In our second feature looking ahead to FIS 2020, we highlight the focus on growing calls for a sustainable recovery and purposeful companies. Nobel prize winner Esther Duflo will talk on solutions to inequality that have been magnified during the pandemic.

The global health and economic pandemic has accelerated worrying trends like de-globalisation and the lack of global leadership. But it has also hastened the drive towards positive trends, namely sustainability. Not only have environmental, social and governance (ESG) investments outperformed their non-sustainable counterparts in recent months, the crisis has underscored how connected humans are to society and nature, and raised awareness of the impact of poor governance. Many of the lowest paid workers on whom the real economy depends lack access to insurance, sick pay and medical benefits.

Elsewhere, oil producing countries, where the International Energy Agency forecasts revenues will drop by as much as 80 per cent for some producers, will be forced to diversify their revenue sources, boding well for a greener future. Across a two-day agenda from June 23-24, FIS Digital 2020 will bring academics and asset owners together around these key themes, asking how institutional investors can help build a sustainable recovery, encourage purposeful companies, and foster equality.

For Fiona Reynolds, chief executive of the PRI, recovery from the pandemic offers a chance to rebuild a new type of economy.

“We must try and emerge from the crisis not with a return to normality, but with a plan for an economy fit for the 21st century,” she says. “I think COVID-19 gives us a really unique opportunity to reprioritise and accelerate to a low carbon economy that incorporates sustainability issues.”

The idea is gaining traction, most visible in the growing calls that government bailout money to corona-hit industries (particularly carbon intensive ones) be linked to companies protecting jobs and raising their environmental standards: if airlines need funds, they should commit to cutting emissions and developing new technologies.

It is already starting to happen. Electric cars will be cheaper and easier to charge under France’s €8 billion auto sector recovery plan. Elsewhere, Air France is set to cut domestic flights and its overall emissions as a condition of its €7 billion bailout, and the EU has said green policies will be central to the hundreds of billions of euros it has pledged for the recovery. The lifelines thrown to Canada’s big corporates will be tied to Task Force on Climate Related Financial Disclosure (TCFD) reporting, largely voluntary until now.

“Bailout packages should not be condition free, particularly for businesses in carbon intensive sectors” says Reynolds who highlights the crucial role of institutional capital as economies re-build, suggesting governments and asset owners work together to insure a pipeline of investable sustainable infrastructure.

Purposeful companies

Recovery from the pandemic could also hasten another paradigm shift. The move away from shareholder primacy got a boost last year when America’s Business Roundtable diverged from its traditional stance and stated US corporations should be run in the interests of stakeholders and shareholders.

FIS 2020 attendees will hear how so-called purposeful companies, at the behest of all their stakeholders from companies in their supply chain to employees and the wider community, are the most sought-after amongst leading investors.

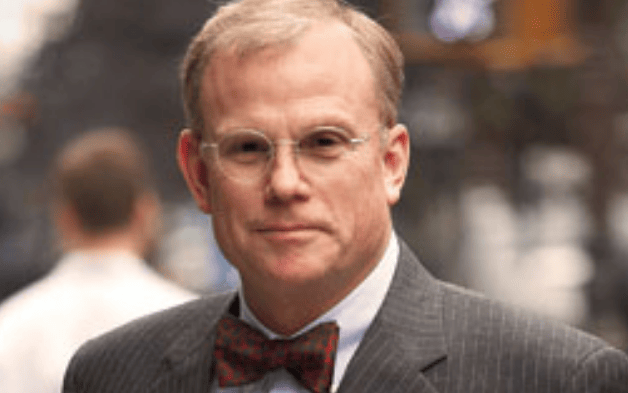

“The pandemic highlighted the vulnerability of business models focused on short-term profit generation. As a provider of pensions and as a responsible steward of the companies in which we invest, we would see this as a positive development,” says Simon Pilcher, chief executive of the United Kingdom’s USS Investment Management.

Views echoed by CalSTRS CIO Chris Ailman, who says the pension fund’s commitment to its members “spans decades and must prioritize long-term value creation over short-term gain.”

Speaking alongside a cohort of other asset owners in a shared statement issued on the eve of the pandemic, Ailman, Hiromichi Mizuno, who has recently stepped down from leading Japan’s $1.4 trillion Government Pension Investment Fund (GPIF) and Gordon Fyfe, head of Canada’s $153.4 billion BCI amongst others, wrote that companies seeking to maximise corporate revenue are unattractive investment targets, and asset managers who ignore long-term risks are unattractive partners.

Purposeful companies are much more likely to put equality centre stage, another enduring topic for FIS regulars.

In conversation with Nobel prize winner Esther Duflo, delegates at the conference will hear how economics and finance can help meet the challenge of inequality, laid bare in the swathe of sobering COVID-19 statistics.

Duflo, who is the Abdul Latif Jameel Professor of Poverty Alleviation and Development Economics in the Department of Economics at MIT and director of the Abdul Latif Jameel Poverty Action Lab, seeks to understand the economic lives of the poor, with the aim to help design and evaluate social policies. She has worked on health, education, financial inclusion, environment and governance. She has written Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty, and the recently released Good Economics for Hard Times.

The Fiduciary Investors Symposium Digital 2020 on June 23 and 24 will look at the extreme uncertainty of the global economy including the changing geopolitical dynamics and the potential unravelling of globalisation; the unprecedented fiscal and monetary policy responses and the implications for investments; how investors are positioning portfolios and managing short and long term risks; supply chain risks and responsible capitalism; what a sustainable recovery looks like and how investors can ensure it happens.

Asset owners can register for the Fiduciary Investors Symposium here.