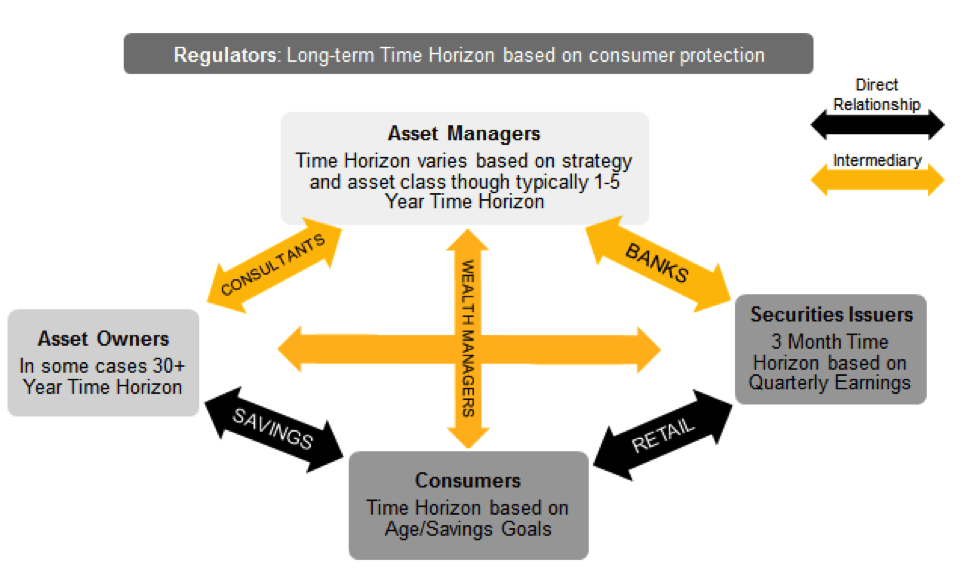

Moreover, short termism can create time horizon mismatches in the investment management value circle generating concerns over principal-agent issues and a misalignment of incentives, as illustrated below.

Figure 1: The investment management value circle and varying time horizons

A key implication of turnover for investors is the hidden cost of portfolio transactions including bid-ask spreads, broker commissions, price impact and taxes which can vary in their traceability and magnitude depending on the characteristics of a given investment strategy.

Asset owners are often not aware of the costs their asset managers incur in the process of portfolio management despite the fact that these costs can often be as significant as management fees. The level of turnover and transaction costs can be a useful indicator of whether a manager is implementing the strategy in line with its stated objectives and investor expectations.

Evidence of long-termism

The average turnover of professionally managed long-only equity funds has been declining over recent decades, despite rising overall stock market turnover.

Moreover, institutional investors tend to favor lower turnover strategies, with around 70 per cent of strategies (by assets under management) having a turnover level of less than 50 per cent and just 4 per cent of strategies having turnover of more than 100 per cent.

We also found that sustainable and responsible investment (SRI) funds exhibit lower turnover than non-SRI funds. This is evidence of the philosophical alignment between the SRI and long-term investment movements and highlights the importance of long-termism to evaluating and addressing environmental, social and corporate governance (ESG) risks and opportunities.

Additionally, through detailed conversations with 10 major asset management firms we learned that trading costs and their related impacts are typically an active consideration in portfolio construction.

While there is a recognised trade-off between alpha and trading costs, managers were generally of the view that trading activities will be influenced by return expectations, risk management considerations and transaction costs – all of which are changing over time.

A majority of the managers interviewed had sought to explicitly align a portion of employee compensation with the time horizon of the strategy’s philosophy. In particular, for longer-term oriented, lower-turnover investment strategies, three- or five-year performance targets will often influence the calculation of employee total compensation.

Evidence of short-termism

Notwithstanding the comments made above, approximately 80 per cent of managers turn over their portfolios every three years or less. The average portfolio turnover for the sample was 58 per cent, implying an average portfolio duration of around 1.7 years. This suggests that most managers may not be performing long-term analysis or obtaining long-term research and data regarding underlying portfolio holdings.

Arguably, if investors turn over their portfolios every one to three years, they are unlikely to generate demand for analysis of long-term risks including those related to ESG factors (such as climate change). These types of risk are therefore susceptible to being mispriced.

As expected, quantitative strategies show consistently higher weight and name turnover compared to fundamental strategies. It is important to note that while quantitative strategies may offer lower management fees than comparable fundamental strategies, they may also incur higher transaction costs, raising the bar for alpha generation.

Recommendations

In a diverse financial ecosystem with many different types of investor with varying motivations and goals, there is likely to be a role for both short- and long-term investment practices. Based on the findings of this research project and others before it, it appears the overall equity market is skewed toward shorter-term behavior. While the investment managers we interviewed did not see a strong need for changes or interventions in markets to promote a more long-term orientation, we believe there are many potential drawbacks to short-termism which need to be better understood.

To this end we recommend the following:

- Asset owners should be explicit about their time horizon in their investment beliefs. Manager monitoring processes should move beyond short-term benchmark-relative performance measures with the aim of assessing progress against expectations over meaningful time periods.

- Asset managers should be explicit about the time horizon over which a given strategy is expected to deliver and how the time horizon feeds into issues such as decision-making and remuneration.

- Regulators should consider the merits of broadening fund disclosure requirements to cover transaction costs in order to better inform asset owner-asset manager discussions.

Alex Bernhardt is principal and head of responsible investment for Mercer in the US.