Stephen Gilmore says he can add 50 to 60 basis points to portfolio returns by using a total portfolio approach. In a long interview, Amanda White spoke to the CIO of CalPERS about why a TPA mindset can add value, simplify accountability and open new opportunities for investments.

In November this year, the $556 billion CalPERS’ board approved a momentous structural change that gives the fund a single reference portfolio for judging performance, delegated authority to investment staff to construct the portfolio, and a simplified measure of success.

The headline news is that CalPERS has adopted a total portfolio approach, but beyond the headlines this mindset and implementation undertaking is a huge transformation, especially for a fund of its size.

Importantly, with TPA comes governance changes, including delegated authority to management that hones accountability and focuses staff on executing the one unified objective. For the board, it means letting go of ingrained decisions, such as setting the asset allocation, in return for more transparency and singular focus.

The ultimate benefit will be increased added value through a shared focus by all investment staff on the same goal.

As much as anything, TPA is a mindset, says Stephen Gilmore, chief investment officer of CalPERS, the largest pension fund in the United States.

And while under a strategic asset allocation approach there might be an intention for all investment staff to stick with the same objective, in practice that wavers when individual asset class benchmarks are introduced.

“They might start with the same objective, but what happens is people focus a lot on individual benchmarks, and there’s a danger they lose sight of the bigger picture,” he tells Top1000funds.com in an interview.

“The biggest advantage of TPA is mindset – you are actually building a portfolio that achieves the objectives [of the fund]. Everyone is pulling together to achieve the overall portfolio outcomes.”

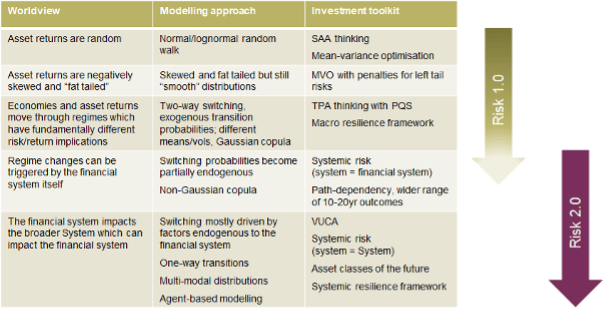

TPA has been in vogue over the past few years, with stalwarts such as CPP Investments, New Zealand Super and the Future Fund believing it creates a framework for decision making and capital allocation beyond the boundaries of SAA. Others question the craze, simply saying isn’t TPA what we do anyway (see TPA just a new acronym for ‘common sense’.)

Gilmore says a lot of people will have their own definition of TPA, but his experience has been influenced by his tenure at the Future Fund, which he joined in 2009, and New Zealand Super, where he was chief investment officer before joining CalPERS. Both funds have used TPA to great effect, with strategic tilting, arguably only possible with a total portfolio view, the biggest value add at NZ Super over the past decade.

“I was very influenced from my early days at the Future Fund. At that time CEO David Neal always focused on the potential disadvantages of having intermediate targets, and lots of benchmarks, because the benchmark could potentially end up being the objective itself, but it’s not really the true objective,” he says.

“So for me, TPA is aligning the portfolio with that overall objective. Most people try to do that but depending on how you structure the governance you can end up inadvertently getting distracted from the big picture objective.”

For CalPERS -which returned 11.2 per cent to June 30, 2025, and 7.6 per cent over 30 years – the responsibility, or objective, is to pay the pensions of its 2.5 million members, and to make the pension fund sustainable. Changing the current structure, which includes 11 asset class benchmarks, and focusing on that overall objective is the essence of TPA. The fund is only 80 per cent funded, so any potential increase in returns will take the pressure off contributions.

“The idea is that [TPA] improves the likelihood of us doing that,” Gilmore says.

Active risk

A WTW Thinking Ahead Institute peer group study of 26 asset owners, quoted by CalPERS in its press release announcing TPA, showed the asset owners using TPA added 1.3 per cent in performance above those using SAA over 10 years.

“[That] 130 basis points is based on a small sample over a specific time, so I wouldn’t place too much reliance on that,” Gilmore says. “Conceptually however, if you’re optimising the portfolio as a whole rather than via asset classes, you should be able to do better by optimising for the whole.

“In terms of how much, I don’t think 130 basis points is likely. It’s ambitious. I’d like to be able to add somewhere between 50 and 60 basis points. It also comes down to how much active risk you take and what you expect to be rewarded. But I do expect there to be value add.”

While TPA is officially slated to come into effect on July 1, 2026, the implementation begins now with workstreams in place around strategy, risk budgeting, and communication.

“We have passed one milestone but there’s a whole period now of implementation,” Gilmore says.

The CalPERS’ board approved a reference portfolio of 75:25 equities:bonds and a limit of 400 basis points active risk around the reference portfolio, according to Gilmore.

“Our portfolio right now is equivalent to about a 72 per cent allocation to equities and the rest being government bonds or cash. The reference portfolio is around 75, so we are slightly below that at this point in time,” he says. “In terms of identifying where we want more or less exposure, the key thing is to have the understanding of all the underlying strategies and how they fit together, to identify if there are any duplicates or gaps. I have some views on that: it’s a process we are undertaking and it will inform us with respect to the portfolio as we go live post the first of July next year.”

