Key Takeaways

- Investors are contending with a lingering late-cycle macro backdrop with latent recession risks for the US economy and most developed markets.

- Rather than wait for the cycle to turn, the journey toward the destination of eventual growth or recessionary outcomes merits its own consideration.

- We believe that staying invested, keeping active and diversifying across public and private markets may allow investors to seize late-cycle opportunities.

Economies move in cycles, and each cycle brings its own challenges and opportunities. In many aspects, the current cycle has shown signs of aging and we are likely in late cycle. As investors debate the chances of growth or recession, we think the journey merits its own consideration. Staying on the sidelines could prove costly, while we believe an active, diversified approach across public and private markets may be the best way to navigate near-term uncertainties and seize late-cycle opportunities.

Late Cycle, Not End Cycle

Some Macro Data Has Slowed, But Not Enough For A Recession

For over a year, the Federal Reserve (Fed) has embarked on aggressive rate hikes—along with balance sheet reduction—to combat stubbornly high inflation. Price pressures in the US have started to ease heading into the second half of 2023. Among the key components, core goods inflation has decelerated the most as supply chain pressures eased, shelter inflation has started to level off in recent months, core services ex-shelter inflation has moderated to some degree yet remains the key risk to our inflation outlook.1 Gradual and uneven progress on disinflation suggests to us that humility is required in forecasting future levels from here, even when most of the key drivers appear to be moving in the right direction.

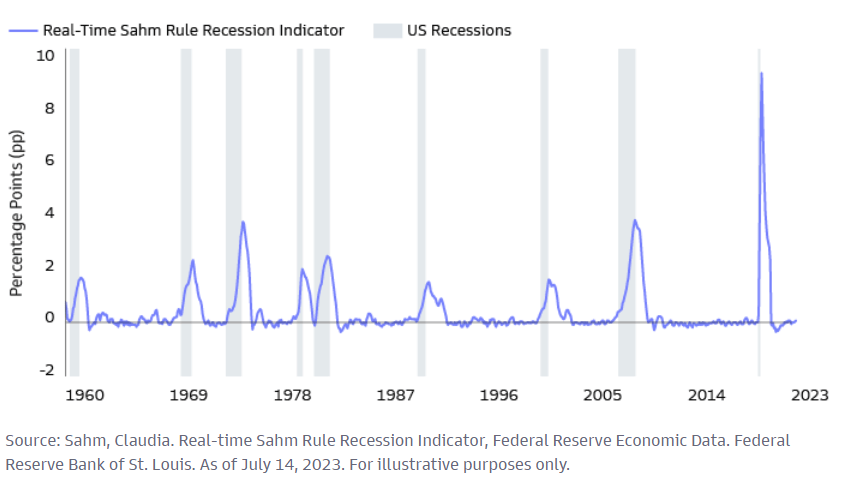

Drags from persistent inflation and cumulative policy tightening have slowed growth to a soft, but non-recessionary pace. The US labor market’s momentum has started to fade—the quits rate has steadily declined since 2022 and dropped to 2.4% in April, just above its 2018-2019 level of around 2.3%. Despite a mild uptick in May, the downtrend over past 12 months indicates that opportunities for switching to better jobs have been diminishing.2 Wage growth has begun to slow, but further deceleration is likely needed to be consistent with the 2% inflation target. At the aggregate level, the US unemployment rate has not risen much beyond its pre-pandemic level of 3.5%. According to the Sahm Rule, which states that we are in the early months of recession when the three-month moving average of the national unemployment rate is 0.5% or more above its low over the prior twelve months, the US economy is not yet in recession as it heads into the second half of 2023.

Sahm Rule Recession Indicator Suggests the US Is Not Yet in Recession

This doesn’t necessarily mean the economy will avoid a downturn altogether. As monetary policy has continued to tighten, shorter-dated interest rates have risen beyond longer-dated ones, leading to an inverted yield-curve—typically an indicator for an impending recession. Heading into the second half of 2023, the spread between 2- and 10-year Treasuries has inverted to the deepest levels since the early 1980s; other measures of yield curve inversion are also pointing to meaningful recession odds. However, yield curve inversion alone is not particularly informative about the timing of an upcoming recession, and there are meaningful downside buffers that may forestall the economy from tipping into a downturn imminently and prolong the duration of the current cycle.

