Singapore’s Temasek is contemplating allocating more capital to core-plus infrastructure projects, especially investments related to data centres, energy transition and ageing facilities as the S$434 billion ($338 billion) fund walks the balance between risk and return.

In a post-annual results media briefing, chief investment officer Rohit Sipahimalani said infrastructure was an asset class starved of capital, particularly around AI, and presents significant opportunities. The fund deploys capital via direct, partnerships and fund investments.

“We are not looking at basic infrastructure, which is already up and running and generating cash flows, because the returns there probably do not meet our thresholds,” he said.

“That is why we are looking at core-plus infrastructure, where there is some development part, but they also have stable, long-term contracts with some inflation protection.”

An example of Temasek’s core-plus investment is the establishment of energy provider O2 Power in India alongside European asset manager EQT in 2020. The company was sold this March for $1.5 billion.

The fund also invests in Brookfield’s renewable-focused Global Transition Fund, and is part of the AI Infrastructure Partnership group that funnels capital into AI-related projects, established by BlackRock, GIP, Microsoft and MGX.

Sipahimalani said core-plus infrastructure is a great source of cash yield which the fund appreciates in uncertain times. It also finds private credit attractive for that exact reason. Temasek is likely to stay away from higher-risk private credit but chase strategies with low double-digit returns and high yields.

He said core-plus infrastructure and private credit might not offer high returns like a leveraged buyout, they are attractive because they offer a “narrower range of outcomes”.

Last fiscal year, a standalone private credit platform called Aranda Principal Strategies was carved out of Temasek’s in-house credit team. It manages a S$10 billion ($7.8 billion) portfolio of Temasek’s funds and direct investments.

Temasek does not disclose asset class allocations, but Aranda sits within Temasek’s partnerships, funds and asset management companies category, which represents 23 per cent of the total portfolio. The other two segments are Singapore-based companies (41 per cent) and global direct investments (36 per cent).

“Given the fact that compared to the last decade when interest rates were close to zero, base rates have gone up, we find it gives us pretty attractive returns with relatively low risk,” Sipahimalani said.

Liquid alternatives like multi-strategy and macro hedge funds are another focus of the fund which Sipahimalani estimates could secure “fairly stable double-digit returns” regardless of equity market environment.

