In the 60 years since the first CFA exam, the accreditation has been forced to evolve to meet the modernization of the profession. As the CFA celebrates this big milestone, chief executive Marg Franklin talks to Amanda White about the enhancements to the CFA program and how it can meet the future investment professional.

The CFA made the most comprehensive enhancements to its program in March this year as it seeks to maintain the essence of Benjamin Graham’s vision to focus on professional standards but also keep pace with the industry’s evolving ethical, technical and client-led demands.

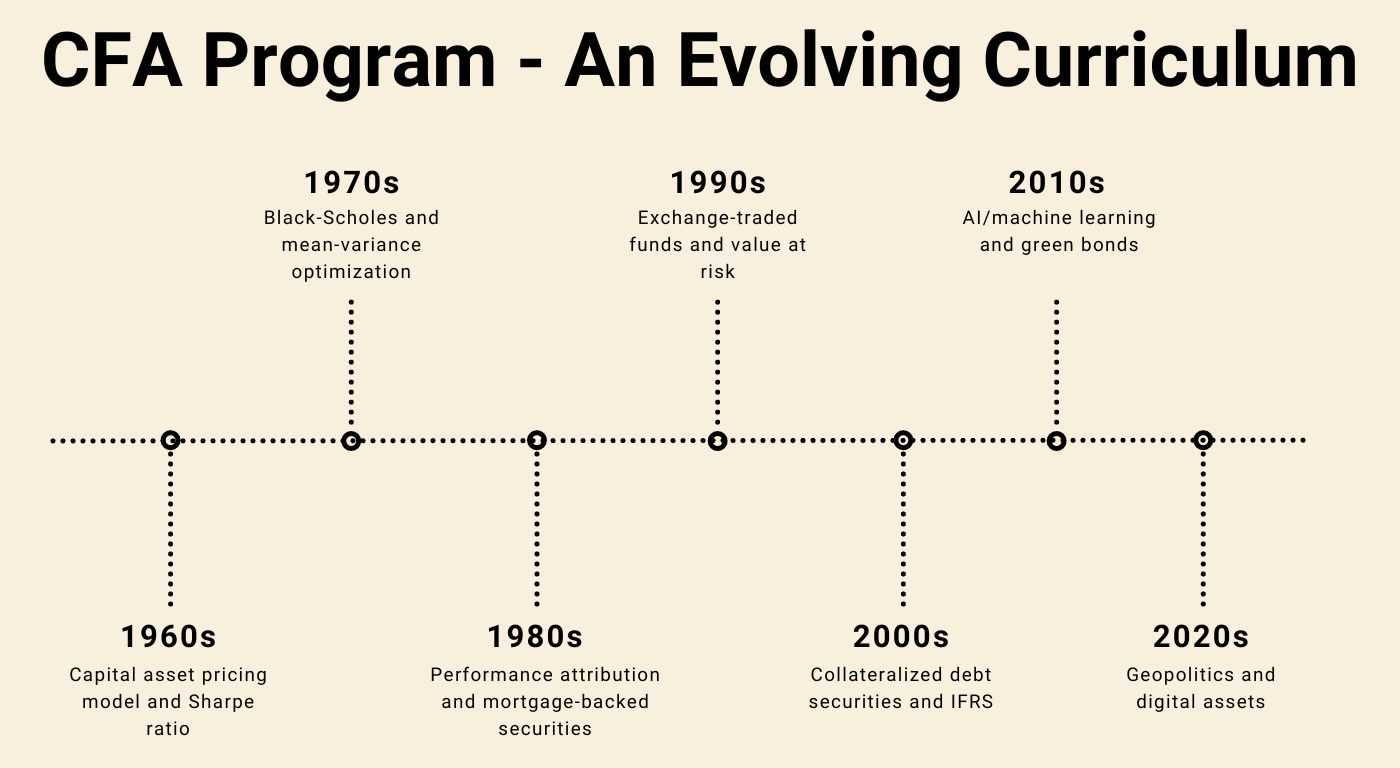

As the industry has evolved, so too has the program. The latest enhancements focus not only on more relevant content as the industry matures, but also on the way people learn, and the usefulness of the accreditation to their career paths.

As the CFA celebrates six decades and more than 190,000 charterholders since the first exam in 1963, chief executive Marg Franklin says the changes were made following extensive research with investment professionals.

Additions to the program incorporated digital practical skills modules that included Python, data science and AI; as well three specialised pathways: portfolio management (the traditional version of level III), private wealth and private markets.