Despite strong headwinds and signs of weakness, the US economy has proven resilient so far in 2023. Many of the upside surprises in the economic activity data have pertained to consumer spending. Goods consumption rebounded quickly in the first quarter to the fastest pace since the second half of 2021, and services consumption remains strong.3 The combination of a strong labor market and solid real disposable income growth could continue to support consumer spending—and therefore economic growth—in the months ahead.

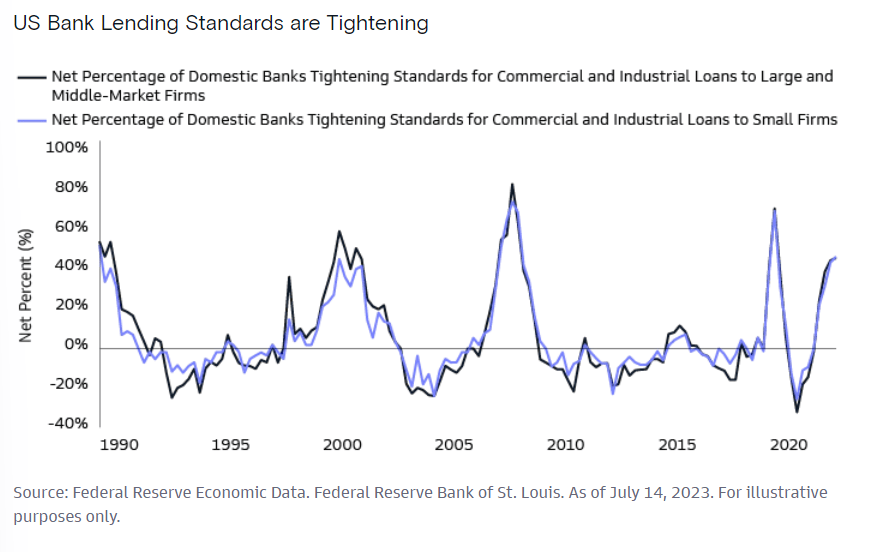

The balance sheets of US households, corporates, and state and local governments also remain solid at the midway point of the year. Moreover, the tail risk of the debt limit crisis has been eliminated and, so far, stress in the US regional banking system is expected to impose a moderate but not recessionary drag on growth. There are signs that bank lending standards have tightened across several types of loans, while the extent of further credit tightening remains uncertain. Fiscal policy bills, such as the CHIPS Act, may further spur manufacturing investments and provide offsets to credit tightening.

