Regeneration will become a key investment theme in the future according to Gabriel Micheli, senior investment manager, thematic equities, Pictet Asset Management.

Speaking at the Fiduciary Investors Symposium at Oxford University, Micheli said the planet has lost around three quarters of its species/life over the past 50 years. Something he called a “staggering loss.”

“Nature provides the services we take for granted, but the the world is becoming less resilient,” he said.

Pictet Asset Management’s experience in sustainable investment goes back two decades. The asset manager’s funds focused on water, the energy transition and land use have seen strong performance over the years and it has also developed a framework that measures corporate impact. However, many investors are less experienced in the space.

They are still focused on “first steps” like removing the damage of climate change via net zero targets, for example. He told delegates that they will have to go further than this to begin biodiversity regeneration and restoration, repairing what has been lost and making sure that the planet’s rebuilt resilience is kept.

He said that restoring biodiversity is dependent on local communities safeguarding and taking care of nature for the long term.

“In the end what matters is that people around [nature] take care of it and that people are empowered to protect it over time.”

The circular economy offers investors a huge opportunity, according to Micheli. Circularity currently accounts for just 7 per cent of the global economy but he forecasts that recycling will become “huge” over time. Other opportunities lie in regenerative agriculture where food groups like Nestle and Danone are already putting capital to work to transform how food is cultivated. Regenerative agriculture is more resilient, reduces tilling and uses less pesticides and more nature based solutions to ensure yields.

Oats or dairy?

One of the most important aspects of Pictet’s work integrating nature comes from measuring the impact of corporate actions and applying those changes to investment strategy.

Micheli pointed to analysis of the difference in biodiversity impact between oat (low) and cow (high) milk to highlight how impact analysis has grown to span the whole value chain. In this case, encompassing packaging to water and land use, and emissions.

The study between the different sources of milk allows investors to understand one company compared to another, he continued. It reveals that one product has a lower impact on biodiversity loss than another which will ultimately be favoured by consumers and policy makers. He said impact analysis allows investors to position for headwinds and benefit from tailwinds that will fan financial returns.

But gathering the data is complex. Analysis must take into account the different impact from land use in different geographies and navigate the lack of standardization in corporate reporting, and the fact companies use different metrics. He said a top-down approach to analysis is also accompanied by incorporating bottom-up corporate reporting. He also stressed the importance of working with academics to delve into the research and add expertise.

Using these processes, the asset manager has classified the biodiversity dependency of all the companies in the MSCI World.

Micheli said that the food industry has the biggest impact on biodiversity. The data also reveals how companies evolve over time, revealing that some companies’ do reverse their negative impact on biodiversity. The data also allows investors to make projections for the future and pinpoint where the impact of biodiversity loss will be felt most keenly. He said that biodiversity loss happens all over the world because global corporations have an impact across the world.

Pictet does not measure biodiversity impact with ESG ratings. Although they are useful, he described ESG ratings as more of a risk management tool. “ESG is about how [companies] operate and do it better,” he said.

Away from data gathering, delegates also discussed the challenge that many investors face because they don’t have a mandate to invest biodiversity. For many it means they are only exploring how to integrate biodiversity, and face capacity constraints. They hold real assets like farms and timberland but the focus is more on ESG than biodiversity.

Micheli countered that investing for impact adds value to any investment strategy; it helps identify companies that the market hasn’t seen and creates performance and alpha for investors. “This is the reason people do it,” he said.

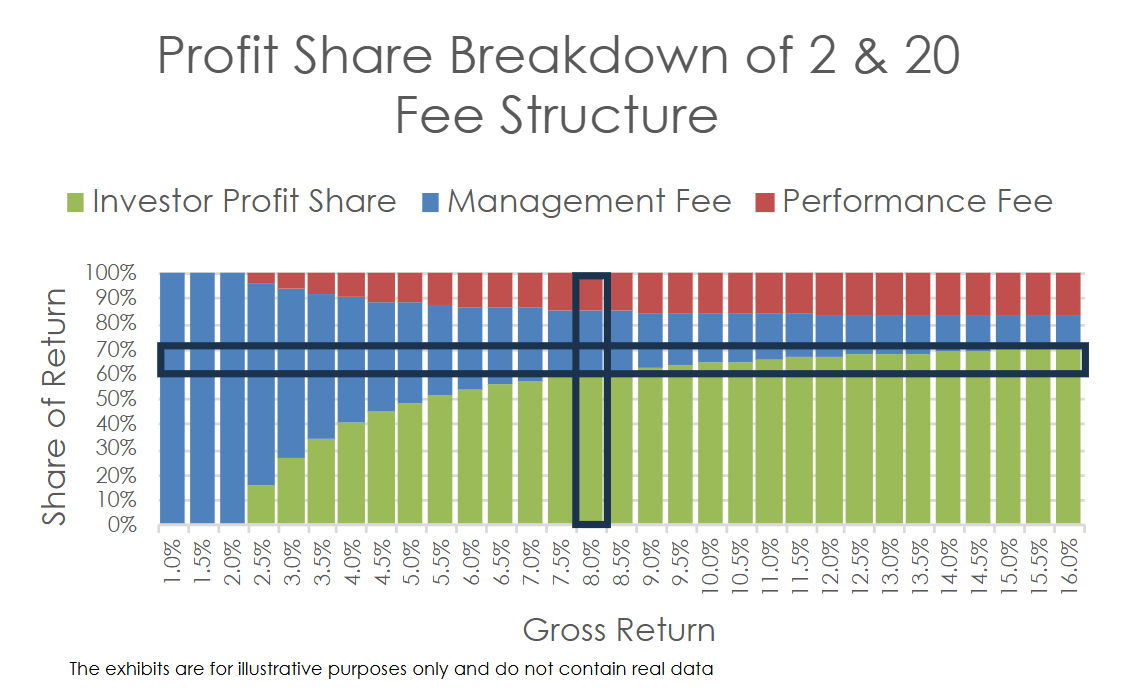

The second gripe is the shape of the fee structure, where there are more nuanced opportunities for asset owners and managers to align their goals, Amin said.

The second gripe is the shape of the fee structure, where there are more nuanced opportunities for asset owners and managers to align their goals, Amin said.