The Global Pension Transparency Benchmark has been the driving force behind global pension funds’ improved transparency of disclosures, with 92 per cent of the 75 funds measured improving their transparency scores during the project’s lifespan.

A collaboration between Top1000funds.com and CEM Benchmarking, the GPTB began with the ambition of holding pension funds to account on their openness of disclosures and has evolved into the yardstick for the transparency of global asset owners with key stakeholders.

Between 2021 and 2025, the project collected more than 11,000 data points per year across 15 countries and the five largest pension funds in each jurisdiction, assessing the transparency of disclosures around the chosen value drivers of cost, governance, performance and responsible investing.

The five-year results underscore the GPTB’s impact and many pension funds’ drive for betterment.

At the country level, all 15 nations’ pension funds made progress. Australia, which has more than A$4 trillion ($3.4 trillion) in its defined contribution pension system, was the biggest mover with an overall country score uplift of 19 points in five years.

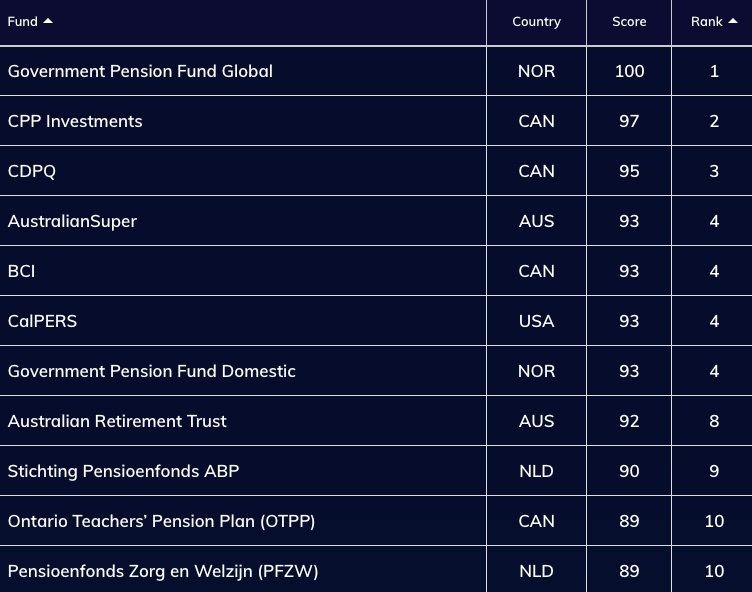

Since the GPTB began publishing individual fund scores in 2022, when Canada’s CPP Investments topped the list with 81 out of 100, transparency standards have surged. In 2025, 18 funds (including CPP Investments) have exceeded that score.

Norway’s $1.9 trillion Government Pension Fund Global, which scored just 75 in 2022, achieved a remarkable leap and earned a perfect 100 in both 2024 and 2025.

The A$330 billion ($215 billion) Australian Retirement Trust, ranked ninth in 2025 with 92 points, was the biggest improver among all funds over the past four years. In 2022, QSuper – which later merged with SunSuper to form Australian Retirement Trust – scored just 49 points, but the consolidation has prompted the creation of more rigorous public reporting standards.

Overall, 92 per cent of funds improved their transparency scores during the project’s lifespan, with the top 20 funds gaining an average of 19 points in four years. Among the laggards, 19 funds had a transparency score under 50 in 2025, compared to 27 in 2022.

The numbers show clear progress, but the real stories emerge from individual funds. Through their own reflections, leading funds reveal the challenges they faced in improving transparency and the strategies that drove their gains.

Life after the perfect score for NBIM

Looking across the benchmark’s top performers, CEM Benchmarking researchers observed real change within an organisation comes from the internal leadership team, rather than from external forces such as regulators.

This is exemplified in the $2 trillion Government Pension Fund Global, where CEO of its investment management company Norges Bank Investment Management Nicolai Tangen spearheaded the transparency initiative internally – similar to his role in the fund’s radical adoption of artificial intelligence.

In 2022, the first year of individual fund scores, the fund ranked fourth in cost, 33rd in governance, eighth in performance, and ninth in responsible investing and in 2025, all of those scores are a perfect 100 for the second year in a row.

“As an investor, the right kind of transparency strengthens our dialogue with the 8,500 companies in our portfolio,” NBIM chief communications and external relations officer Marthe Skaar tells Top1000funds.com.