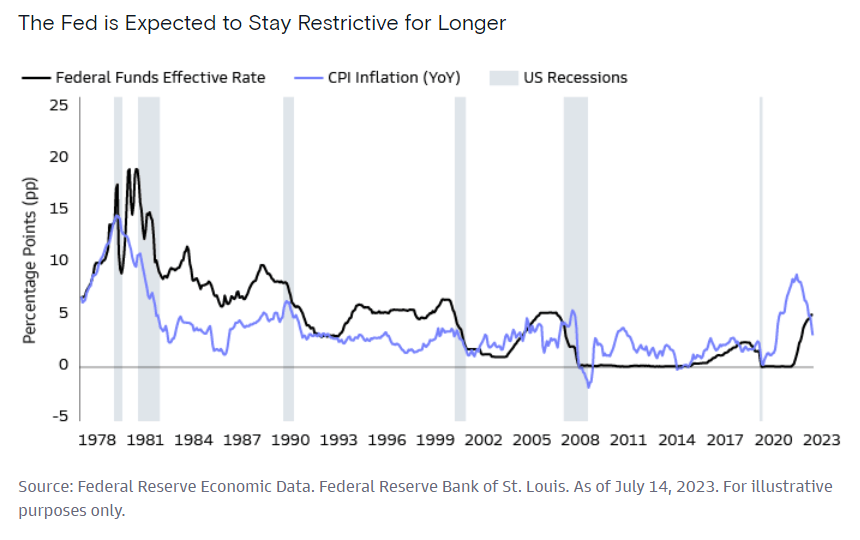

Higher Rates for Longer

We believe the outlook for any further hikes will likely depend on whether labor market rebalancing has progressed far enough to solidify disinflation. In June, the Fed dots projected two additional hikes left for this year,4 which was viewed as a hawkish surprise by markets. Yet despite the aggressive pace of hikes, the level of Fed Funds rate has only recently risen to levels comparable to inflation. This contrasts with historical hiking cycles when the Fed hiked rates well above inflation. Therefore, we continue to expect that US monetary policy will stay restrictive for longer. Such an environment is expected to be particularly challenging for business models that rely on higher leverage, lower cost of borrowing and ample liquidity. On the flip side, however, this may also represent an opportune time to be a lender, particularly in private markets.

Seizing Opportunities

Considering the Fed’s hawkish stance, the timeframe for a monetary policy pivot and the duration of the late-cycle phase remains highly uncertain. But rather than sitting on the sidelines and waiting for the cycle to turn, we believe staying invested with an active, diversified approach may be the best way to navigate uncertainty and seize late-cycle opportunities in the meantime.

Private Credit: Be a Lender

In a higher-for-longer rate environment, we see opportunities for investors to earn equity-like returns in private credit. Compared to public fixed income, private credit involves directly providing loans to companies in privately negotiated transactions. The strategy can offer incremental income generation and greater resiliency during periods of heightened volatility, serving as a potentially strong complement to traditional fixed income. The current environment is buoying private credit yields—the average new-issue yield across all US leveraged loans reached 10.2% in 2Q 2023, the highest since 2009.5 This is being driven by borrowers willing to pay more for the certainty of execution and custom terms that private lenders offer. Rising rates and market volatility have led to a slowdown in high yield and leveraged loan issuance, as lenders, including smaller domestic banks, curtail their activity. Private credit has stepped in to fill the gap, expanding the strategy’s share of corporate and real asset lending, particularly across segments of commercial real estate facing tighter credit conditions, income pressure and elevated refinancing needs.

Private lenders today have the benefit of being able to focus on high-quality borrowers with attractive coverage ratios and favorable terms to mitigate downside risk. As interest rates have climbed, private credit loans are offering equity-like returns in the double digits and, in general, private credit terms tend to include bespoke protections and provisions not found in the high yield or leveraged loan market.6 Private credit portfolios can also select investments without the need to manage to a benchmark. Selectivity can be a key advantage—and a potential downside mitigant—in an environment of increased dispersion, slowing growth, tightening monetary policy and headwinds to profitability. As the asset class matures, we believe private credit is becoming an increasingly viable replacement for traditional leveraged finance providers, offering increasing scale, customization, and certainty to borrowers that often view these benefits as compensation for the higher cost of capital.

Fixed Income Resilience

One upside of the transition to a higher rate regime is that the forward income and total return potential of core bonds, such as high-quality government bonds, has improved significantly. They have also delivered positive returns in past recessions and may act as an important ballast to portfolios should an adverse scenario materialize in this cycle.7 Further, core bonds have tended to have a low or negative correlation with equities and other risk assets which drives potential diversification benefits. Given the backdrop of late cycle economy, close to peak hiking cycle, and attractive level of real yield, we find long-duration US Treasuries attractive. Overall, we remain cautious on US credit, but continue to believe that there is opportunity for active management in this space. The recent banking crisis is expected to push US banks to tighten lending standards further and we do not believe this tightening is fully reflected in credit spreads, which are only at median levels over the cycle and not yet an attractive point of entry. Nonetheless, investors should continue to be mindful of security-level relative value and market dislocations that may present idiosyncratic opportunities, and active security selection remains crucial.

Equities: Keep Your Options Open

This year, market positioning appears to be cautious on risk assets, and positioning surveys point toward net underweight allocation of global equities at mid-year point. The US equity market currently embeds two different dynamics. On one hand, mega-cap tech stocks are being driven by high growth expectations as equity investors debate the influence generative AI may have on the future revenue growth and profitability of companies, and the valuation of stocks. On the other hand, the rest of the market is inching higher instead of rallying sharpy as inflation outlook and market sentiment improves. Currently, the valuation of tech remains within historical ranges and well below the peaks of early 2000s.8 Besides, with equity volatility at multi-month lows, the cost of downside mitigation has also become attractively cheap. Considering the macro backdrop, equity fundamentals, market pricing and positioning, we prefer to stay invested in equities with some hedged exposures.

