Singapore’s Temasek has unveiled its biggest organisational overhaul in more than a decade, splitting its investment portfolio into three entities to “sharpen” investment focus, boost accountability and align performance metrics.

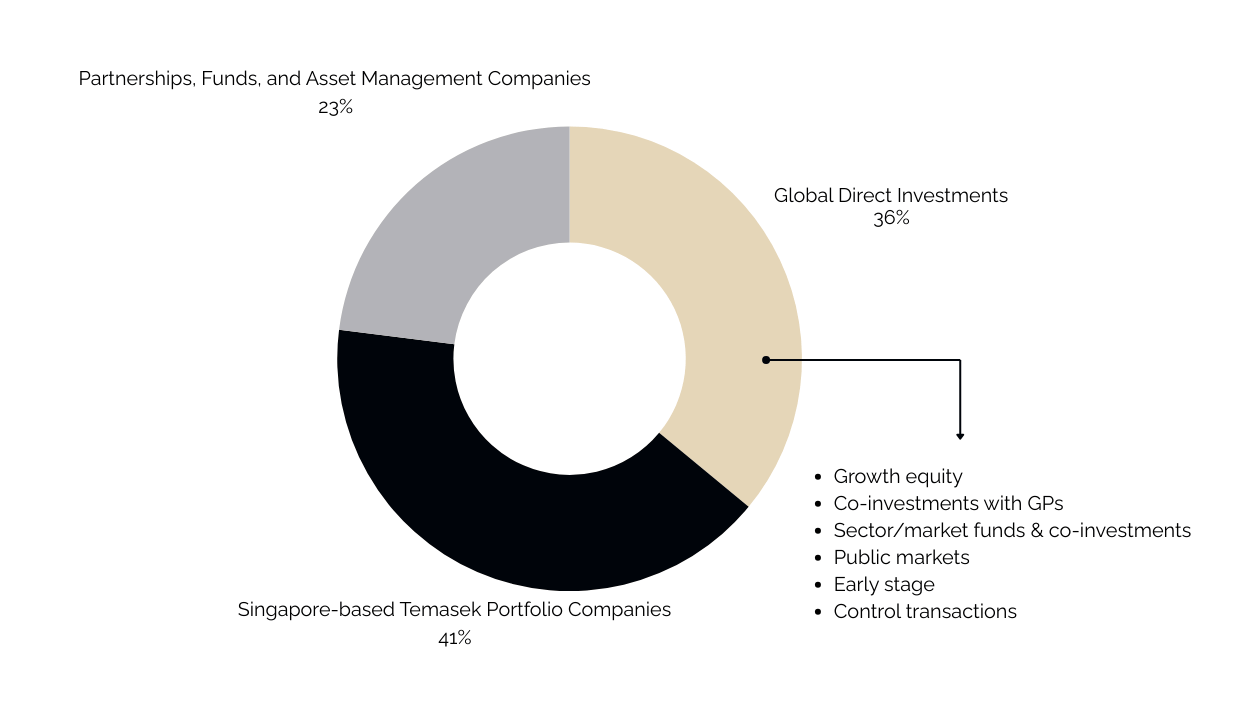

From April 2026, the S$434 billion ($324 billion) sovereign wealth fund will manage its investments via Temasek Global Investments, Temasek Singapore and Temasek Partnership Solutions, respectively looking after the three portfolio segments: global direct investments (40 per cent of the fund), Singapore-based portfolio companies (40 per cent), and partnerships, funds, and asset management companies (20 per cent).

Temasek Holdings CEO Dilhan Pillay said the three investment segments have distinct attributes and “there are good reasons” behind the separation.

“[Since our last restructure 11 years ago] we developed so many other capabilities to support our portfolio strategies, our investment strategies, and that’s really what we’ve been investing in – capabilities for the world that was changing, and the world that will continue to change,” Pillay told reporters last Friday.

“In that period of change, we too need to change.”

The nature of investments is the most notable difference: Temasek is typically a minority investor in its global direct investments segment and often leans into the expertise of like-minded partners, but it is a control investor in Singaporean companies and is looking to be more active in board nominations moving forward.

Performance metrics used to evaluate these investments also diverge. Financial return is the performance that matters the most in the global direct investments segment as Temasek is a shorter-term owner of these businesses, but for Singaporean companies the success is also hinged upon portfolio companies’ operating metrics including business transformation, capital structure optimisation and even talent development, Pillay said.

In turn, different kinds of capabilities are desired in the three segments. It is crucial for the global direct investment team – consisting of 290 professionals – to source and execute the right deals and maintain sector expertise, while the Singaporean investment team needs to have knowledge around company restructuring and capital management.

In a media release, the fund said the new structure would allow it to “support portfolio strategies for growth and returns, and perform with greater accountability and alignment”.

Alongside Temasek International, which holds the group’s corporate functions, the four subsidiaries will sit under Temasek Holdings – a Singapore government-linked entity whose financials are subjected to certain audit and accountability requirements, known as the Fifth Schedule entity. All four subsidiaries are chaired by Pillay.

The overhaul is a part of Temasek’s 10-year strategy, known as T2030, and offered a glimpse into the fund’s forward-looking investment philosophy. To weatherproof its portfolio, the fund is targeting a 60/40 split between the “resilient” and “dynamic” portfolio components.

The resilient component will deliver a stable, narrower range of outcomes over time and include core Singaporean and global portfolio companies, “compounders” with long-term potential, partnership funds and asset management companies, private credit and core plus infrastructure. It has a 5 per cent target allocation to private credit compared to 2 per cent currently.

The dynamic component will be companies with high growth prospects, including growth equity, public markets and liquid strategies, and opportunities identified by its innovation and emerging technologies team dedicated to scoping out future-facing solutions.

Pillay said Temasek has been enhancing its capabilities in public markets during the last 18 months, which is crucial for liquidity and the fund’s triple-A credit ratings, and has already seen an “uplift in the performance”.

Elsewhere in the portfolio, Temasek is holding a strategic review on how to better synergise between the dozen asset management companies it controls. The main asset management platform for Temasek is Seviora Holdings which has four subsidiaries, including Azalea which securitises its LP interest in private equity funds. Other companies include Aranda, a private credit offshoot carved out of Temasek’s in-house credit team which now manages a S$10 billion portfolio of its funds and direct investments.

Temasek Global Investments will be led by Chia Song Hwee, who also becomes co-CEO of Temasek International this October. Temasek Singapore will be headed by chief financial officer Png Chin Yee. Rohit Sipahimalani remains chief investment officer of the group.

Temasek invested S$52 billion and divested S$42 billion in the year to March 2025. The 10-year and 20-year total shareholder return – a compounded and annualised figure which includes dividends paid by Temasek and excludes investments from shareholders – is 5 and 7 per cent respectively in Singapore dollars.