The board of CalPERS has directed staff to look into aligning its $357 billion portfolio with the UN’s sustainable development goals.

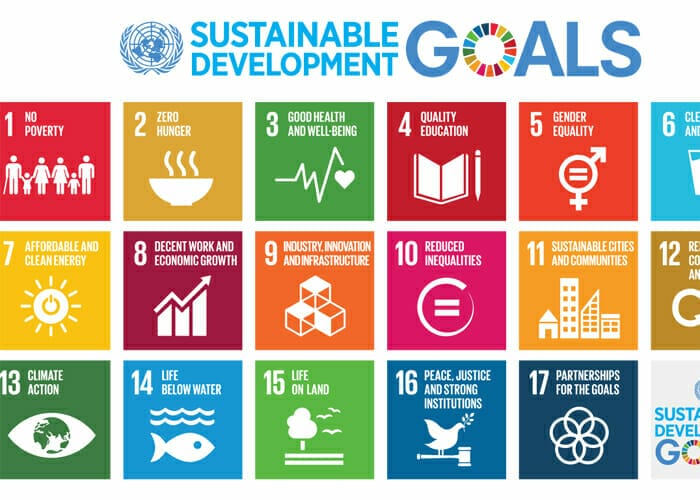

The largest pension fund in the US is already one of the global leaders in engaging with companies on ESG risks, but by adopting the UN SDGs it would embrace more specific social objectives, such as ending poverty, hunger and gender inequality.

CalPERS’ chief investment officer Ted Eliopoulos characterised the 17 SDGs as a “gift to investors” at the board’s retreat meeting on January 16 in Petaluma, California. He said investment staff would report back to the board at its July meeting regarding how the goals could connect with CalPERS’ existing sustainability investment plan. Other institutional investors will be invited to that meeting to discuss their experiences implementing the SDGs.

The 17 goals address everything from the environment to various social principles. But Eliopoulos acknowledged in an interview that whether aligning a portfolio with them when they are combined will lead to better returns hasn’t been tested.

“It is definitely a nascent area and the taxonomy that the UN has provided through the sustainable development goals provides a framework for investors that have long tried to consider what subject matters fall under the environmental and social” categories, Eliopoulos said after the meeting.

He called the UN’s SDGs, which 190 nations ratified in September 2015, “authoritative” but said “for investors, it’s a new development and it’s going to take time to digest and understand” how it might relate to portfolios.

He said collaboration with other global pensions would help shape the ultimate application of the SDGs. Australian fund Cbus Super and large Dutch pension plan ABP have both made the SDGs part of their investment plans. Other European funds, such as Dutch PGGM, are also incorporating them into their investment philosophy and implementation.

The move towards implementing SDGs at CalPERS came after the board and investment staff heard from UN assistant secretary-general Elliott Harris, who urged CalPERS to adopt the goals. He said that would help the UN.

“We need to understand how best to measure the impact of the SDGs on financial returns, and how best to preserve the goals and targets in ways that attract the interest of private investors,” Harris said.

He explained that while CalPERS’ sustainable investment strategic plan considers factors such as climate change and natural resource scarcity, that may not be enough.

“The concept of risk may well have to be expanded even further to incorporate the lack of progress toward some of the other aspirations of the sustainable development agenda – such as reducing inequities or [achieving] gender empowerment and equity – which themselves have an impact on macroeconomic factors,” he said.

Harris said CalPERS’ leadership would help generate standards of financial reporting that allow for a systemic evaluation of these new risks.

CalPERS investment director for sustainability, Anne Simpson, said in an interview that she believes implementing the UN goals will help the system drive returns. The pension plan has only a 68 per cent funding ratio and is in the process of lowering its expected annual rate of return from 7.5 per cent to 7 per cent because of diminished future return expectations. Simpson called the situation “demanding”.

“The sustainability development goals are intended to build prosperity,” she said. “As an investor, you could say this is how you build opportunity for us and risk gets addressed. So, that’s really why we’re interested.”