AI Disruption May Lead to Active Management Opportunities

The ability and accessibility of generative AI models and their implications for creating well-crafted content, from persuasive rhetoric to code, has accelerated exponentially. We expect the integration of AI within enterprises and wide scale adoption by consumers may have a huge impact on societies and economies over the coming years. As investors, we believe AI is a growth driver with a wide variety of applications and is on a path to disrupting entire industries as we currently know them. In our view, companies that are harnessing generative AI to enhance their business, leveraging predictive AI to make their business smarter, and those manufacturing the hardware to enable the proliferation of AI are set to disproportionately benefit. In our view, each business will need a clear strategy to incorporate AI if they want to remain a market leader. We find this is a particularly exciting time to be evaluating AI opportunities. Finding the next generation of winners will likely require investors to be nimble and look beyond benchmarks.

Diversification Matters in a Dislocated Global Cycle

The beginning of the current monetary tightening cycle featured synchronized deployment of policy measures in most major economies, but the finale may reveal more differentiated responses as growth and inflation trajectories regionally diverge. While the Fed may be approaching the end of its hiking campaign, further tightening may be required by the European Central Bank (ECB) and Bank of England (BoE) to keep a lid on prices. Contrary to the hawkish stance of other G4 central banks, the Bank of Japan (BoJ) has remained accommodative for an extended period of time. Considering strong domestic demand, we continue to see diversification opportunities in Japanese equities. Beyond advanced economies, emerging markets are moving at their own pace, resulting in a desynchronized global cycle. Emerging market growth momentum remains soft but is no longer deteriorating. Inflation has plummeted in some countries, for example Brazil, Chile, and Mexico. Most EM central banks have reached the end of their respective hiking cycles, and the first EM central banks have begun their easing cycles. High real yields, weak currencies, low inflation may support diversification opportunities in local currency government bonds.

China’s cycle is also distinctively dislocated from most developed markets, with the People’s Bank of China (PBoC) in easing mode. China’s economic activity has rebounded following the lifting of mobility restrictions, but the boost from re-opening has been fading, with macro data missing market expectations coming into the second half of 2023.9 In our view, China’s recovery is likely to be non-linear from here. We believe the country remains a large, growing market with a vast opportunity set, though there is also an important shift in foreign direct investments occurring from China to countries such as Vietnam, India, and Mexico. Besides, US-China geopolitical gyrations may also create a more uncertain environment. Overall, we think a diversified, active approach is key to capitalize on investment opportunities in a dislocated global cycle with differentiated drivers at the country level.

Watch For The Next Phase of The Cycle

As cycles turn, investment opportunities shift. We continue to monitor closely the balance of risks between the economy’s strength and vulnerabilities, as they provide more clues on where we are in the journey toward the future stages of the business cycle. The upcoming quarters are likely key in revealing global central banks’ degree of success in bringing down inflation, the future path of monetary policy, as well as to what extent balance sheet resilience and fiscal programs may offset drags from interest rate and credit tightening. But uncertainty and disruption present opportunities for long-term investors. In our view, market participants should remain vigilant to growth and inflation dislocations across economies—as well as trends that transcend cycles—and stay invested, seizing late-cycle opportunities where they can be found.

Important Information

1 US Bureau of Labor Statistics. As of July 7, 2023.

2 US Bureau of Labor Statistics. As of May 31, 2023.

3 US Bureau of Economic Analysis. As of June 30, 2023.

4 Federal Reserve. As of June 14, 2023.

5 LCD, “Amid credit tightening, leveraged loan market revisits Financial Crisis levels” As of June 7, 2023

6 Cliffwater Direct Lending Index. Analysis of the unlevered, gross of fees performance of U.S. middle market corporate loans. As of June 30, 2023

7 Bloomberg, Datastream and Goldman Sachs Asset Management. Analysis of German, UK, US and Japan government bonds annualized total return in local currency from March 31, 1980 to March 31, 2023.

