Global economic activities will not be back to pre-COVID levels until 2022 according to CPP Investments’ outlook, with the giant Canadian investor expecting the situation to get worse before it gets better.

Speaking at a FCLTGlobal discussion on resilience, CPP Investments’ head of Asia Pacific, Suyi Kim said that long-term investors like CPP expect companies and leaders to prepare for the pandemic’s effects on their businesses.

“We are seeing negative news every day. It is proven that fear and insecurity shuts down our long-term thinking and creativity,” she said. “My advice to companies is to resist fear and seize the opportunity to come out of this crisis stronger.”

Kim pointed to the innovative behaviour of Starbucks during the 2008 financial crisis which was forced to close stores that were loss making when its customers reacted to the environment and opted for cheaper coffee.

“Importantly over the crisis they shifted their focus from bureaucracy back to the customer, and implemented new ideas based on free thinking and community involvement. Following the GFC their profits grew three times and their stock price went up more than four times.”

But while Kim encouraged optimism and confidence from corporate leaders, she said that needed to be coupled with realism and preparedness.

“We need to be prepared for the situation getting even worse and the recovery taking even longer,” she said. “When COVID first hit I was talking to portfolio companies and target companies and all of them were predicting their businesses would be back to normal by this summer, we know now that will not be. And despite support from central banks and governments the real economy is still very much struggling. We have seen the speed of the recovery slowing down.”

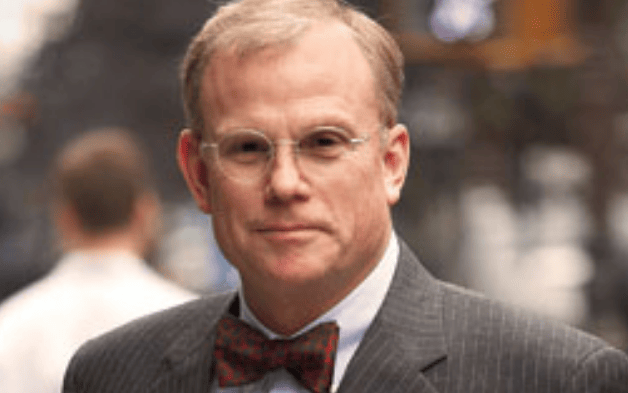

Also speaking on the webinar, Chow Kiat Lim, the chief executive of GIC said the pandemic had revealed examples of how companies have been able to take bold actions because they have built trust over many decades.

“If you have trust you should use it in times like this,” he said, spelling out that trust is made of two elements: competence and alignment of interest.

“If you have those two things then you get a lot of trust, which means you have the benefit of being able to take bolder actions. If you have trust behind you, then you can behave decisively. Leadership is making something happen that otherwise would not happen and to do that you need the trust of stakeholders so you can act on it.”

He said that competence is a matter of preparedness, in building resources and capabilities, and practice.

“A pandemic or any other form of dislocation of the day to day operations is something you can prepare for, create a business contingency. We have been doing that for more than 25 years. Every year we split the team to go somewhere else to see if computers work and the desk is functioning. Competence is one thread to build trust.”

But he also said alignment of interest was important and urged companies to look after the health, safety and wellbeing of their employees and stakeholders.

Resilience was about being able to recover quickly, he said.

“The pandemic teaches us not just to recover on your own, individual resilience is not sufficient, we need collective resilience,” he said pointing to the closing of borders as an example.

“Closing of borders is necessary to stop the spread of the disease, but yet as long as some countries are not able to have that under control then we are looking at prolonged periods of borders being closed, that is not good for business, the economy, jobs or investors,” he said. “It is drawing down our social capital and at some point we need to find a way to build it back up. Resilience requires us not having weak links, we need a collective way to be able to deal with it. If every organisation can internalise and think about these things, then collectively will have a lot of resilience coming out of this crisis.”

CPP Investments’ Kim also said the pandemic was an opportunity to build loyalty from employees, customer and suppliers.

“Employees are your key assets – take care of them and adapt to their needs,” she said.

CPP Investments has implemented a number of HR measures to adapt to the situation including special COVID days off, allowances for home office set up, and flexibility around returning to the office.

“Demonstrate compassion for suppliers and customers and ensure they too can quickly recover.”

Some active examples from CPP Investments’ portfolio of companies making concessions include a Hong Kong-based broadband network which was offering free broadband to underprivileged families and an Indian toll road company distributing food to migrant workers making their way back home from city to countryside.