“The Global Pension Transparency Benchmark has pushed us and our peers to be more deliberate about what we disclose. When done well, collective transparency can drive better practices across the industry.”

Lessons from CPP Investments

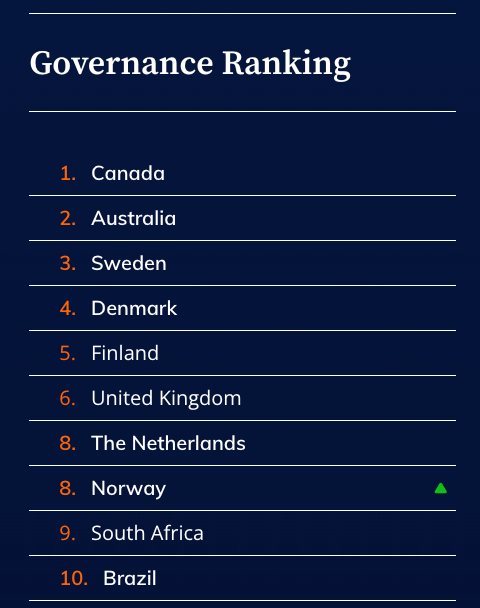

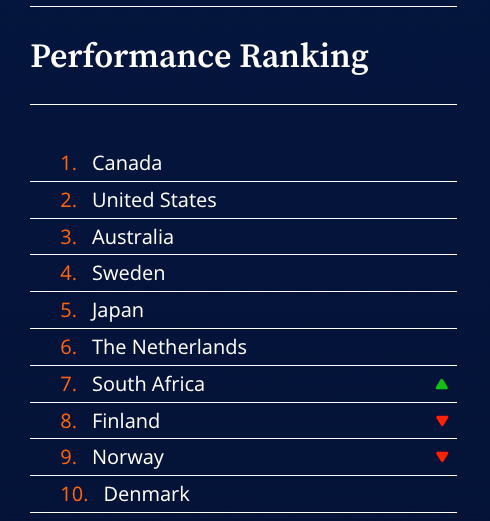

Canada as a nation has reigned for five straight years as the country with the highest score, as measured by the average score of the five largest pension funds. The five Canadian funds surveyed have consistently stayed among the top 15 ranked funds even though competition has ramped up over the years. The nation’s largest investor, the C$714 billion ($510 billion) CPP Investments, led the charge over the years.

To have sound transparency practices, a fund’s public disclosures not only have to be available but also easily accessible.

Beyond annual reports, CPP Investments structures its public disclosures around quarterly financial statements; policies and proxy voting reports; public meetings with beneficiaries around Canada; digital access and its website and social platforms; and executive communications via speeches and interviews.

“Transparency is how we serve Canadians and how we compete globally – a cultural advantage that deepens trust, strengthens partnerships, and attracts talent,” CPP Investments senior managing director and global head of public affairs and communications, Michel Leduc, tells Top1000funds.com.

A healthy dose of peer competition has also pushed funds collectively to pursue excellence. “Retirement systems endure only when the public trusts them. We want the sector as a whole to perform well. One bad performer hurts the sector, which hurts all of us,” Leduc says of the dynamic.

“Leaning heavily into transparency to earn public trust and confidence means welcoming and being comfortable with ‘holding our feet to the fire’ as energy to perform at the highest level.

“That is good to inspire a healthy competitive spirit and hard work. That’s palpable across all our offices worldwide.”

In factor rankings, Canadian funds had the best practices in responsible investing, governance and performance reporting but were beaten by the Netherlands in transparency of cost disclosures.

Leduc acknowledges there is always room for improvement within the fund. It aims to run ahead of stakeholder expectations but not improving “for the sake of it”.

“It’s never just about more information. Not all information is useful. It is about the right information. This is the distinction I frequently make between disclosure and transparency,” he says.

“The latter implies something more sophisticated. It is goal-oriented, including whether it leaves the stakeholder better informed and therefore more likely to support the strategy. They become promoters.”

NBIM’s Skaar echoed CPP Investments’ sentiment that more information may not lead to more transparency. The fund believes that having good transparency means being accountable to stakeholders while protecting intellectual property related to investments.

“Transparency is a moving target, and we need to be thoughtful about that. What stakeholders need to know evolves, and so must our approach,” she says.

“The challenge isn’t just doing more – it’s ensuring that what we share actually serves accountability and understanding, without creating noise or exposing information that could harm the fund’s ability to deliver returns.”