8 I/B/E/S and Datastream. As of July 19, 2023.

9 National Bureau of Statistics of China. Bloomberg. As of July 17, 2023.

Glossary

CHIPS Act establishes and provides funding for the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Fund to carry out activities relating to the creation of incentives to produce semiconductors in the United States.

Correlation is a measure of the amount to which two investments vary relative to each other. Past correlations are not indicative of future correlations, which may vary.

G4 Central Banks refers to the Bank of England (BoE), the Bank of Japan (BoJ), the Federal Reserve (FED), and the European Central Bank (ECB).

Hawkish refers to more aggressive monetary policy, the opposite of Dovish.

Mega-cap tech stocks refer to technology companies >$100bn in market cap.

Quits rate refers the number of quits during an entire month as a percent of employment. Quits include employees who left voluntarily, with the exception of retirements or transfers to other locations.

Recession is defined as two consecutive quarters of negative growth in real GDP.

Sahm Rule Indicator, as identified by Claudia Sahm, identifies signals related to the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months.

Syndicated loans refer to financing, or loans, that are offered by a group of lenders—known as a syndicate—who collaborate to provide funding for a single borrower.

Volatility is a measure of variation of a financial instrument’s price.

Risk Considerations

All investing involves risk, including loss of principal.

Equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Different investment styles (e.g., “growth” and “value”) tend to shift in and out of favor, and, at times, the strategy may underperform other strategies that invest in similar asset classes. The market capitalization of a company may also involve greater risks (e.g. “small” or “mid” cap companies) than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements, in addition to lower liquidity.

Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, prepayment and extension risk. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline in the bond’s price. The value of securities with variable and floating interest rates are generally less sensitive to interest rate changes than securities with fixed interest rates. Variable and floating rate securities may decline in value if interest rates do not move as expected. Conversely, variable and floating rate securities will not generally rise in value if market interest rates decline. Credit risk is the risk that an issuer will default on payments of interest and principal. Credit risk is higher when investing in high yield bonds, also known as junk bonds. Prepayment risk is the risk that the issuer of a security may pay off principal more quickly than originally anticipated. Extension risk is the risk that the issuer of a security may pay off principal more slowly than originally anticipated. All fixed income investments may be worth less than their original cost upon redemption or maturity.

High-yield, lower-rated securities involve greater price volatility and present greater credit risks than higher-rated fixed income securities

Emerging markets investments may be less liquid and are subject to greater risk than developed market investments as a result of, but not limited to, the following: inadequate regulations, volatile securities markets, adverse exchange rates, and social, political, military, regulatory, economic or environmental developments, or natural disasters.

The risk of foreign currency exchange rate fluctuations may cause the value of securities denominated in such foreign currency to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. These risks may be more pronounced for investments in securities of issuers located in, or otherwise economically tied to, emerging countries. If applicable, investment techniques used to attempt to reduce the risk of currency movements (hedging), may not be effective. Hedging also involves additional risks associated with derivatives.

Alternative investments are suitable only for sophisticated investors for whom such investments do not constitute a complete investment program and who fully understand and are willing to assume the risks involved in Alternative Investments. Alternative Investments by their nature, involve a substantial degree of risk, including the risk of total loss of an investor’s capital.

Investments in real estate companies, including REITs or similar structures are subject to volatility and additional risk, including loss in value due to poor management, lowered credit ratings and other factors.

The above are not an exhaustive list of potential risks. There may be additional risks that are not currently foreseen or considered.

Conflicts of Interest

There may be conflicts of interest relating to the Alternative Investment and its service providers, including Goldman Sachs and its affiliates. These activities and interests include potential multiple advisory, transactional and other interests in securities and instruments that may be purchased or sold by the Alternative Investment. These are considerations of which investors should be aware and additional information relating to these conflicts is set forth in the offering materials for the Alternative Investment.

General Disclosures

Diversification does not protect an investor from market risk and does not ensure a profit.

Past correlations are not indicative of future correlations, which may vary.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant.

Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Goldman Sachs has no obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes.

THESE MATERIALS ARE PROVIDED SOLELY ON THE BASIS THAT THEY WILL NOT CONSTITUTE INVESTMENT ADVICE AND WILL NOT FORM A PRIMARY BASIS FOR ANY PERSON’S OR PLAN’S INVESTMENT DECISIONS, AND GOLDMAN SACHS IS NOT A FIDUCIARY WITH RESPECT TO ANY PERSON OR PLAN BY REASON OF PROVIDING THE MATERIAL OR CONTENT HEREIN. PLAN FIDUCIARIES SHOULD CONSIDER THEIR OWN CIRCUMSTANCES IN ASSESSING ANY POTENTIAL INVESTMENT COURSE OF ACTION.

The views expressed herein are as of the date of the publication and subject to change in the future. Individual portfolio management teams for Goldman Sachs Asset Management may have views and opinions and/or make investment decisions that, in certain instances, may not always be consistent with the views and opinions expressed herein.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change, they should not be construed as investment advice.

This material is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon the client’s investment objectives.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. Nothing in this document should be construed to constitute allocation advice or recommendations.

The website links provided are for your convenience only and are not an endorsement or recommendation by Goldman Sachs Asset Management of any of these websites or the products or services offered. Goldman Sachs Asset Management is not responsible for the accuracy and validity of the content of these websites.

The opinions expressed in this white paper are those of the authors, and not necessarily of Goldman Sachs. Any investments or returns discussed in this paper do not represent any Goldman Sachs product. This white paper makes no implied or express recommendations concerning how a client’s account should be managed. This white paper is not intended to be used as a general guide to investing or as a source of any specific investment recommendations.

Examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA): This material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches (“GSBE”). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Switzerland: For Qualified Investor use only – Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Bank AG, Zürich. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Bank AG, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Asia excluding Japan: Please note that neither Goldman Sachs Asset Management (Hong Kong) Limited (“GSAMHK”) or Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H ) (“GSAMS”) nor any other entities involved in the Goldman Sachs Asset Management business that provide this material and information maintain any licenses, authorizations or registrations in Asia (other than Japan), except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore, Malaysia, India and China. This material has been issued for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited, in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H) and in or from Malaysia by Goldman Sachs (Malaysia) Sdn Berhad (880767W).

Hong Kong: This material has been issued or approved for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited, a licensed entity regulated by the Securities and Futures Commission of Hong Kong (SFC). This material has not been reviewed by the SFC. © 2023 Goldman Sachs. All rights reserved.

Singapore: Investment involves risk. Prospective investors should seek independent advice. This advertisement or publication material has not been reviewed by the Monetary Authority of Singapore. This material has been issued or approved for use in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H).

Australia: This material is distributed by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (‘GSAMA’) and is intended for viewing only by wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth). This document may not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced or distributed to any person without the prior consent of GSAMA. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth). Any advice provided in this document is provided by either of the following entities. They are exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences, and are regulated under their respective laws applicable to their jurisdictions, which differ from Australian laws. Any financial services given to any person by these entities by distributing this document in Australia are provided to such persons pursuant to the respective ASIC Class Orders and ASIC Instrument mentioned below.

- Goldman Sachs Asset Management, LP (GSAMLP), Goldman Sachs & Co. LLC (GSCo), pursuant ASIC Class Order 03/1100; regulated by the US Securities and Exchange Commission under US laws.

- Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), pursuant to ASIC Class Order 03/1099; regulated by the Financial Conduct Authority; GSI is also authorized by the Prudential Regulation Authority, and both entities are under UK laws.

- Goldman Sachs Asset Management (Singapore) Pte. Ltd. (GSAMS), pursuant to ASIC Class Order 03/1102; regulated by the Monetary Authority of Singapore under Singaporean laws

- Goldman Sachs Asset Management (Hong Kong) Limited (GSAMHK), pursuant to ASIC Class Order 03/1103 and Goldman Sachs (Asia) LLC (GSALLC), pursuant to ASIC Instrument 04/0250; regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws.

