This is the final part in a series of six columns from WTW’s Thinking Ahead Institute exploring a new risk management framework for investment professionals, or what it calls ‘risk 2.0’. See other parts of the series here.

In previous pieces in this series, we looked at historical and forward-looking risk events. There are a number of instructive commonalities of risk events and resulting benefits of a risk 2.0 mindset that can be drawn out.

Primacy of the market is a key driver of risk

Under a risk 1.0 lens, the economy/market is assumed to have primacy and all other actions are determined so as to optimise market outcomes. However, one consequence of this from a risk 2.0 perspective is that the singular focus on economic optimisation can, over time, create fragilities within societal systems. The pursuit of efficiency at the cost of resilience can lead us deeper into systemic risk. In addition, in some cases it is the propagation of risk events through the social system that leads to the financial impact of these events. For example:

- urbanisation has resulted in increased efficiency by concentrating populations in smaller areas but this has also resulted in concentrated exposures to physical climate risks and increased vulnerability to other dangers (e.g., disease)

- globalisation of food supply chains has allowed a significant increase in efficiency and profits but has created significant vulnerability to weather events in the major global bread baskets. Hungry populations are likely to cause financial losses.

An important shift when moving to a risk 2.0 mindset is therefore to move away from the system as a hierarchy with the economy/market at the apex, to a ‘flatter’ view where the health of all parts of the system needs to be thought about simultaneously when making risk management decisions.

Limits to quantitative analysis / “narratives eat models for breakfast”

Another important observation is that historical data is of relatively little use in pricing/quantifying the risks that materialise(d). As a result, a risk 1.0 mindset assumes the scenarios are technical problems that can be solved with limited long-term adverse impact.

In contrast, a risk 2.0 mindset recognises that these events are the result of the build-up of pressures that are not easily observed in historical data and are triggered by the crossing of key tipping points that are not easily reversed. This said, in most cases the process for understanding the scenarios and the important causes and effects is reasonably intuitive and, in the case of the future scenarios, superior insight is not needed to establish a reasonably vivid narrative for what is likely to happen. This highlights the need for the use of softer/more qualitative measures as part of risk 2.0 practice.

Upward sloping term structure of risk / ”inevitability”

A final set of observations particularly in relation to the forward-looking scenarios is that the risk 2.0 mindset highlights that:

- climate change is a ‘threat multiplier’, i.e. beyond the direct impacts of climate change it can be a key catalyst for other systemic risks that would be expected to materialise over a shorter time horizon than the longer-dated impacts of physical climate risks

- assuming no change to current economic and social probabilities, the cumulative probability of any one of these events occurring will continue to increase over time, i.e. under ‘business as usual’, some version of these events appears inevitable at some sufficiently-long time horizon.

This both supports the upward sloping term structure of risk described in part 2 as well as challenges the risk 1.0 view that systemic risks like climate change are too distant in nature to be incorporated into the current definition of fiduciary duty.

Insights gained from adopting a risk 2.0 mindset

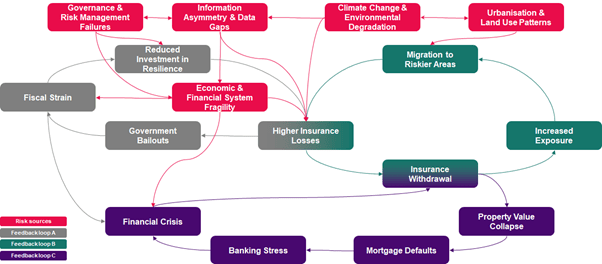

An important result of adopting a risk 2.0 mindset is a better understanding of the key drivers of a given risk event, the broader impacts of these and the associated feedback loops and interaction effects. This is set out at a high level below for the uninsurable futures scenario described in part 5:

| Risk 1.0 | Risk 2.0 |

| Adapt–Delay

• Focus on coping with impacts after the tipping point has been crossed, eg – Community-Based Catastrophe Insurance: Local schemes that pool risk and reduce administrative costs. – Informal risk-sharing mechanisms: Traditional community-based approaches to managing climate risk. • Limitations: – These approaches do not reduce underlying risk drivers. – They may be overwhelmed by escalating damages due to climate change. |