China story

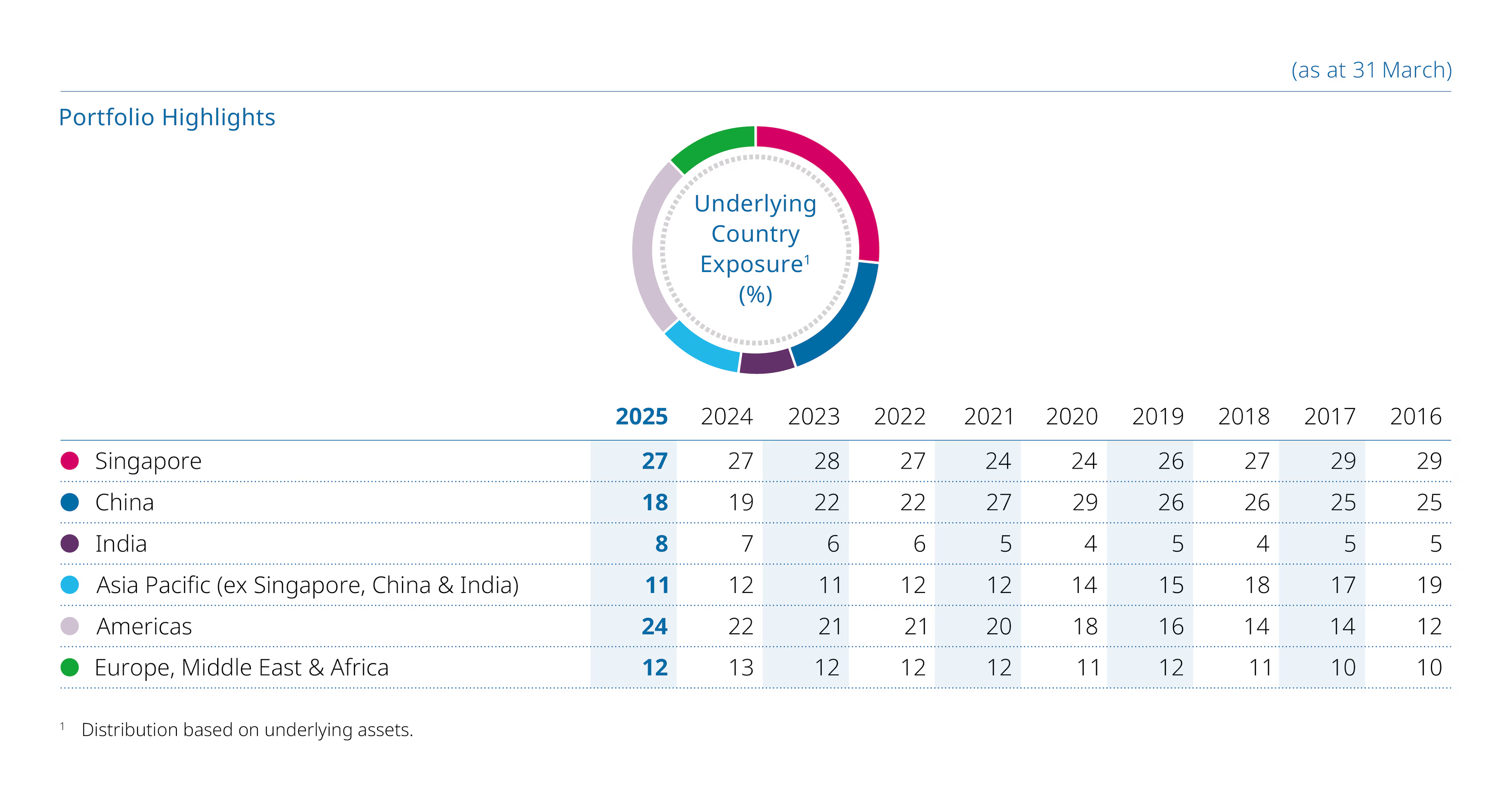

In terms of geographic allocations, Temasek’s exposure to China has hit a decade low in 2025 as the fund gradually shifted its capital to US and European markets. However, Sipahimalani believes there is now less downside risk in China’s economy as the government pledged to cushion any growth shocks, not to mention that asset valuations are “quite reasonable”.

The fund’s exposure to China decreased from 19 per cent of the portfolio in 2024 to 18 per cent in 2025, although in dollar terms the allocation is up by S$4 billion ($3.1 billion). Still, there has been a meaningful reduction compared to a recent high of 29 per cent allocation in 2020.

“We need to shift our priorities to align with views of China as a more mature economy,” Sipahimalani said, adding that the nation will not see the same level of explosive growth as it had in the past decade.

“In the renewables space, there are significant opportunities like in EVs and batteries. Also, we recently invested, for example, in companies operating commercially distributed solar generation, like rooftop panels.”

Four of Temasek’s top 10 listed holdings are Chinese enterprises including WeChat owner Tencent, e-commerce giant and new AI infrastructure darling Alibaba, delivery service Meituan and Ping An Insurance.

Over half (53 per cent) of Temasek’s portfolio is anchored in just three countries: Singapore, China and India. But Americas (24 per cent) is the second largest single allocation after the domestic market (27 per cent), and Europe, Middle East and Africa claimed 12 per cent.

Its offices in Americas, including New York, San Francisco, Washington DC and Mexico, accounted for the lion’s share (33 per cent) of the S$155 billion ($120 billion) direct investment portfolio.

The decrease in China exposure was only natural as Temasek repositioned as an Asia-focused investor to a global fund, Sipahimalani said. Moving forward, adjustments to geographical allocations will be “marginal” and hinged on bottom-up opportunities and individual market performance.

“We are quite happy with the relative positioning we have across markets… you will not see the same level of changes or big moves that you saw over the last decade,” he said.

US looks expensive

Contrary to what it is seeing in China, Sipahimalani said US equity valuations are looking high at 22 times earnings.

“They are probably at the top decile of the last 70-80 years. We have to be disciplined and conscious when we make investments,” he said.

“In the medium term, there is always going to be the debt issue but we do not think that is an immediate issue. But we have to think about that with a long-term perspective, and what it means for the US dollar.”

The fund is also grappling with the biggest investment question in the past few years, which is what it would take for US exceptionalism to collapse. However, Sipahimalani admitted that he does not have a clear answer yet and expects the US to remain the biggest recipient of its capital unless some extraordinary event happens.

“There is nothing we can foresee [to make us pull back from the US]. Things happen that none of us can predict,” he said.

“AI is a clear example. Nothing we can foresee will cause us to change that. We had mentioned last year about our plans to invest $30 billion over five years in the US and we are well ahead of that pace.”

Temasek has been shifting its portfolio to businesses that are less likely to get caught in the crossfire of trade conflicts in the past several years – a strategy that is paying off with US’ renewed threats on several trading partners, including a 10 per cent levy on BRICS countries this week.

For example, in China and India, the fund does not have any investment that relies on exports to the world. The focus in India has been on financial services, healthcare and consumer businesses in the past few years.

“None of them had any first order impact from tariffs. The same is true across most regions,” Sipahimalani said. “The second order impact, based on global growth, would impact everyone.”

Temasek invested S$52 billion and divested S$42 billion last fiscal year. The 10-year and 20-year total shareholder return – a compounded and annualised figure which includes dividends paid by Temasek and excludes investments from shareholders – is 5 and 7 per cent respectively in Singapore dollars.