Improved data and analytics – one of three priorities for Gilmore alongside TPA and culture since arriving in Sacramento in July 2024 to take the top job – is key to that.

“We embarked on a very big initiative to try and consolidate our data and analysis and try to improve the whole-of-portfolio focus. We need good data to be able do the analytics, to think about the exposures, to look at the factors. So that is an ongoing effort and I’m really pleased with how the investment team are engaging with our technology people, they see the benefits of improved data sets,” he says.

“That will allow us to have a better understanding of all the portfolio components – how they interact together and allow us to do things we perhaps find difficult to do right now.”

There are some obvious top of the house changes that the fund is looking at, including balance sheet and treasury management, and dynamic asset allocation. It has also recently done a lot of work on liquidity management, which has allowed it to take on less liquid positions with more confidence.

“I think there are things we can do there in the future that would add value – we have that potential,” he says of the treasury function. “With dynamic asset allocation there is stuff we can do there as well but to do that successfully you need the right governance arrangements in place.”

Changes to investments

While at the outset Gilmore doesn’t think there will be material changes to investment allocations, he believes CalPERS can lean into its natural advantages, which he identifies as scale, a long horizon and brand.

“Given our size and connections, we have a lot of information and we don’t always use that optimally,” he says. “Putting all that together there are lots of things… and you’ll see some areas we are already trying to use those advantages.”

One example is the fund’s approach to private equity, where it has embarked on a revamped strategy focused more on partnership relationships.

“This is paying dividends,” he says. “We have more focus on partnership relationships, also on co-investment because of that alignment with partners. We have also made some changes in terms of reorienting the focus more towards growth and venture and mid-market rather than large buyout. I think the team has done a good job on manager selection. All that plays into size and branding and horizon that I talked about.”

Gilmore sees stronger collaboration between teams, such as across private equity and private debt, as a great benefit in the change of mindset beyond an asset class patch and towards the total portfolio goal.

“Teams will be more collaborative than in the past because they are thinking about things at the total portfolio level and have a common framework for thinking about capital use and required rates of return,” he says.

“Ultimately everyone should be asking, is this is a good investment? Then if it is, you want it in the portfolio and it matters less exactly where it fits in the portfolio.

“The TPA approach gives us an advantage in thinking about investments that might not easily fit into a particular bucket and helps with integrating themes into a portfolio.”

Further, if everyone is focused on the single purpose portfolio outcomes, there is potential to have asset classes doing things they wouldn’t otherwise be doing, he says.

There are already a number of internal committees in place – such as a total fund management committee, which looks at the top down and an investment underwriting committee looking at deals of a certain size – but Gilmore sees the biggest challenge to the new structure is trying to encourage more collaboration.

“The most complicated thing is fostering that collaboration and thinking about how the governance arrangements work. In the past, if you ran a particular asset class you could go away and just allocate your capital and didn’t really need to check in with the other teams,” he says.

“So the big thing now is having to be more collaborative in the interests of building up a better overall portfolio. So we are doing a lot of work on that and also doing a lot of work on having a unified, or consistent approach to identifying the cost of capital.”

In addition, collaboration between teams is encouraged through individual performance assessment.

“When it comes to assessing the performance of people we look at various competencies – collaboration is one of those. Within the leadership of the investment team, we have explicitly called that out and given that more focus in terms of incentives people are eligible for. Collaboration and communications and mindset – we are all in this together trying to build the best portfolio.”

Accountability and delegated authority

No matter which way you try to get your head around the total portfolio approach, it all leads back to the same place: good governance. Nothing is implementable without it.

The board at CalPERS is now giving the investment staff the delegated authority to set the asset allocation and implement the investment strategy. In return, they have a more simplified measure of accountability in one benchmark (the reference portfolio) and can easily measure management’s value add.

“What stands out to the board is [that this approach] makes management more accountable, so there is more transparency in terms of this is what the reference portfolio has generated and how has management done with respect to their mandate,” Gilmore says.

“We are still figuring out what exactly gets reported to the board. We know we need to be more transparent and that we also need to spend more time on why we have adopted a particular strategy and how that has panned out.

“So I think the board will get a better quality of discussion. It’s the quid pro quo. The board is giving the management team more discretion to create the portfolio, so the management team has to be more transparent and accountable as a result of that.”

Gilmore is confident he has the right team internally, although two crucial positions – deputy CIO of private markets and managing investment director, total fund portfolio management – are currently vacant.

“One of the things with the TPA is it can be quite empowering. It involves change, but I’ve been really impressed by how people have responded to that change. There’s engagement and the team is really good at just getting it done – that is very rewarding. It’s a good place to be: nice people, capable people, with a really good mission.”

But he’s not one to rest on his laurels, and if you talk to his former colleagues at the Future Fund and NZ Super they’ll tell you Gilmore likes a challenge. He’s adamant the team needs to adopt a continuous improvement mindset.

“We are never there in terms of the final destination because we are going to be incorporating more information, more capabilities and the external environment will continue to change. TPA is not a case of ‘it’s done’. People are working hard.”