Adapt–Transform

• Prepare society to live sustainably within a changed risk landscape, eg – Managed relocation: Moving communities from high-risk areas to safer zones. – Inclusive planning: Ensuring equitable outcomes for displaced populations, especially Indigenous communities. • Strategic value: – Recognises that some areas may become permanently uninsurable. – Requires long-term planning, community engagement, and robust governance. |

| Avoid–Delay

• Seek to maintain insurance availability through short-term fixes, eg – Government-backed reinsurance schemes. – Premium subsidies and affordability caps. – Improved data access and modelling using big data and remote sensing. • Limitations: – These measures are reactive and may not be sustainable as climate impacts intensify. – They address symptoms rather than root causes.

|

Avoid–Transform

• Target systemic change to prevent crossing tipping points, eg – Nature-based solutions: Restoring ecosystems to reduce hazard exposure. – Climate-resilient infrastructure and building design. – Insurance industry reform: Incentivizing adaptation, increasing transparency, and reducing support for fossil fuel producers. – Forward-planning: Red-zoning, land-use regulation, and climate risk commissions. • Strategic value: – Builds long-term resilience. – Reduces hazard, exposure, and vulnerability simultaneously. – Encourages cross-sector collaboration and innovation. |

Source: UHU-EHS, TAI

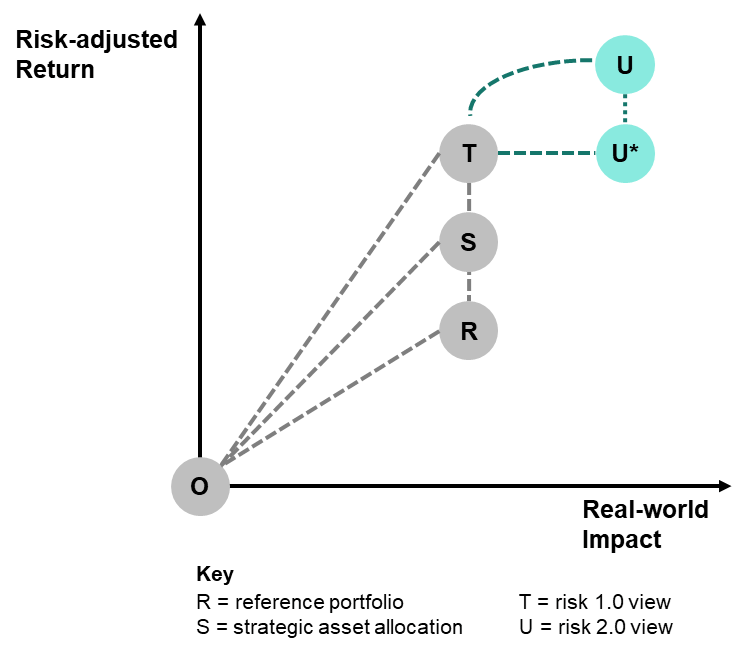

A third benefit is that a risk 2.0 mindset starts by considering the system and systemic risk which means true risk management must include system stewardship. An investor with this mindset recognises that a current investment in the future public good can result in subsequent private gain and/or that reducing the likelihood or severity of systemic risks increases the value of all financial assets. This takes us from position T to U* or U in the figure below.

[1] UNU Institute for Environment and Human Security. 2023. Uninsurable future

The vehicle is a part of the latest generation of driverless fleet from Baidu’s autonomous driving subsidiary, Apollo Go. It hosts close to 1,000 robotaxis on the road servicing consumers of Wuhan, which was picked strategically as a major testing hub due to its extensive car parts manufacturing capacity.

The vehicle is a part of the latest generation of driverless fleet from Baidu’s autonomous driving subsidiary, Apollo Go. It hosts close to 1,000 robotaxis on the road servicing consumers of Wuhan, which was picked strategically as a major testing hub due to its extensive car parts manufacturing capacity.