No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

New Zealand: This material is distributed in New Zealand by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (’GSAMA’) and is intended for viewing only by wholesale clients in Australia for the purposes of section 761G of the Corporations Act 2001 (Cth) and to clients who either fall within any or all of the categories of investors set out in section 3(2) or sub-section 5(2CC) of the Securities Act 1978, fall within the definition of a wholesale client for the purposes of the Financial Service Providers (Registration and Dispute Resolution) Act 2008 (FSPA) and the Financial Advisers Act 2008 (FAA),and fall within the definition of a wholesale investor under one of clause 37, clause 38, clause 39 or clause 40 of Schedule 1 of the Financial Markets Conduct Act 2013 (FMCA) of New Zealand (collectively, a “NZ Wholesale Investor”). GSAMA is not a registered financial service provider under the FSPA. GSAMA does not have a place of business in New Zealand. In New Zealand, this document, and any access to it, is intended only for a person who has first satisfied GSAMA that the person is a NZ Wholesale Investor. This document is intended for viewing only by the intended recipient. This document may not be reproduced or distributed to any person in whole or in part without the prior written consent of GSAMA.

Canada: This presentation has been communicated in Canada by GSAM LP, which is registered as a portfolio manager under securities legislation in all provinces of Canada and as a commodity trading manager under the commodity futures legislation of Ontario and as a derivatives adviser under the derivatives legislation of Quebec. GSAM LP is not registered to provide investment advisory or portfolio management services in respect of exchange-traded futures or options contracts in Manitoba and is not offering to provide such investment advisory or portfolio management services in Manitoba by delivery of this material.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law by Goldman Sachs Asset Management Co., Ltd.

South Africa: Goldman Sachs Asset Management International is authorised by the Financial Services Board of South Africa as a financial services provider.

Colombia: Esta presentación no tiene el propósito o el efecto de iniciar, directa o indirectamente, la adquisición de un producto a prestación de un servicio por parte de Goldman Sachs Asset Management a residentes colombianos. Los productos y/o servicios de Goldman Sachs Asset Management no podrán ser ofrecidos ni promocionados en Colombia o a residentes Colombianos a menos que dicha oferta y promoción se lleve a cabo en cumplimiento del Decreto 2555 de 2010 y las otras reglas y regulaciones aplicables en materia de promoción de productos y/o servicios financieros y /o del mercado de valores en Colombia o a residentes colombianos. Al recibir esta presentación, y en caso que se decida contactar a Goldman Sachs Asset Management, cada destinatario residente en Colombia reconoce y acepta que ha contactado a Goldman Sachs Asset Management por su propia iniciativa y no como resultado de cualquier promoción o publicidad por parte de Goldman Sachs Asset Management o cualquiera de sus agentes o representantes. Los residentes colombianos reconocen que (1) la recepción de esta presentación no constituye una solicitud de los productos y/o servicios de Goldman Sachs Asset Management, y (2) que no están recibiendo ninguna oferta o promoción directa o indirecta de productos y/o servicios financieros y/o del mercado de valores por parte de Goldman Sachs Asset Management.

Esta presentación es estrictamente privada y confidencial, y no podrá ser reproducida o utilizada para cualquier propósito diferente a la evaluación de una inversión potencial en los productos de Goldman Sachs Asset Management o la contratación de sus servicios por parte del destinatario de esta presentación, no podrá ser proporcionada a una persona diferente del destinatario de esta presentación.

Israel: This document has not been, and will not be, registered with or reviewed or approved by the Israel Securities Authority (ISA”). It is not for general circulation in Israel and may not be reproduced or used for any other purpose. Goldman Sachs Asset Management International is not licensed to provide investment advisory or management services in Israel.

Jordan: The document has not been presented to, or approved by, the Jordanian Securities Commission or the Board for Regulating Transactions in Foreign Exchanges.

Bahrain: This material has not been reviewed by the Central Bank of Bahrain (CBB) and the CBB takes no responsibility for the accuracy of the statements or the information contained herein, or for the performance of the securities or related investment, nor shall the CBB have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein. This material will not be issued, passed to, or made available to the public generally.

