At a recent board meeting, trustees at Alaska’s sovereign wealth fund APFC garnered insights on governance from recent turmoil at PSERS’ and Ohio State Teachers.

With the benefit of hindsight, the governance crisis at $73 billion Pennsylvania Public School Employees’ Retirement System (PSERS) that exploded in 2021 to catch everything in its path and result in criminal and regulatory investigations and legal fees running into millions of dollars, was painfully obvious.

Drawing on widely reported stories in the media at the time, Tiffany Reeves, partner, Faegre Drinker Biddle & Reath LLP, laid out PSERS governance issues to gathered trustees at the $82 billion Alaska Permanent Fund Corporation’s (APFC) during a recent board meeting at the Juneau-based fund.

Two-hatted elected officials sat on PSERS board and there was a lack of clarity on the different roles of board and investment staff, she said.

New ideas were blocked by the absence of any succession plan (the board chair had been in situ for 25 years) and the roles and responsibilities of oversight committees was unclear. Trustees regularly fielded multiple designees, creating crowded and unruly board meetings. Staff took lavish trips paid for by money managers leading to conflicts of interest and in another misstep, a material calculation error left beneficiaries having to pay more into their pensions.

Board books – so thick they resembled ‘War and Peace’ – were dropped on the board a few days before meetings, compounding trustee’ fears of looking foolish and unease that the investment team weren’t giving them the information they needed. Dissatisfied factions leaked information to the press and a culture bereft of decorum flourished, characterised by a lack of civility, over-zealous inquiry, interpersonal conflicts, withholding information, defensiveness and politicking.

Reeves said that PSERS’ widely reported governance challenges showed that no matter the value of assets under management, state treasurer, pension fund or sovereign wealth fund, poor governance is caused by recurring and consistent themes.

“When you see these patterns of behaviour, name it and address it swiftly. If you don’t a compounding effect with erode the culture of your organisation. Culture is defined by the worst thing you tolerate,” she said.

In contrast good governance can result in outperformance of 1-3 per cent relative to peers.

Reeves’ presentation marked APFC continuing its efforts to advance and modernise governance practices and align with industry best practices after governance at the fund has come under the spotlight. Last year, leaked emails revealed investment staff had come under pressure to invest in particular strategies from trustee Ellie Rubenstein in a clear conflict of interest. In 2022 “materially below par” compensation linked to budget constraints led to the fund struggling to fill staff vacancies, and in 2021 board members unexpectedly ousted former executive director Angela Rodell.

What is fiduciary duty

Reeves began by addressing the concept of fiduciary duty. Fiduciaries encompass all professionals who make or have the authority to make discretionary administrative or investment decisions related to the fund, encompassing board members to investment managers and investment advisors.

Core fiduciary duties include prudence and loyalty. For example, fiduciaries have a duty to diversify, a duty to provide information; understand trust law, ensure transparency and avoid conflict of interest. Prudence involves a total portfolio perspective rather than focusing on any individual asset class in isolation; the need to consider economic conditions, liquidity and the preservation of the appreciation of capital.

The duty of loyalty means that trustees act only for the beneficiaries. “If the public get annoyed you won’t do something, it’s because they misunderstand what your fiduciary duty is and how you are confined,” she said.

She added that fiduciaries are judged on the prudence of the process behind decision making. Fiduciaries are guided by the material factors that inform decision making at the point in time decisions are made in a defined process – they don’t make decisions and then “reverse engineer” prudence.

Shooting from the hip doesn’t work

Good governance is the bridge between fiduciary duty and the process/implementation – or, as Reeves explained, “the how.”

Governance is rooted in foresight rather than making it up as you go, she said. It supports fiduciaries duty of loyalty and care, and provides guardrails that support decision making, and establishes decision making in advance of challenging situations.

“I can’t stress enough how important it is to establish the rules of the road before a crisis. Shooting from hip doesn’t work.”

Stay in your lane

Good governance also depends on clarity of the different roles of the board and staff. Only this way can board and investment teams stay in their lane.

“It’s hard when you don’t know what your lane is,” she says. Referencing the CFA’s OPERIS governance framework, Reeves said a board role is high level; involved in setting goals and objectives, oversight and monitoring. In contrast, the job of the investment team is to implement and execute.

“The framework is very clear on the powers that are for the board and the powers that are for staff,” she said, adding that the board approves key decisions, sets policy and prudently delegates – although the board is not in a position to delegate oversight.

