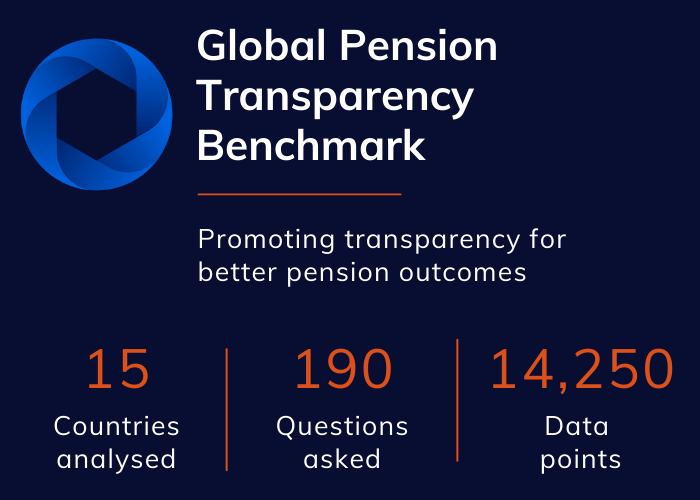

The transparency of pension fund disclosures has improved in the past year across the 15 countries and 75 pension funds measured in the Global Pension Transparency Benchmark, a collaboration between Top1000funds.com and CEM Benchmarking.

The GPTB, now in its second year, examines the transparency of disclosures across four drivers of value, namely cost, governance, performance and responsible investing.

In this second year, governance disclosures showed the biggest improvement with the average score of 65 out of 100 marking an improvement of seven from last year’s average score of 58. Governance was the best overall average score of the four factors.

The Canadian funds continue to excel in this category which CEM Benchmarking’s Michael Reid says is consistent with their reputation for excellent governance.

In last year’s review CEM noted that governance scores were most closely correlated with the overall score: good governance produces positive results and creates greater incentive (or perhaps less disincentive) to be transparent with stakeholders.

This year responsible investing disclosures showed an equal correlation with governance. Good governance allows funds to move beyond simply managing assets and towards addressing wider environmental and social issues.

The overall average performance score was 62, a slight decline from 64 last year and the second highest scoring factor after governance. The performance factor was the only factor to have a decline in the score this year. Average country scores ranged from 43 to 84.

The average country cost factor score was 48, unchanged from last year’s review, with individual scores ranging from 10 to 77.

The average country score for responsible investing was 49 out of 100 up from 42 in last year’s review, marking the biggest relative improvement among any of the four factors. These improvements mean that responsible investing is no longer the lowest scoring factor overall, having surpassed the average score for the cost factor. Improvements to disclosures were evident across all components and most countries. RI did continue to have the greatest dispersion of scores reflecting that countries are at different stages of implementing responsible investing within their investing framework. Average country scores ranged from 11 to 77, a slightly smaller range than last year.

“It was apparent from the reviews that many funds are actively taking steps to improve communications on responsible investing to stakeholders. In particular, many funds are expanding their disclosures to include quantifiable measures and progress towards climate related targets,” Reid says.

The GPTB ranks countries on their disclosures and found the following countries to be the outstanding performers in each category:

• Canada for governance

• The Netherlands for cost

• The Netherlands for responsible investing

• The United States for performance.

The Netherlands continued to lead the way in cost disclosure with the highest country score of 77. Scores were tightly banded from 71 to 89 and the top four cost factor scores were held by Dutch funds.

The Netherlands also ranked number one in the responsible investing factor, usurping last year’s winner of Sweden, with a score of 77. Both countries had improved disclosures over the past year. The Nordic countries – Sweden, Denmark, Finland, and Norway – continued to do very well on RI as a region, with all countries receiving scores well in excess of the overall average.

In the performance factor, the components with the highest scores continued to include asset mix and portfolio composition and risk policy and measures. Similarly the lowest scores were seen for asset class returns and value added and benchmark disclosures.

The US funds continued to lead the way, with an average country score of 84 for the performance factor. The US funds typically had extensive and good quality reporting across all performance components.

To examine the results for 2022 across factors, countries and the underlying funds click here.