Kuwait: This material has not been approved for distribution in the State of Kuwait by the Ministry of Commerce and Industry or the Central Bank of Kuwait or any other relevant Kuwaiti government agency. The distribution of this material is, therefore, restricted in accordance with law no. 31 of 1990 and law no. 7 of 2010, as amended. No private or public offering of securities is being made in the State of Kuwait, and no agreement relating to the sale of any securities will be concluded in the State of Kuwait. No marketing, solicitation or inducement activities are being used to offer or market securities in the State of Kuwait.

Oman: The Capital Market Authority of the Sultanate of Oman (the “CMA”) is not liable for the correctness or adequacy of information provided in this document or for identifying whether or not the services contemplated within this document are appropriate investment for a potential investor. The CMA shall also not be liable for any damage or loss resulting from reliance placed on the document.

Qatar: This document has not been, and will not be, registered with or reviewed or approved by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or Qatar Central Bank and may not be publicly distributed. It is not for general circulation in the State of Qatar and may not be reproduced or used for any other purpose.

Saudi Arabia: The Capital Market Authority does not make any representation as to the accuracy or completeness of this document, and expressly disclaims any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of this document. If you do not understand the contents of this document you should consult an authorised financial adviser. The CMA does not make any representation as to the accuracy or completeness of these materials, and expressly disclaims any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of these materials. If you do not understand the contents of these materials, you should consult an authorised financial adviser.

United Arab Emirates: This document has not been approved by, or filed with the Central Bank of the United Arab Emirates or the Securities and Commodities Authority. If you do not understand the contents of this document, you should consult with a financial advisor.

East Timor: Please Note: The attached information has been provided at your request for informational purposes only and is not intended as a solicitation in respect of the purchase or sale of instruments or securities (including funds), or the provision of services. Neither Goldman Sachs Asset Management (Singapore) Pte. Ltd. nor any of its affiliates is licensed under any laws or regulations of Timor-Leste. The information has been provided to you solely for your own purposes and must not be copied or redistributed to any person or institution without the prior consent of Goldman Sachs Asset Management.

Vietnam: Please Note: The attached information has been provided at your request for informational purposes only. The attached materials are not, and any authors who contribute to these materials are not, providing advice to any person. The attached materials are not and should not be construed as an offering of any securities or any services to any person. Neither Goldman Sachs Asset Management (Singapore) Pte. Ltd. nor any of its affiliates is licensed as a dealer under the laws of Vietnam. The information has been provided to you solely for your own purposes and must not be copied or redistributed to any person without the prior consent of Goldman Sachs Asset Management.

Cambodia: Please Note: The attached information has been provided at your request for informational purposes only and is not intended as a solicitation in respect of the purchase or sale of instruments or securities (including funds) or the provision of services. Neither Goldman Sachs Asset Management (Singapore) Pte. Ltd. nor any of its affiliates is licensed as a dealer or investment advisor under The Securities and Exchange Commission of Cambodia. The information has been provided to you solely for your own purposes and must not be copied or redistributed to any person without the prior consent of Goldman Sachs Asset Management.

European Economic Area (EEA): This marketing communication is disseminated by Goldman Sachs Asset Management B.V., including through its branches (“GSAM BV”). GSAM BV is authorised and regulated by the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten, Vijzelgracht 50, 1017 HS Amsterdam, The Netherlands) as an alternative investment fund manager (“AIFM”) as well as a manager of undertakings for collective investment in transferable securities (“UCITS”). Under its licence as an AIFM, the Manager is authorized to provide the investment services of (i) reception and transmission of orders in financial instruments; (ii) portfolio management; and (iii) investment advice. Under its licence as a manager of UCITS, the Manager is authorized to provide the investment services of (i) portfolio management; and (ii) investment advice. Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law. In Denmark and Sweden this material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches (“GSBE”). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law (“FIEL”). Also, Any description regarding investment strategies on collective investment scheme under Article 2 paragraph (2) item 5 or item 6 of FIEL has been approved only for Qualified Institutional Investors defined in Article 10 of Cabinet Office Ordinance of Definitions under Article 2 of FIEL.

Date of First Use: August 7, 2023 326527-OTU-1841471