Trustees should have a line of sight and can drill down when they think it’s appropriate. But they should not go on “a hunting mission” that delves into investment staff decision making. Instead a robust reporting and compliance function should gives trustees comfort and bring access to information and line of sight.

The problem of two hats

Governance gets challenging when fiduciaries wear two hats. For example, fiduciaries might be members of a sponsor organisation, a member of a state employer or political appointees. It’s possible to navigate this conflict by keeping beneficiaries front and centre, she said.

“When you are making decisions, you can only consider beneficiaries.”

There is always tension between what is best for an organisation and what is best for the executive when organisations have state appointees, she continued. A typical area of conflict between state politics and board decisions comes when pension funds seek to recruit internal expertise and pay more than government pay grades. In such cases, trustees must stay mindful of fulfilling their fiduciary duty to grow the trust by hiring qualified individuals.

Fiduciaries have to think what is the best policy for the fund and what will be the long term consequences if the legislature doesn’t support those policies. Reeves reassured that the best decision will arise out of these conflicts. The governance construct will inform the best decision, and she said group decisions are generally better.

Moreover, by filling positions with experts teams can trust they have the governance ability to understand which hat to wear.

She said board members also owe fiduciary duty to each other. They need to actively participate in decision making and maintain effective working relationships and decorum. Board members are liable for the conduct of other trustees and in this way, the board acts as a collective body.

She concluded that in periods of uncertainty, it is more important than ever to have trust because high trust organizations are more resilient.

This article was corrected on 8th March to highlight Tiffany Reeves’ description of the governance challenges at PSERS was wholly drawn from media reports at the time. Reeves has no direct knowledge of the events at PSERS, and this part of the presentation was based on media and public reports.

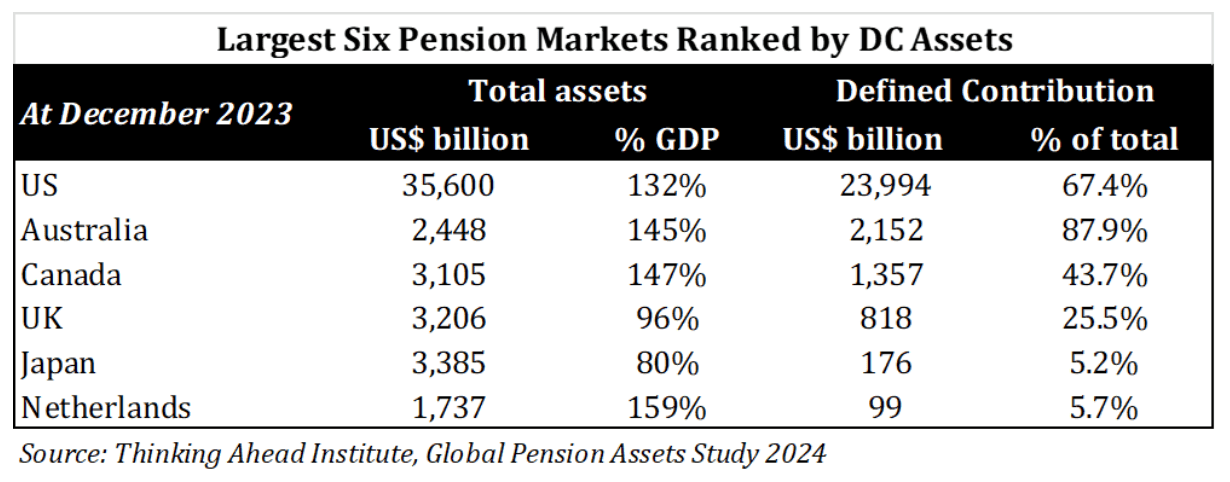

Our broad-ranging report considered the benefits, risks and issues arising from big super. The overall conclusion is that Australia’s super system is a boon. It has facilitated the creation of a large pot of retirement savings that is being professionally managed, and brings benefits related to improved stewardship of capital and broadening out of available funding sources in the economy.

Our broad-ranging report considered the benefits, risks and issues arising from big super. The overall conclusion is that Australia’s super system is a boon. It has facilitated the creation of a large pot of retirement savings that is being professionally managed, and brings benefits related to improved stewardship of capital and broadening out of available funding sources in the economy.