This article makes the case that energy is the metaphorical lifeblood of any system, and is therefore the fundamental systemic risk. This insight should inform how we go about our net-zero investing.

As my entry point, let me ask and answer a question: what is energy for? Removing humans from the frame momentarily, this leaves us free to observe that energy comes from the sun; that plants convert the sun’s energy via photosynthesis into sugars; that some animals eat the plants; and that other animals eat animals.

It follows that the plants need to replace what has been eaten. If there is any energy left over, the plant can think about growth – either making itself bigger, or by making copies of itself. From this, we can see that energy has two uses – maintenance, or the repair of damage, and growth, or the making of new things.

When something is new there is very little maintenance to do, allowing almost all the energy to be expended on growth. If it is also small, the rate of growth can be spectacular (low-base effect). Over time, parts wear out and need to be replaced so a larger and larger proportion of energy is spent on maintenance, and less is available for growth. In addition, the “thing” is now bigger and so the rate of growth falls, and eventually stops. Biological growth for an individual entity has a stopping rule; when all the incoming energy is required for maintenance, growth stops.

As we have removed humans for the time being, the “thing” above will be biological, but the principles also transfer to mechanical things. It takes energy to create a machine, and more energy to maintain it.

Returning to our human-free world, we can now start to think about systemic risk. Our thing will seek to replicate itself and grow its population. In isolation, a population can grow up to the limits of available energy. So the population of a bacterium in a petri dish will grow exponentially and then crash to zero when the food runs out. The population of rabbits on an island will rise and fall as it adjusts to the availability of grass. But populations rarely exist in isolation. Instead, we typically observe multiple populations existing simultaneously in an ecosystem, which introduces the complexity of different types of relationships – from symbiotic to predator-prey. These ecosystems can evolve to an equilibrium state, which will be within the limit of available energy, and the rates of extraction and rates of replacement will be equal (a prey species will have enough offspring to replace those being eaten).

Evolving towards equilibrium does not mean systemic risk is absent – just ask the dinosaurs. Even excluding external shocks posed by meteors, a new species could arrive over the hill and find that it is perfectly suited to this new environment. At best, the existing species will have to concede some ground to accommodate the new arrival. At worst, the newcomer outcompetes one of the existing components and sets off a cascade of consequences. Or, perhaps, the climate changes with a similar wide range of possible effects.

We can now re-introduce humans and let them do their thing. They build societies and economies (the ‘system’) some of which, over time, collapse. This thought piece would suggest that the collapsed historical systems out-grew their ability to maintain themselves.

One more thought before we get to our present context. When systems grow, they also increase in complexity. As the number of components grows, the number of possible connections between them explodes. Niches tend to get smaller, and specialisms deeper. There is now a need for energy to also support significant information processing. As we have discussed above, the availability of energy is a systemic risk. I see it as the fundamental systemic risk. And we increase that risk every time we grow our system. I suggest a hypothesis: human systems will always be associated with rising systemic risk. We apply our ingenuity to overcome system constraints. This leads some to believe that human ingenuity will always be able to overcome the next presenting problem. The other side of that trade is that, if we fail on any one occasion, then systemic risk may not show much mercy.

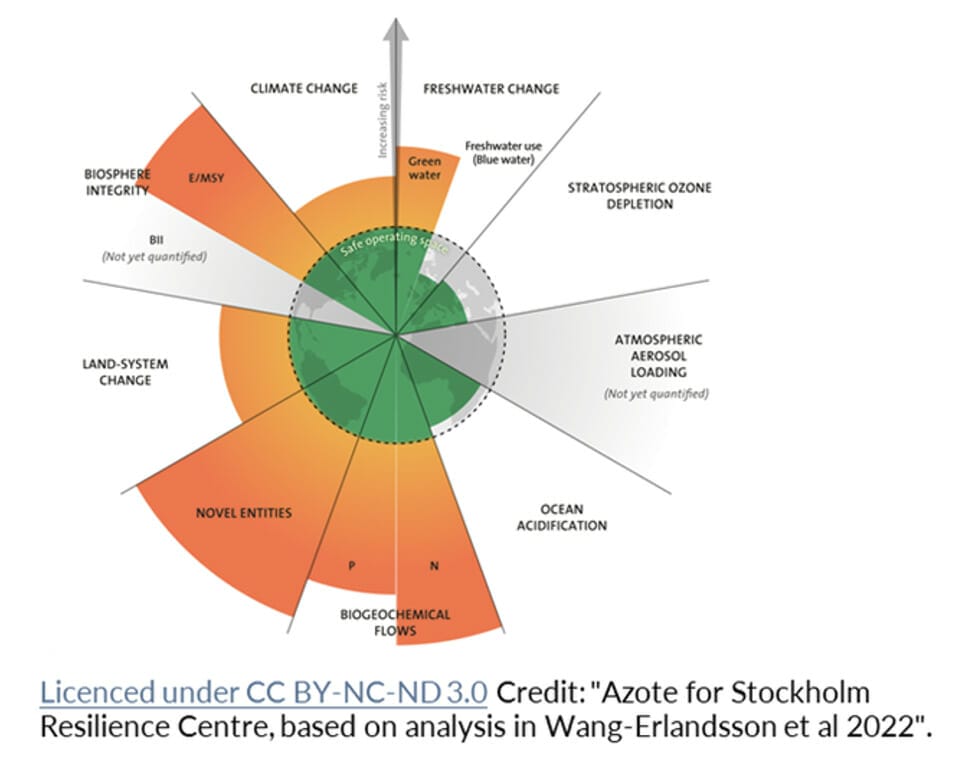

Our present context is illustrated by the graphic. It was created by Johan Rockström as part of his seminal work on planetary boundaries. This version contains 2022 data. The planetary boundaries are indicated by the dotted line. The colour green signifies activity within the boundary. The colour orange highlights activity beyond the boundary. The way we are running our system is – according to the scientists – literally unsustainable.

Climate change has captured the majority of the public attention, and emissions are in breach of their planetary boundary (and so our climate is warming and will continue to do so under present conditions). But the biodiversity problem is even worse – the label ‘E/MSY’ (extinctions per million-specie-years) shows it so much further beyond its planetary boundary. We should expect most ecosystems to change.

The chart also shows that we have big problems with plastics (‘novel entities’) and how we produce our food (‘land-system change’ and ‘biogeochemical flows’). If you believe the scientists have done good work and placed the boundaries in the correct places, then it is hard to think of any better visualisation for systemic risk. We are running our system too aggressively.

So, how might our current context of systemic risk and breached planetary boundaries play out? There are broadly two pathways – to deliberately manage the risk down through time, or to continue as we are and expect the system to reduce the risk in its own way at some stage through a collapse.

Hopefully the first option is obviously preferrable, but the difficulties of bringing it about are equally obvious. Global governance, and stronger national governance, would help.

However, the landing place I am aiming for is net-zero investing.

If it is true that a system will always try to grow unless constrained, then it follows that it will lap up any energy that is available, irrespective of its carbon content. This means that trying to reduce fossil fuel energy will be pushing against the ‘natural order of things’.

It further means that addressing systemic risk, and the breached planetary boundaries, will require the deliberate imposition of constraints – in order to change the shape of the system, and how (or whether) it can grow.

It is my belief that net-zero investing will need to incorporate this idea of constraints, so that it can succeed with the net-zero part of its mission.

Tim Hodgson is co-founder of the Thinking Ahead Institute at WTW, an innovation network of asset owners and asset managers committed to mobilising capital for a sustainable future.