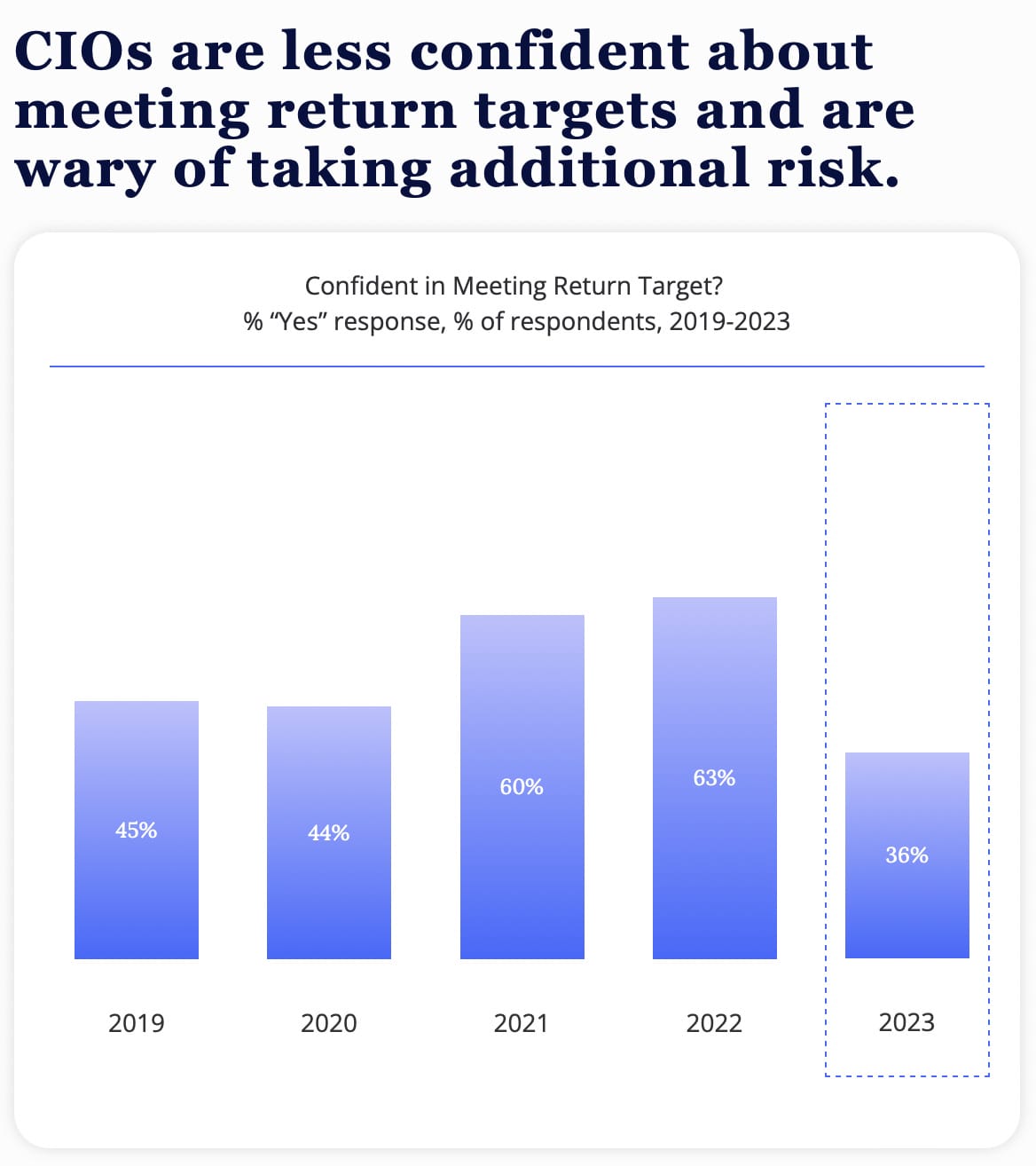

There is a plunge in confidence among CIOs that they will meet their return targets, with only 36 per cent of participants in the 2023 CIO Sentiment Survey expecting they will.

This is almost half the response from the previous year where 63 per cent of CIOs were confident in meeting their return targets.

The 2023 CIO Sentiment Survey, a global collaboration between Top1000funds.com and CaseyQuirk, part of Deloitte Consulting, finds asset owners keeping their allocations static but focusing on agility as they observe dramatic market changes not seen in a generation. And only 11 per cent are taking on additional risk to achieve return targets due to the uncertainty of markets.

With a majority lacking confidence that they will meet their return targets, respondents are re-evaluating their equity exposures, re-structuring their fixed income allocations and de-emphasising private markets.

While most investors were in a wait and see holding pattern regarding allocations The data found liquid equity exposures in a holding pattern, but 31 per cent said they are considering shifting their equities to more inflation-proof sectors.

They are also de-emphasising private markets and expecting write-downs to continue until at least the end of 2023.

Fixed-income allocations are also being re-structured due to fundamental changes in the rate environment, leading to a resurgence of high-quality active fixed income, and tactical increases in active emerging market debt to take advantage of high yields.

Chris Ailman, chief investment officer of CalSTRS, which is the second largest public pension fund in the United States, said fixed income allocations had shrunk in recent years but higher returns are now reversing that trend.

“Now that [fixed income] will have 4-6 per cent return, people will be putting in more money,” Ailman said. “It’s not a massive asset allocation change, the 80/20 portfolio was creeping to 85/15, and it will go back to 80/20. That return on cash and fixed income will help with overall returns.”

Internal management and external relationships

The ongoing shift towards internal investment continues, with 75 per cent of respondents saying they plan to decrease or retain the number of managers on their roster – a figure that is 8 per cent higher than in 2022.

Understaffed internal teams and a talent shortage are the top challenges impacting investment teams, cited by 58 per cent of respondents.

While asset owners have been working hard to build improved technology into their investment process, 57 per cent feel digital advancements have not significantly enhanced their manager due diligence process.

Not a single respondent is running a fully remote operation anymore, with 40 per cent requiring their employees to be in the office between 3-4 days a week, and 35 per cent requiring 1-2 days. Most of the remainder had relatively flexible policies, with only 6 per cent requiring employees to be in the office 5 days a week.

Only 20 per cent of respondents feel it is “important” or “very important” for asset management partners to require their investment teams to be in the office.

The full results can be found here.