“The most important feature of the changes is we added the practical skills modules for each level,” Franklin tells Top1000funds.com in an interview.

“We know candidates and employers want more job-ready candidates. We champion integrity and well-educated, ethically oriented professionals. My ambition is that we are a very effective leader for investment professionals and fill a role that they can’t get elsewhere. I’m thrilled about the enhancements to the program and how they have been received.”

Other useful changes for candidates include the badging of level I and II so they can show their commitment as they move through their career, a reduction in the volume of materials to maintain a 300-hour preparation time for each exam, and more practice materials.

Over time the CFA has also been introducing certificates and structured learning around specialist skills to upskill and re-skill investment professionals as their careers develop. Data science and ESG certificates are already available and early next year a climate certificate focused on technical skills will be added.

“There is a huge supply/demand gap for these skills,” Franklin says. “There also need to be more people certified in private markets, the same with private wealth and they are all in flight for next year.”

Other areas of evolution include adapting the program to other areas of the investment food chain, by examining more closely what it means to be part of a T-shaped team where there are specialists who may not need their CFA charter but need to understand certain components of it. This includes adapting the investment foundations module for middle and back-office people.

Similarly, as the industry embraces AI, investment professionals need to understand data scientists, and the reverse is also true.

“We need to meet the industry composition where it is. The two parties need to understand each other,” Franklin says. “We are in an environment where society is demanding better, the world is more complicated and returns are harder to come by. The leadership we provide that has a sense of practicality and purpose for the ultimate betterment of society has never rung more true. Ultimately we are building a better system by improving investment professionals.”

CFA leadership starts with research

Research is at the heart of the CFA’s leadership. It is pervasive in the changes to the program and lies is core to its forward-looking reports on important areas such as diversity equity and inclusion, the investment professional of the future and AI.

As the world and the investment community become more complex, Franklin says the stakes are higher for investment professionals.

“We have always provided excellent research particularly with structural longer-term aspects of the industry,” she says, pointing to research released earlier this year on a crypto currency and a portfolio perspective, the Handbook of AI and Big Data Applications in Investment, which was a culmination of five years of work; and to the Future of Work and the changing nature of culture, which is due to come out in October.

CFA is launching a research and policy centre this year, headed by Paul Andrews, which will build out its own research capabilities and bring in luminaries from the industry.

The research will be organised around four themes: sustainability; resilience of the capital markets, which gets to things like social media, AI and big data and the influence of that on the industry; and the investment professional.

“Our convening power is extraordinary, part of that is because we are not for profit and have no commercial imperative for an outcome, but also we are not a trade association, that is powerful,” Franklin says.

“We look through the lens of our mission and give people the ability to look around corners.”

In 1963, 284 professional investors took the first CFA exam across the United States, only six of them were women. Today 18 per cent of the 190,000 charterholders are women, up from 2 per cent in the first exam.

In 1963, 284 professional investors took the first CFA exam, only six of them were women

The CFA’s work to focus the industry on diversity equity and inclusion (DEI) is an example of the organisation’s power to effect change. (See Accelerating change: operationalising DEI)

In 2021 it released a DEI code, rooted in six principles: pipeline, talent acquisition, promotion and retention, leadership, influence, and measurement. It was the culmination of a collaboration between CFA and a working group of industry leaders, including the experimental partners program and asset owners such as Texas Teachers, BCIMCo, and Australia’s VFMC, that began back in 2019.

“No one expected [the code] to be as widely successful as it has been,” Franklin admits. “But 18 months past the launch and we have exceeded our expectations. We had a goal of 40 signatories and it is now at 158 signatories.”

Franklin describes diversity as an organisation’s ability to attract talent, inclusion as the retention rate, and equity as internal promotion.

“Anybody can get diversity, but the retention is where you really have to scrutinise what is in your culture as a barrier or blocker to a more diverse workforce,” she says.

“The world is getting more complex, so you want more perspectives, more experiences, talents and skills, and managing that is not easy. Anything worthwhile is not easy, otherwise it would be arbitraged away.”

The CFA itself was the first signatory to the DEI Code and Franklin says organisations will need to do a lot of internal interrogation in their approach to a diverse workforce but also to encapsulate AI and remote working.

“We are not perfect, far from it, but we have spent a lot of time trying to improve” Franklin says.

“I’m pleased with the multi-dimensional thinking we are doing around that. We think about how the industry will look going forward and we eat our own cooking. I’m proud of that.”