Fiduciary Investors Series

Blue Owl’s James Clarke on navigating private credit’s first real cycle

Featured Story

Why pensions have become a beacon of female leadership in finance

Investor Profile

Sweden’s FTN focuses on fees and returns in latest procurement

Investor Profile

Iceland’s LV mulls more EM exposures, PE co-investments after SAA review

Partnered Content

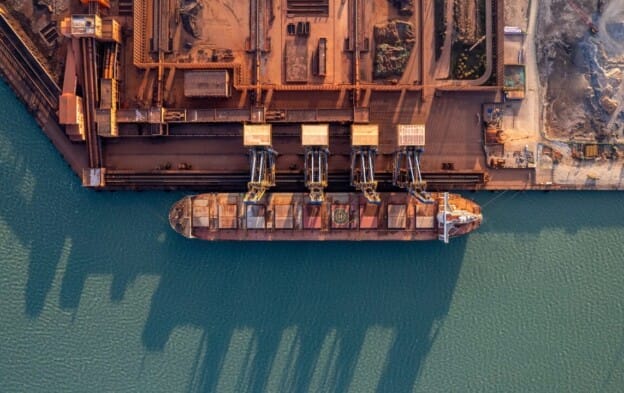

Infrastructure investors look beyond US to capture Europe’s green premium

The Asset Owner Directory is an interactive tool to give readers an insight into the world of global asset owners. It includes key information for the largest asset owners around the world such as key personnel, asset allocation and performance.

| Fund Name | Country | AUM ($B) | Articles | More Info |

|---|---|---|---|---|

Healthcare of Ontario Pension Plan (HOOPP) | Canada | $90 | 44 | View Info |

California State Teachers Retirement System (CalSTRS) | United States | $368 | 132 | View Info |

New York State Common Retirement Fund | United States | $273 | 34 | View Info |

Swedish Fund Selection Agency | Sweden | $108 | 4 | View Info |

Featured Story

West Yorkshire prepares to up the pressure on Shell and BP

Promoting transparency for

better pension outcomes

FIS Oxford 2025

Why allocators need a ‘continuous exploration’ mindset for AI adoption

Fiduciary Investors Symposium

The global economy is increasingly bifurcated between the US, Europe and Asia and how the growth projections and geopolitical risks between these regions plays out is of increasing interest to asset owners. This event looks at the return and impact opportunities in the region, and the importance of Asia in the global economy.

March 24-25, 2026 | Raffles Hotel, Singapore

Fiduciary Investors Symposium

This event looks at the challenges long-term investors face in an environment of disruption including ongoing geopolitical risk and shifts in global economic dynamics. By accessing faculty of Harvard’s esteemed university, this event will leave investors empowered to tackle disruption in their portfolios and working lives.

June 1-3, 2026 | Harvard University, USA

Featured Story

Europe rearms, defence returns surge, asset owners rethink exposure

Podcasts

Treasurer Steiner on Oregon’s private equity future

Investor Profile

CPP Investments, NBIM reflect on lessons from a 5-year transparency journey

Risk

NBIM quantifies the portfolio threat of economic fragmentation

“Top1000funds.com is a breath of fresh air in terms circulating stories that encompass new ideas and original thinking to keep us all abreast of the ideas that matters to us in the asset management industry in general and asset allocation spheres. I thank you for that.”

Hareb Masood Al-Darmaki

Deputy chair of investment committee; advisor to the managing director, Abu Dhabi Investment Authority

“Top1000funds.com provides a great mix of stories that are of interest to asset owners and those who work with them, covering both investment topics and organisational ones. While aimed at “the world’s largest institutional investors,” the articles are relevant to all kinds of asset owners, as well as professionals at other investment organisations.”

Tom Brakke

TJB Research (United States)

“The Top1000funds.com newsletter has become a very powerful source of information for the community of asset owners around the world. It is relevant and deep. I’ve known Amanda White for more than a decade now, she probably has the deepest understanding of the topics that are of interest to asset owners in the field globally.”

Jaap van Dam

Principal director investment strategy, PGGM; and author of Achieving Investment Excellence (The Netherlands)

“I really enjoy reading Top1000funds.com articles for my reference in investment. I would describe it as a kind of lighthouse when I was lost in turbulent market situation.”

Dong Hun Jang

CIO, POBA (Korea)

“Congratulations to Amanda and the team on this milestone. Your timely and relevant articles consistently offer thoughtful insights about the industry, and I look forward to seeing what the next era of investing will bring.”

Rebecca Fender

Head of the Future of Finance Initiative, CFA Institute

“Top1000funds.com produces high quality and thoughtful journalism that frequently aids my thinking.”

Tim Hodgson

Co-head, Thinking Ahead Group

“Accurate, authoritative, informative and readable. Top1000funds.com is everything a specialised industry publication should be. Congratulations on your 1000th issue.”

Fiona Reynolds

Chief executive, PRI

“I have been a big fan of Top1000funds.com for years and eagerly await the next issue. There are three reasons for this. First, it is very prescient. I will always remember how it was writing about income inequality as a system-level risk like climate change long before this was generally recognised. Second, it is always on top of the most relevant current events in sustainable investing. Third, it brings in guest writers who are luminaries in this domain.”

Robert G. Eccles

Visiting Professor of Management Practice, Said Business School, Oxford University